On May 20, Binh Minh Plastics Joint Stock Company (code BMP) will finalize the list of shareholders receiving the remaining dividends of 2023 at a rate of 61% in cash (receiving 6,100 VND per share). The expected payment date is June 10.

With 81.86 million outstanding shares, Binh Minh Plastics is expected to spend nearly 500 billion for this dividend payment. The Nawaplastic Industries (Saraburi) – a member of Thailand’s SCG Group – will “pocket” about 275 billion VND because it holds a controlling stake of 55% in Vietnam’s leading plastic enterprise.

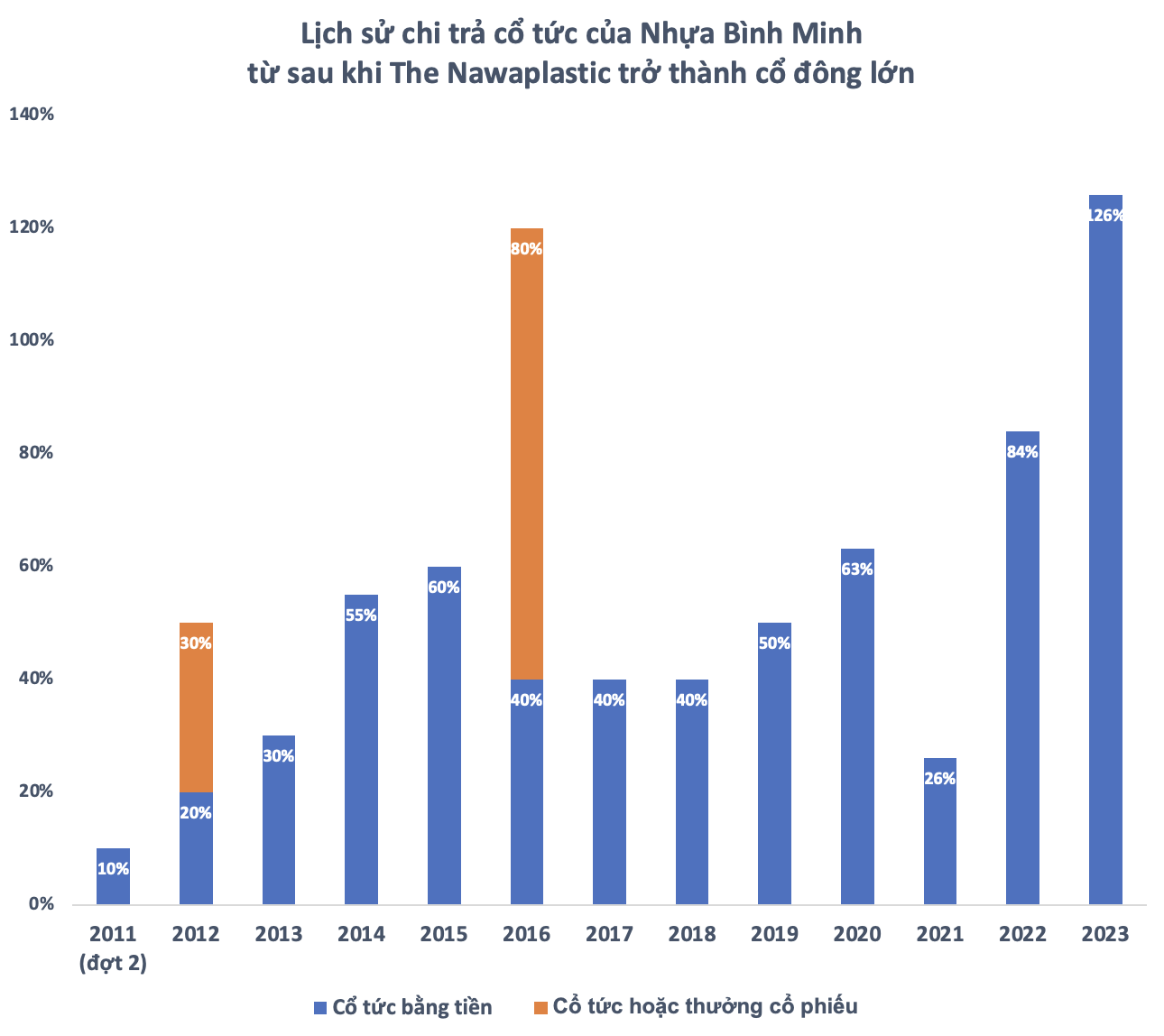

Previously, Binh Minh Plastics temporarily paid the first dividend of 2023 at a rate of 65% in late last year. Including the upcoming dividend payment, the business will complete the plan approved by the 2024 Annual General Meeting of Shareholders with a total dividend rate of 126% for 2023.

Regarding the 2024 dividend policy, Binh Minh Plastics plans to allocate at least 50% of its after-tax profit in 2024 for dividend distribution. In fact, in recent years, this enterprise has spent almost all of its annual profit on cash dividends.

