MWG unexpectedly saw a huge buy transaction of over 545 billion VND from foreign entities, while corresponding ETF restructuring orders pushed up liquidity towards the end of the session. The two exchanges saw an increase in matched orders of up to 59% compared to the morning session, with the VN-Index maintaining its uptrend due to support from blue-chip stocks.

The market suddenly experienced a strong shake-up this afternoon. Near 2 pm, the VN-Index returned to almost the highest point of the morning, but then dropped rapidly afterward. By 2:17 pm, the index was only up less than 2 points. Trading speed was also pushed up higher with large liquidity. This could be a strong buying and selling phase before officially entering the ATC order restructuring phase.

Overall, the market did not face too much pressure and there were also corresponding orders coming in. Surprisingly, MWG traded quite blandly today, with a matched order volume of only about 29.6 million shares, foreign entities buying nearly 11.3 million shares, and a net value of 545.3 billion VND. The stock is expected to be sold more than 48 million shares. MWG had an expected low price of floor level during the ATC, but closed with a slight increase of 0.18%.

The presence of corresponding cash flows for fund restructuring transactions helped boost liquidity significantly. This afternoon, the HoSE and HNX matched nearly 9,989 billion VND, an increase of 59% compared to the morning session. HoSE’s matched orders increased by 61% to 9,344 billion VND. As a result, the total liquidity of the two exchanges on the day increased by more than 20% compared to the previous session, reaching 16,279 billion VND. This level of trading is not high, only slightly higher than the average of the week before the holiday, about 3%.

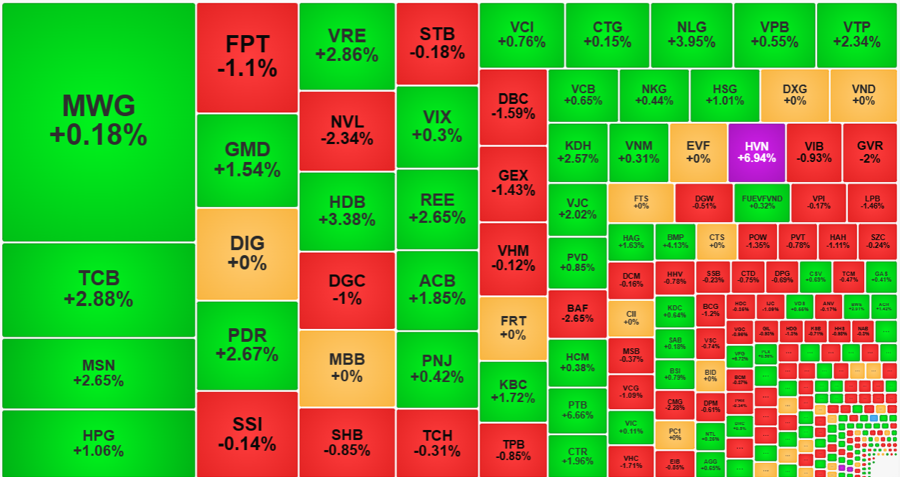

However, the increase in liquidity and fairly balanced price matching also shows that there is cash flow waiting for today’s session to buy. The VN-Index closed the session with an increase of 0.38%, equivalent to +4.67 points, indicating a slight fluctuation. The market breadth was balanced, with 223 stocks increasing and 200 stocks decreasing, much better than when the index fell to its lowest point (194 stocks increasing and 231 stocks decreasing), showing a positive “order fighting” capability. On the other hand, the distribution of cash flow was still completely dominant on the increase side, at 59% compared to 30.8% on the decrease side.

Foreign investors recorded a net buy of 515 billion VND this afternoon, focusing on MWG (545.3 billion VND). Therefore, this entity actually sold slightly on other stocks. However, only the FUESSVFL fund certificate was significantly sold with -127.8 billion VND being the most prominent. Some stocks were also sold quite a lot, including VHM -57.1 billion VND, STB -27.3 billion VND, GVR -24.5 billion VND, HDB -23.8 billion VND, VPB -22.8 billion VND, and TCB -21.2 billion VND. In addition to MWG, other stocks bought by foreign entities included PDR with +84.3 billion VND, VRE with +59.7 billion VND, VCB with -51.9 billion VND, MSN with +48.4 billion VND, HPG with +42.9 billion VND, and HSG with +25.2 billion VND.

The group of blue-chip stocks continued to be the ones maintaining the high level of the VN-Index and contributing to the stabilization of the overall sentiment. Today, the liquidity in this basket was high, reaching nearly 7,239 billion VND, an increase of 33% compared to yesterday and the highest level in 5 sessions. In the top 10 stocks that supported the points at the end of the day, only HVN had a ceiling increase of 6.94% and did not belong to the VN30 group. This basket also had 7 stocks that increased by more than 1%, namely HDB with an increase of 3.38%, TCB with 2.88%, VRE with 2.86%, MSN with 2.65%, VJC with 2.02%, ACB with 1.85%, and HPG with 1.06%. Many of these stocks saw fund transactions with millions of units during the ATC. Out of the 10 stocks with the largest liquidity in the market, 8 were from the VN30.

The market is currently in a strong recovery phase after going through a sharp decline in April. However, this is still just a technical recovery, so the overall cash flow has not increased as strongly as before. On the other hand, there will be short-term profit-taking phases that slow down the progress. The market was quite noisy today due to the selling pressure from the funds. However, the increase in cash flow is a good sign.