Photo Illustration

According to preliminary statistics from the General Department of Customs, the import of completely built-up automobiles of all kinds in March reached 15,860 units with a value of over USD 330 million, a sharp increase of 64.4% in volume and 62.3% in value compared to the previous month. Accumulated in the first quarter, the whole country imported 32,272 automobiles, worth over USD 675 million, down 23.2% in volume and 27.1% in value compared to the same period in 2023.

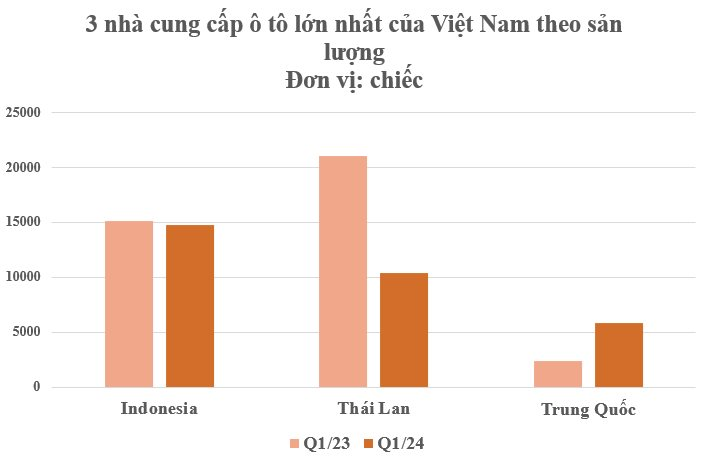

It is worth noting that the ranking of automobile supply markets has changed. If in the first quarter of 2023 and in the whole of 2023, Thailand was the largest supplier of Vietnam, in the first quarter of 2024, Indonesia has replaced the Land of the Golden Temple to become the largest supplier of our country. The import volume of automobiles reached 14,762 units, worth over USD 213 million, down 2.3% in volume but up 1.7% in value.

Thailand ranked second with 10,420 units, worth over USD 203 million, a sharp decrease of 50% in volume and 51.3% in value compared to the same period last year.

Third is the Chinese market with 5,821 units in the first quarter, worth over USD 176 million, a sharp increase of 144% in volume and 89% in value compared to the first quarter of 2023. Chinese electric car lines are expected to enter Vietnam, mostly mainstream electric car lines. Notably, BYD is looking for a partner to act as an agent in Vietnam. The Chinese automaker is rumored to bring to Vietnam 2 models Atto 3 (SUV) and Seal (sedan).

In terms of consumption, according to a report just released by the Vietnam Automobile Manufacturers Association (VAMA), in March 2024, the total market sales (including only data from members belonging to VAMA and the entire market for imported vehicles) reached 27,289 vehicles, an increase of 135% compared to February but a decrease of 9% compared to March 2023. Of which, passenger cars achieved sales of 19,014 units, up 135%; commercial vehicles reached 8,047 units, up 131%; and special-purpose vehicles reached 228 units, up 307% compared to February.

For the whole of the first quarter of 2024, according to VAMA’s synthesis, the total automobile market reached sales of 58,165 vehicles, down 17% compared to the same period in 2023. Of which, passenger cars reached 41,858 units, down 21%, commercial vehicles reached 15,915 units, down 6% and special-purpose vehicles reached 392 units, down 48% compared to the first quarter of 2023.

Entering 2024, the beginning of the year is the time when the preferential policy of 50% reduction in registration fee for domestically manufactured and assembled automobiles ends. This will affect sales because it is a significant part of financial support for customers. Therefore, the difficulties for automobile manufacturing and distribution enterprises in the Vietnamese market will continue for at least the first half of 2024.

2024 will also witness fierce competition among automakers for market share. Leading automakers in terms of market share in 2022 such as Toyota and Honda recorded a decline in market share in 2023, while smaller automakers (Ford, Kia, Mazda, Mitsubishi) grew thanks to a better pricing strategy. In addition, Chinese manufacturing enterprises are also bringing many brands into Vietnam (Lynk&Co, Haima, MG) and opening assembly plants that have been operating since 2023 (Wuling, Chery).