Sentiment in the stock market soared during the morning session. The construction materials group led the surge with a 2.16% gain. HPG increased by 2.29% that day, a key factor in the HOSE index’s upward trend. Other steel stocks also exhibited positive movement. HSG gained 1.77%, and NKG rose by 1.54%.

Additional stocks within this sector, such as VGS (+2.42%), VCS (+3.83%), VHL (+4.55%), and GKM (+2%), also experienced growth.

TCB, HPG, VCB, MSN, and BID significantly contributed to the index’s rise. However, FPT suffered a decline toward the end of the session, leading to a slight 0.25-point decrease in the VN-Index.

The day’s surge was bolstered, in part, by the securities and food and beverage groups. Stock prices in these sectors were predominantly green. VNM, MSN, and SAB all gained ground. In the securities sector, numerous stocks, including SSI, VND, VCI, HCM, SHS, VIX, FTS, MBS, BSI, and CTS, primarily displayed positive gains during the morning session.

Despite strong growth, liquidity remained relatively low during the morning session. The total transaction value across the market reached just over 6 trillion VND, significantly lower than the recent average.

10:40 AM: Oscillation Followed by Uptrend

The overall market continued to demonstrate differentiation due to a balance between buying and selling forces, but upward momentum prevailed. At 10:40 AM, the VN-Index had gained more than 6 points, trading around 1,222 points. The HNX-Index rose by 1.23 points, hovering around 228 points.

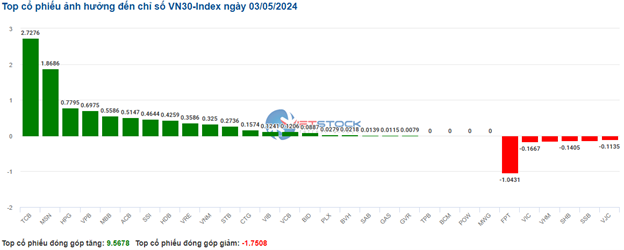

The constituents of the VN30 index were mostly painted in green. Notably, TCB, MSN, HPG, and VPB added 2.73 points, 1.87 points, 0.78 points, and 0.69 points to the VN30-Index, respectively. Meanwhile, FPT, VIC, VHM, and SHB faced selling pressure, shaving off a collective 1 point from the overall index.

Source: VietstockFinance

|

The banking sector led the gains, with over 60% of its stocks showing green. Key players such as SSI increased by 1.3%, VND decreased by 1.48%, VCI dropped by 1.4%, and HCM fell by 2.09%. Only two stocks, TVS and VFS, exhibited losses amounting to less than 1%.

Additionally, banking stocks experienced solid growth, with a bias towards buying. TCB surged by 2.56%, BID rose by 0.61%, CTG gained 0.62%, VPB increased by 0.82%, and ACB climbed by 0.74%.

On the other hand, the real estate sector, while contributing to the market’s uptrend, faced considerable differentiation. On the buying side, VRE, KDH, KBC, and PDR maintained gains of 1.02% to 2.86%. However, VHM and VIC, two industry giants, underperformed, significantly impacting their sector. As of 10:40 AM, the sector had a leading transaction value in the market, surpassing 787 billion VND, with over 36 million units traded.

The retail sector exhibited a contrasting trend with a notable bearish presence. MWG declined by 0.18%, PNJ dropped by 0.42%, and FRT fell by 0.91% amid substantial selling pressure.

Compared to the beginning of the session, buyers and sellers were closely matched, with over 960 stocks remaining flat. Buyers had a small advantage, with 193 stocks decreasing (17 hitting the floor) and 391 stocks increasing (32 reaching the ceiling).

Source: VietstockFinance

|

Opening: Market Positivity at the Start, Securities Stocks Surge

The market opened the May 3rd session with optimism as the VN-Index displayed a green tone from the get-go. By 9:30 AM, the index had climbed by 5 points, reaching 1,221.45 points. Meanwhile, the HNX-Index increased by 1.15 points to 228.64 points.

Buyers held an upbeat stance, driving the market with 350 stocks on the rise and only 121 stocks facing declines.

On May 2nd, Prime Minister Pham Minh Chinh issued Directive No. 14/CT-TTg regarding the implementation of monetary policy for 2024. The directive instructs the State Bank of Vietnam (SBV) to guide credit institutions in reducing costs to strive for a reasonable decline in lending interest rates.

Additionally, the directive emphasizes the monitoring of both international and domestic situations to forecast and implement monetary policy proactively, flexibly, and effectively. It particularly stresses the harmonization and balance between interest rates and exchange rates. Credit growth should be managed effectively, harmonized with macroeconomic stability, inflation control, and economic growth, ensuring the safety of banking operations and the credit institution system.

Securities stocks led the charge this morning, experiencing a 1.34% increase, propelled by gains in constituents such as FTS (+2.02%), SSI (+0.86%), VND (+1.23%), VCI (+1.19%), HCM (+1.52%), SHS (+1.1%), MBS (+1.12%), BSI (+3.16%), and VIX (+1.49%).

Furthermore, banking stocks also recorded positive gains from the start of the session, rising by 0.81%. Key stocks driving this growth include TCB (+2.77%), MBB (+1.34%), BID (+0.81%), CTG (+0.93%), and VPB (+0.82%).