New Structure Ownership Imminent?

Specifically, the General Meeting of Shareholders of Truong Thinh Energy Investment Joint Stock Company (HOSE: TTE) has approved the notable content of allowing Viet Phuong Investment Group Joint Stock Company (VPG) to acquire shares, leading to an ownership of over 25% of the total number of voting shares of TTE without having to conduct a public tender offer.

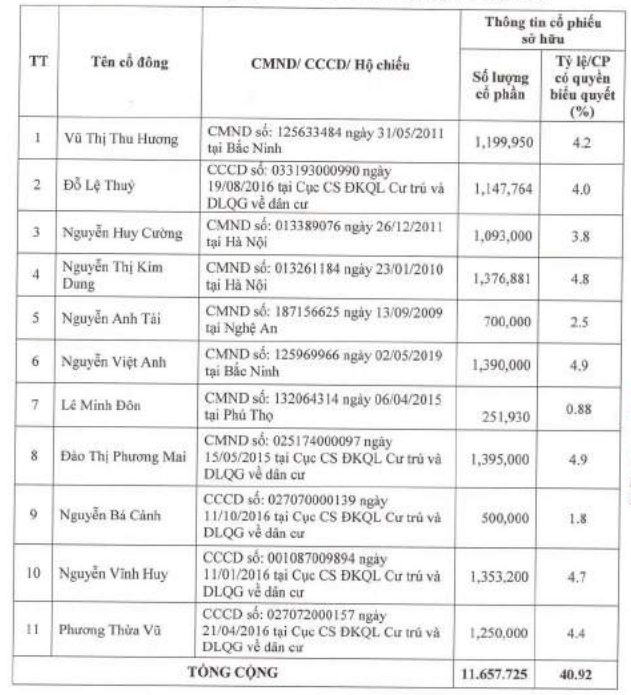

The list of shareholders planning to transfer shares to VPG includes 11 individuals, owning up to nearly 11.7 million shares, or 40.92% of the capital at TTE. Notably, this list includes Mr. Phuong Thua Vu – Chairman of TTE’s BOD and directly owning 4.39% of the capital, and Mr. Nguyen Ba Canh, who is Mr. Vu’s brother-in-law and currently owns 1.75% of the capital, according to information in TTE’s Corporate Governance Report (BCQT) for 2023.

The transaction is expected to be completed in 2024, through matching orders or negotiated transactions.

|

List of shareholders who plan to transfer shares to VPG

Source: Resolution of TTE’s 2024 Annual General Meeting of Shareholders

|

In fact, this matter was approved at the 2023 Annual General Meeting of Shareholders; however, due to various reasons, the transfer has not yet been carried out and will continue in 2024.

Also according to information in the 2023 BCQT, there is no shortage of names within TTE who are directly related to VPG, such as Mr. Dinh Xuan Hoang, who is both the General Director of TTE and the Deputy General Director of VPG; Ms. Le Thi Thu Huong, who is both an Independent Member of TTE’s BOD and an Assistant General Director of VPG.

|

Regarding VPG, the Company was formerly known as Viet Phuong Trade, Investment and Tourism Co., Ltd., established on January 5, 1996. Its main business activities include trade, services; public passenger transportation by taxi; and the exclusive distribution of stainless steel from NEUMO Group (Germany). During the period from 2001 to 2006, the Company invested abroad and participated in the manufacturing sector; invested in automobile production and assembly; and heavily invested in real estate. A notable project during this period was the investment in a wood processing and manufacturing factory in Khammouan province, Laos. In March 2007, the Company converted its business model into a Joint Stock Company. Throughout the subsequent period until 2010, the Company exploited non-metallic minerals such as kaolin, feldspar, and high-white stone; and explored metal minerals such as lead, zinc, and bauxite in Laos. During the period from 2010 to 2015, the Company invested and became the largest shareholder of Vietnam Asia Commercial Joint Stock Bank (VAB). Additionally, the Company invested in the construction of the Vientiane City Hall building and handed it over to the Lao capital’s authorities. The Company also explored investments in the energy sector. Since 2016, the Company has stepped up mineral exploitation and entered the pharmaceutical industry; invested in the construction of a high-quality low-iron quartz powder processing factory in Thua Thien Hue province; signed a contract to exploit and process bauxite ore with Laos; and invested in the pharmaceutical sector, becoming a strategic shareholder of Vietnam Pharmaceutical Corporation – Joint Stock Company (Vinapharm). |

Pre-tax Profit Plan Three Times Higher than 2023

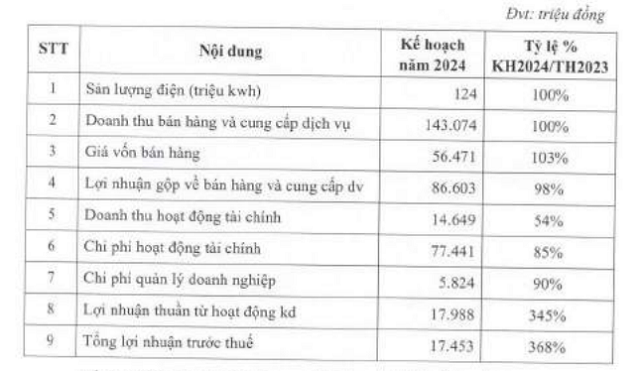

Looking ahead to 2024 and anticipating continued challenging hydrological conditions, TTE has set a target for electricity output of 124 million kWh, which is the same as in 2023. As a result, revenue is also expected to remain largely unchanged compared to 2023, at approximately VND 143 billion.

With an expected 46% decrease in financial revenue, a 15% decrease in financial expenses, and a 10% decrease in corporate management expenses, TTE estimates a pre-tax profit that is 3.7 times higher than in 2023, corresponding to nearly VND 17.5 billion.

|

TTE’s 2024 Business Plan

Source: Resolution of TTE’s 2024 Annual General Meeting of Shareholders

|

In 2023, TTE achieved nearly VND 143 billion in revenue and over VND 4.7 billion in pre-tax profit, representing respective decreases of 7% and 82% compared to 2022, and fulfilling only 55% of the revenue plan and 20% of the pre-tax profit plan for the year.

According to TTE, climate change and the El Nino phenomenon have led to unfavorable hydrological conditions, with less rainfall and prolonged heat, which have affected the operation of hydropower plants. The complex weather conditions and lower water levels in hydropower reservoirs during the first several months of the summer have been significantly lower than the multi-year average (particularly in March and April, with a 20-50% shortfall), resulting in reduced capacity and output of hydropower plants throughout the system.

Additionally, increased investment costs due to the provision of impairment losses on financial investments in joint ventures and associates (accounting for over 30% of financial expenses) have also contributed to the sharp decline in profits.

TTE’s Ta Vi Hydropower Plant in Tra Giac commune, Bac Tra My district, Quang Nam province

|

In the first quarter of this year, TTE recorded over VND 34 billion in revenue, over VND 2.8 billion in pre-tax profit, and over VND 2.4 billion in net profit, representing respective decreases of 13%, 23%, and 25% compared to the same period last year. With these results, TTE has achieved 24% of its revenue plan and 14% of its pre-tax profit plan for 2024.

Huy Khai