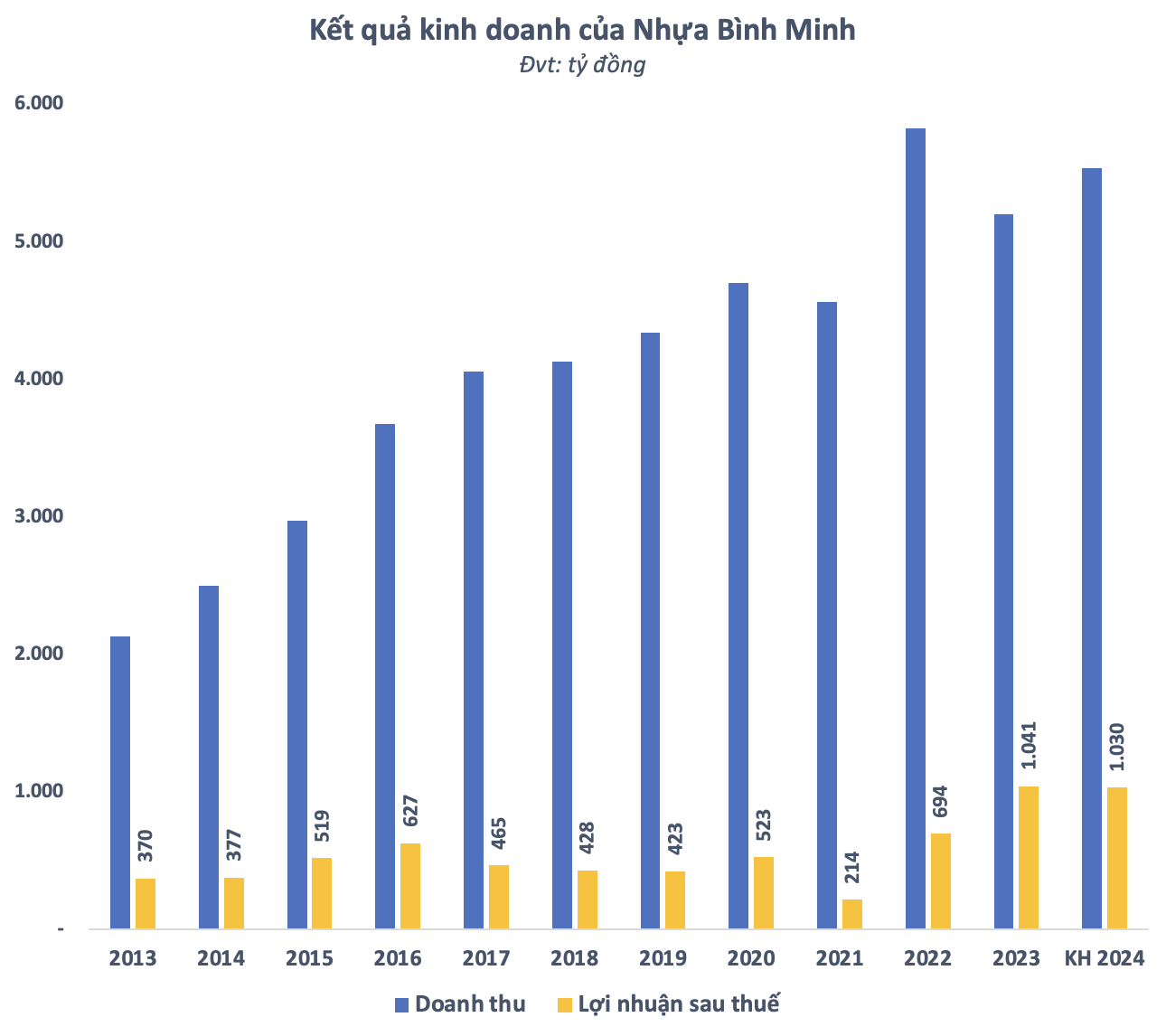

In 2024, Binh Minh Plastics plans to do business with a goal of VND 5,540 billion in revenue, an increase of 6.5% compared to 2023. After-tax profit is expected to be VND 1,030 billion, almost unchanged from the previous year. If the plan is completed, Binh Minh Plastics will have a second consecutive year of profit of thousands of billions of VND.

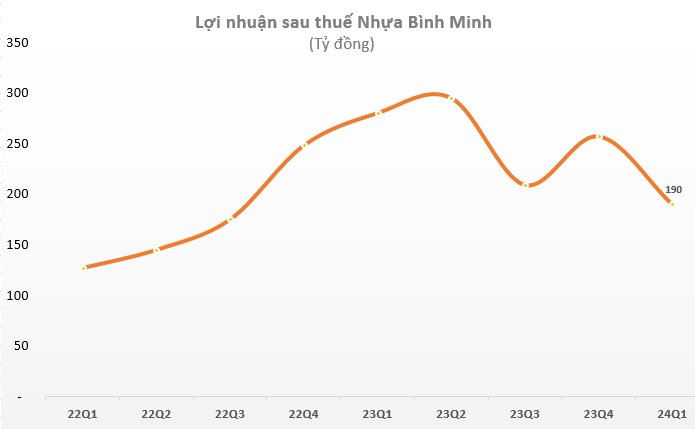

In the first quarter of 2024, Binh Minh Plastics recorded net revenue of VND 1,002 billion, down 31% compared to the same period last year. Gross profit decreased by 23% to 425 billion VND. Gross profit margin improved from 38.4% to 42.4% this quarter.

After deducting expenses, Binh Minh Plastics earned VND 190 billion in after-tax profit in the first quarter of 2024, down 32% year-on-year. This is also the enterprise’s lowest profit in six quarters, since the third quarter of 2022.

In the market, BMP shares have slightly adjusted after setting a new historical peak and are currently at 111,400 VND/share. The corresponding market capitalization is over VND 9,100 billion, an increase of nearly 55% compared to a year ago.