Oil Prices Fall Over Demand Concerns

Oil prices settled near seven-week lows on Thursday, pressured by weak global demand, rising inventories, and receding hopes for a quick end to U.S. interest rate hikes.

Brent futures rose 23 cents, or 0.3%, to $83.67 a barrel. U.S. West Texas Intermediate (WTI) crude fell 5 cents, or 0.1%, to $78.95, its lowest since March 12. Both benchmarks are below their respective 200-day moving averages, a key technical indicator that signals a shift to a bear market for crude.

Gold Prices Drop

Gold prices fell as the focus shifted back to the prospect of interest rates staying higher for longer, with investors also awaiting economic data that could influence the Federal Reserve’s policy path.

Spot gold was down 0.5% to $2,306.69 per ounce. U.S. gold futures settled 0.1% lower at $2,309.6.

Copper Declines on China Demand Worries

Copper prices extended their losses, pressured by concerns that the recent rally to two-year highs was driven by speculation while demand in top consumer China remains weak.

Three-month copper on the London Metal Exchange (LME) fell 1.5% to $9,750 a tonne, retreating from a two-year peak of $10,208 hit on April 30.

Japanese Rubber Falls for Second Session

Japanese rubber futures fell for a second consecutive session amid thin trading as China remained on an extended public holiday, while lackluster demand in major economies continued to weigh on sentiment.

Osaka Exchange’s benchmark December rubber contract settled down 0.7 yen, or 0.23%, at 302.7 yen ($1.95) per kg.

Coffee Dips

Robusta coffee futures fell 7.5% to $3,680 a tonne on Thursday, continuing their retreat from a record high of $4,338 hit earlier this week.

Sugar Rises

Raw sugar futures rose 0.2% to 19.25 cents per lb.

Indian Rice Prices near Three-Month Low

Indian export rice prices hovered near a three-month low due to subdued demand and ample supplies, while Thai rice prices edged higher from one-month lows on supportive domestic demand.

Corn, Soybeans Rise

Soybeans and corn futures on the Chicago Board of Trade (CBOT) rose on concerns that severe flooding in southern Brazil is posing a risk to unharvested corn and soybeans.

CBOT July soybeans ended up 28-3/4 cents at $11.99 a bushel, after hitting their strongest in over three weeks earlier in the session.

CBOT July corn gained 9 cents to $4.59-3/4 a bushel, after the contract touched its highest since Feb. 7 at $4.60-1/2.

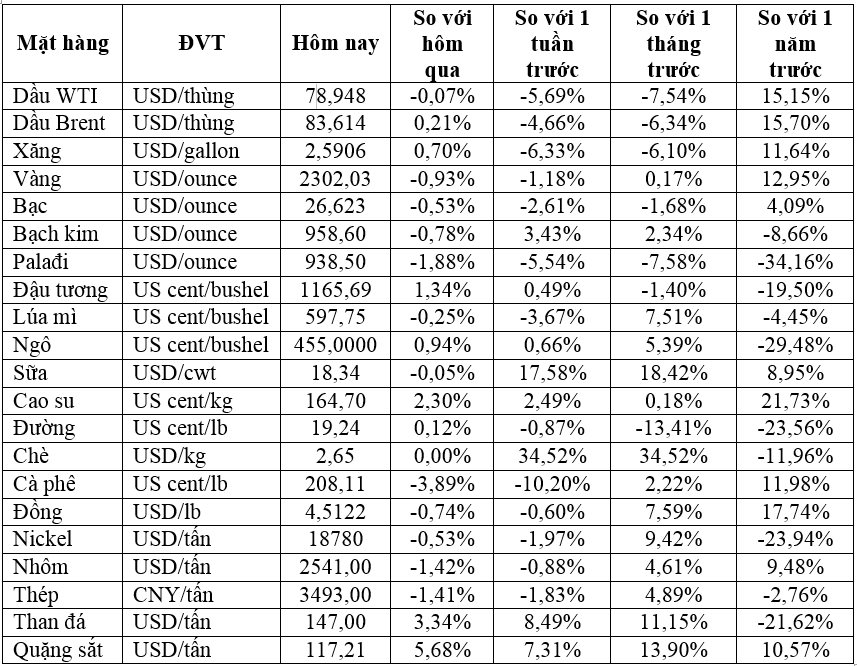

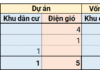

Key Commodity Prices as of May 3