In the first quarter of 2024, the textile industry has had a encouraging start with the export turnover reaching 9.5 billion USD, increased by 9.6% compared to the same period last year. All major export markets of Vietnam’s textile industry have grown quite well.

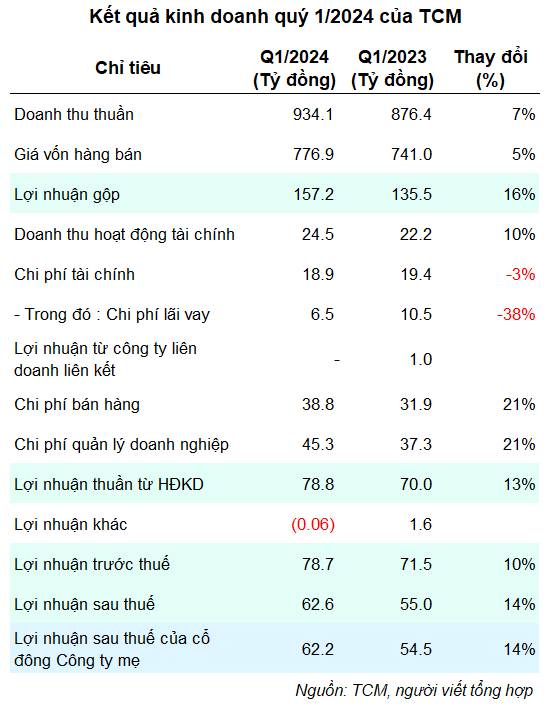

Recognizing the positive signals from market, TCM recorded a net revenue of over 934 billion VND in the first quarter, up 7% year-on-year. Garment and textile segment contributed up to 98% of total revenue. After deducting cost of goods sold and expenses, the company’s net profit was over 62 billion VND, up 14% and the highest profit in the past 6 quarters since the 4th quarter of 2022. Gross profit margin increased by 2 percentage points to 17%.

| TCM’s Quarterly Net Profit 2022-2024 |

In 2024, TCM set a target of net revenue of VND 3,707 billion and net profit of over VND 161 billion, respectively up 12% and 21% year-on-year. At the end of the first quarter, the company achieved over 25% of the revenue target and nearly 39% of the profit target for the year.

TCM expects to complete the plan based on the forecast of Vietnam’s textile export situation in 2024 and the company’s current order status. Specifically, TCM has received and is receiving about 88% of the planned revenue for orders in the second quarter of 2024 and about 83% for the third quarter of 2024.

On the balance sheet, at March 31, 2024, the total asset of TCM was nearly 3,235 billion VND, a slight decrease of 1% compared to the beginning of the year. The reason is that inventories decreased by 13% to 896 billion VND; cash and cash equivalents decreased by 1% to nearly 430 billion VND.

On the other side of the balance sheet, liabilities were about VND 1,162 billion, down 8% compared to the beginning of the year, due to a 9% decrease in short-term borrowings and financial leasing to nearly VND 578 billion, of which Vietcombank – HCMC Branch lent more than VND 415 billion. Long-term borrowings and financial leasing liabilities remained at over VND 48 billion.