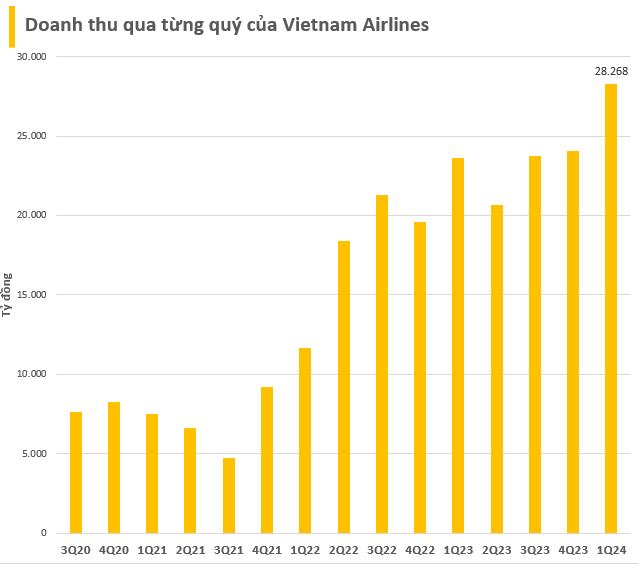

Vietnam Airlines, the flag carrier of Vietnam, has recently announced its first quarter 2024 financial results, reporting a remarkable 28,270 billion VND in revenue, a surge of over 25% compared to the same period last year. It marks the highest quarterly revenue since the company’s transformation into a joint-stock company in 2015.

Vietnam Airlines’ revenue surge is attributed to the shortage of aircraft in the aviation market, coupled with high airfares during the peak Tet holiday season. This has significantly boosted domestic air travel demand. Bamboo Airways, a direct competitor to Vietnam Airlines in the domestic market segment, has recently reduced several routes and aircraft, providing Vietnam Airlines with additional market share.

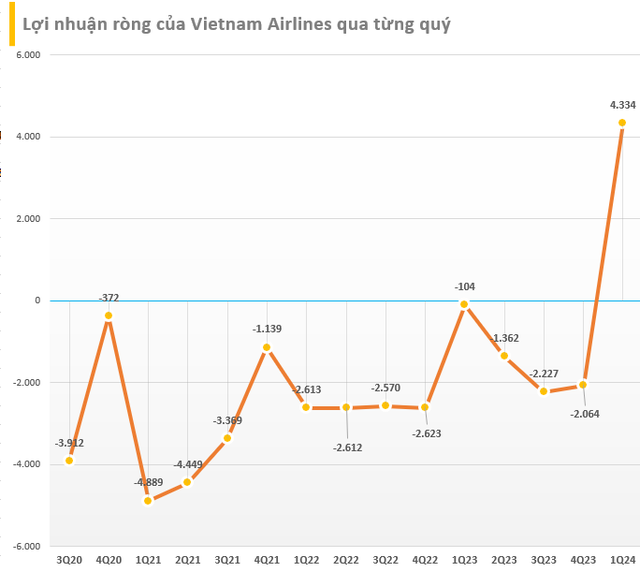

Despite a modest increase in the cost of goods sold, the company’s gross profit reached 4,048 billion VND in the last quarter, double the figure from the same period last year. Financial revenue decreased by 62.5% to 137 billion VND. However, financial expenses nearly doubled to 1,470 billion VND due to increased foreign exchange losses. The airline incurred a net loss of nearly 650 billion VND from exchange rate differences, as the company has significant foreign currency-denominated debt.

Both sales and administrative expenses witnessed an increase. Nevertheless, Vietnam Airlines reported other income amounting to 3,672 billion VND. Consequently, the airline recorded a net profit of 4,334 billion VND, a stark contrast to the 103 billion VND loss it incurred during the same period last year. This marks a record quarterly profit for the company since its inception.

According to Vietnam Airlines’ explanation, the company’s profit surge in this quarter compared to the same period last year is primarily due to its parent company, Pacific Airlines, and its subsidiaries, all of which have reported profits. Additionally, the airline experienced a substantial increase in consolidated other income due to Pacific Airlines recognizing income from the cancellation of debt under an aircraft leaseback agreement. This is the first quarter since the COVID pandemic that Pacific Airlines has recorded a positive business result.

Despite the positive results, Vietnam Airlines still has an accumulated loss of 36,742 billion VND as of March 31st. This has resulted in a negative equity of 12,556 billion VND for the company. Vietnam Airlines’ total financial debt stands at 24,401 billion VND, while its total assets have reached 56,316 billion VND.