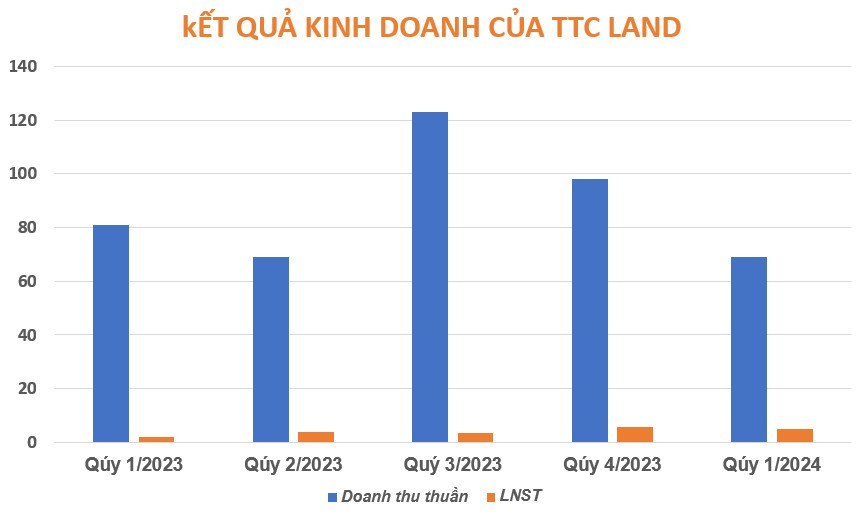

Saigon Thuong Tin Real Estate Corporation (TTC Land, stock code: SCR) has just announced its financial report for the first quarter of 2024, which recorded a net revenue of VND 69 billion, a decrease of 14.8% compared to the same period last year.

TTC Land’s revenue structure comes from real estate transfer; leasing commercial floors in the projects of TTC Plaza Binh Thanh, TTC Plaza Duc Trong, Charmington La Pointe; revenue from building management services, etc. Although net revenue decreased, TTC Land’s gross profit margin increased from 26% in the first quarter of 2023 to 40% in this quarter.

Regarding financial revenue, TTC Land reached more than VND 67 billion, a slight increase of 3% compared to the same period last year, mainly recording dividends distributed from the investment of VND 11 billion. Financial expenses were nearly VND 79 billion, an increase of 44%, in which interest expenses were VND 78.6 billion, an increase of only 3% compared to the same period last year.

TTC Land continues to promote restructuring and save operating costs, so the total cost of business management (excluding the recovery of provisions) is VND 15.5 billion, a decrease of more than 10% compared to the same period last year (the same period last year was VND 17.3 billion). Besides, in the first quarter, the company also recovered the previously provisioned amount of VND 13 billion.

As a result, profit before tax was more than VND 7 billion, an increase of VND 1.3 billion over the same period, and profit after tax reached VND 4.8 billion, 2.4 times higher than the same period last year. With the above profit level, TTC Land has completed 43% of the profit plan for 2024.

As of March 31, 2024, TTC Land’s total assets were VND 10,658 billion, not much changed compared to December 31, 2023. The company recorded an inventory of nearly VND 4,017 billion, of which unfinished real estate was VND 2,810 billion, real estate goods were VND 1,163 billion.

Current receivables from customers were recorded at VND 198 billion, of which VND 144 billion was the receivable corresponding to the final payment of the real estate sale and purchase contract that had not been transferred the Certificate of land use rights and house ownership.

In this period, TTC Land is focusing on prioritizing resources for existing projects, and has no plans to develop more land funds, so the items of customers’ advances to TTC Land have not changed much compared to the end of 2023.

At the recent Annual General Meeting of Shareholders for the fiscal year 2023, TTC Land’s leadership said that the strategy to 2025 and vision to 2030, the company will become a closed real estate enterprise. In the ecosystem of TTC Group currently under management, which includes about 1,300 ha of industrial park real estate, more than 700,000 m2 of warehouse real estate, the goal is to reach more than 2,000 ha of industrial park land and more than 1 million m2 of warehouse floor space by 2030.