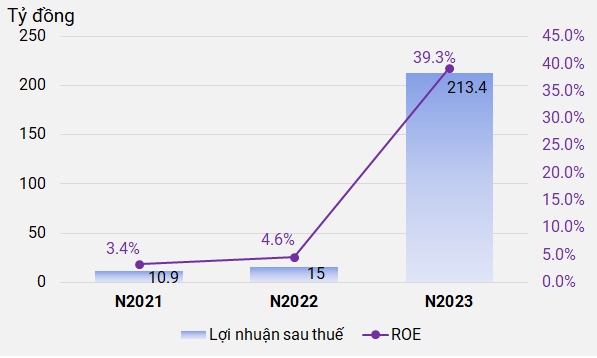

Mai Vien Real Estate Investment Joint Stock Company, the investor of Cantavil commercial center (Thu Duc district, Ho Chi Minh City), reported to Hanoi Stock Exchange (HNX) that its after-tax profit in 2023 reached over VND213 billion, 14 times higher than the previous year and was the highest profit in the past three years.

With this result, the Company’s Return on Equity (ROE) reached over 39.3%, far exceeding 4.6% of the previous year.

|

Profit of Mai Vien Real Estate in the last three years

Source: Compiled by the author

|

The indicator shows that by the end of 2023, the Company had equity of nearly VND543 billion, with nearly VND814 billion of debt, including VND600 billion of outstanding bonds. This is the bond code MVJCH2124001 still in circulation of the Company, issued on October 26, 2021, maturing on October 26, 2024, with an interest rate of 11.5%/year.

It is known that the above bond has secured assets, including land use rights, house ownership rights, and other assets associated with Fusion Suites Saigon Hotel at No. 3-3A-3B-5 Suong Nguyet Anh, Ben Thanh Ward, District 1, Ho Chi Minh City. The proceeds were contributed by the Company to invest in Thac Bac Long Cung eco-tourism area, Hoa Binh province, together with Dai Lam Joint Stock Company through a business cooperation contract.

The entire bond was purchased by 250 individual investors. Over the past year, Mai Vien Real Estate has paid VND69 billion of bond interest.

Former TTE Chairman Takes the Chair of Fusion Suites Saigon Hotel

Thac Bac Long Cung eco-tourism area, invested by Dai Lam Joint Stock Company, is located in Cu Hamlet, Tu Son Commune, Kim Boi District. In May 2021, the People’s Committee of Hoa Binh Province approved the policy of converting the purpose of using more than 38 hectares of forest to implement the project.

Another enterprise in this project that mobilized bonds to cooperate with Dai Lam is Vinh Plaza Trading Joint Stock Company with bond code VPZCH2124002 worth nearly VND227.5 billion and bond code VPZCH2124001 worth VND300 billion, with interest rate of 11%/year. The bonds were mobilized in 2021 and have been fully repaid and repurchased ahead of schedule.

| Dai Lam was established in 2009 and currently has a charter capital of VND300 billion, with Mr. Truong Van Dang (born in 1994) as Director and legal representative. |