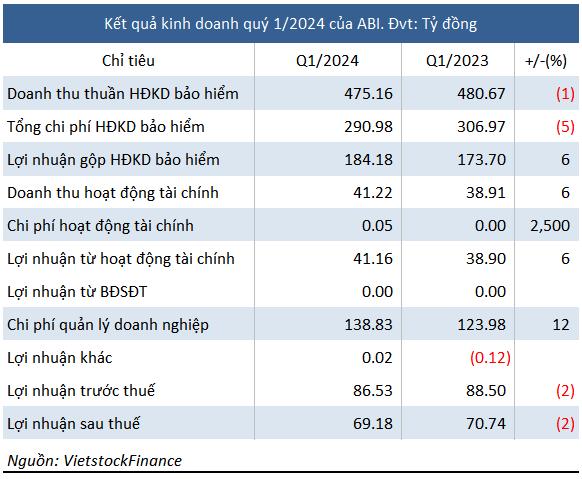

In the first quarter, ABI recorded a growth of 4% year-on-year in gross insurance premium revenue, reaching nearly VND 503 billion. However, the cost of reinsurance ceded surged by 56% to nearly VND 72 billion, resulting in a slight 1% decline in net insurance revenue to over VND 475 billion.

Despite this, the insurance business still reported a 6% increase in profit compared to the same period last year, reaching over VND 184 billion, due to a 14% reduction in total insurance claims expenses.

In addition, the profit from financial activities, primarily interest on time deposits, increased by 6% year-on-year to over VND 41 billion.

Although both insurance and financial operations of ABI saw a 6% rise, the net profit still dropped by 2% to over VND 69 billion.

The decline in net profit was primarily driven by a 12% increase in business management expenses to nearly VND 139 billion. Notably, the cost of office equipment and supplies for ABI witnessed the most significant increase among the company’s management expenses – a 4.6-fold surge compared to the same period last year, reaching nearly VND 5 billion.

As of March 31, 2024, ABI had 20 branches, compared to only 13 branches on March 31, 2023. This expansion in the business network can be attributed to the significant increase in ABI‘s office supplies expenses.

For 2024, ABI targets a minimum 20% increase in insurance business revenue compared to 2023. The pre-tax profit is projected to reach a minimum of VND 320 billion. Compared to the plan, ABI has achieved 22% of the minimum profit target.

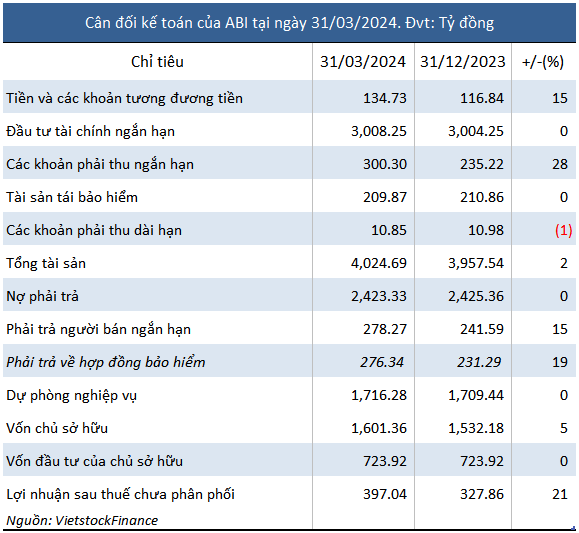

As of the end of the first quarter of 2024, ABI‘s total assets increased by 2% compared to the beginning of the year, amounting to nearly VND 4,025 billion. Of which, short-term financial investments accounted for 75% of total assets (VND 3,008 billion), remaining unchanged compared to the beginning of the year. These are mainly time deposits with terms over 3 months.

Moreover, the Company maintained its long-term investments at the same level as the beginning of the year, totaling VND 58,302 billion. These are also time deposits with terms over 12 months.

The Company’s liabilities are all short-term, mostly in the form of insurance technical reserves of over VND 1,716 billion, unchanged since the beginning of the year.