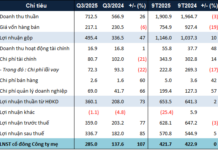

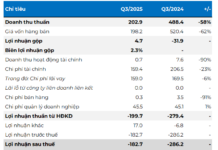

Vietnam Fumigation Joint Stock Corporation (code VFG) has just announced its financial report for the first quarter of 2024 with net revenue reaching nearly VND 966 billion, an increase of 40% over the same period last year. The slower increase in cost of goods sold helped improve gross profit margin from 20% in the same period to 23.9% in the past quarter. Gross profit reached VND 230.6 billion, an increase of nearly 67% over the first quarter of 2023.

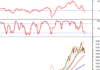

In the first quarter of the year, sales and general and administrative expenses increased sharply, by 200% and 157% over the same period in 2023, respectively. As a result, VFG’s net profit was VND 78.7 billion, up 38% compared to the first quarter of 2023. This is the second highest quarterly profit in the company’s history, after the record number achieved in the last quarter of 2023. preceding.

According to the explanation, due to the increase in prices of some of Vietnam’s billion-dollar agricultural products such as rice, durian, coffee, …, the company increased its sales activities, resulting in a sharp increase in revenue. Besides, the slower increase in cost of goods sold due to cash flow balancing, discounts for suppliers contributed to increasing profit. In addition, financial activities during the period were also effective.

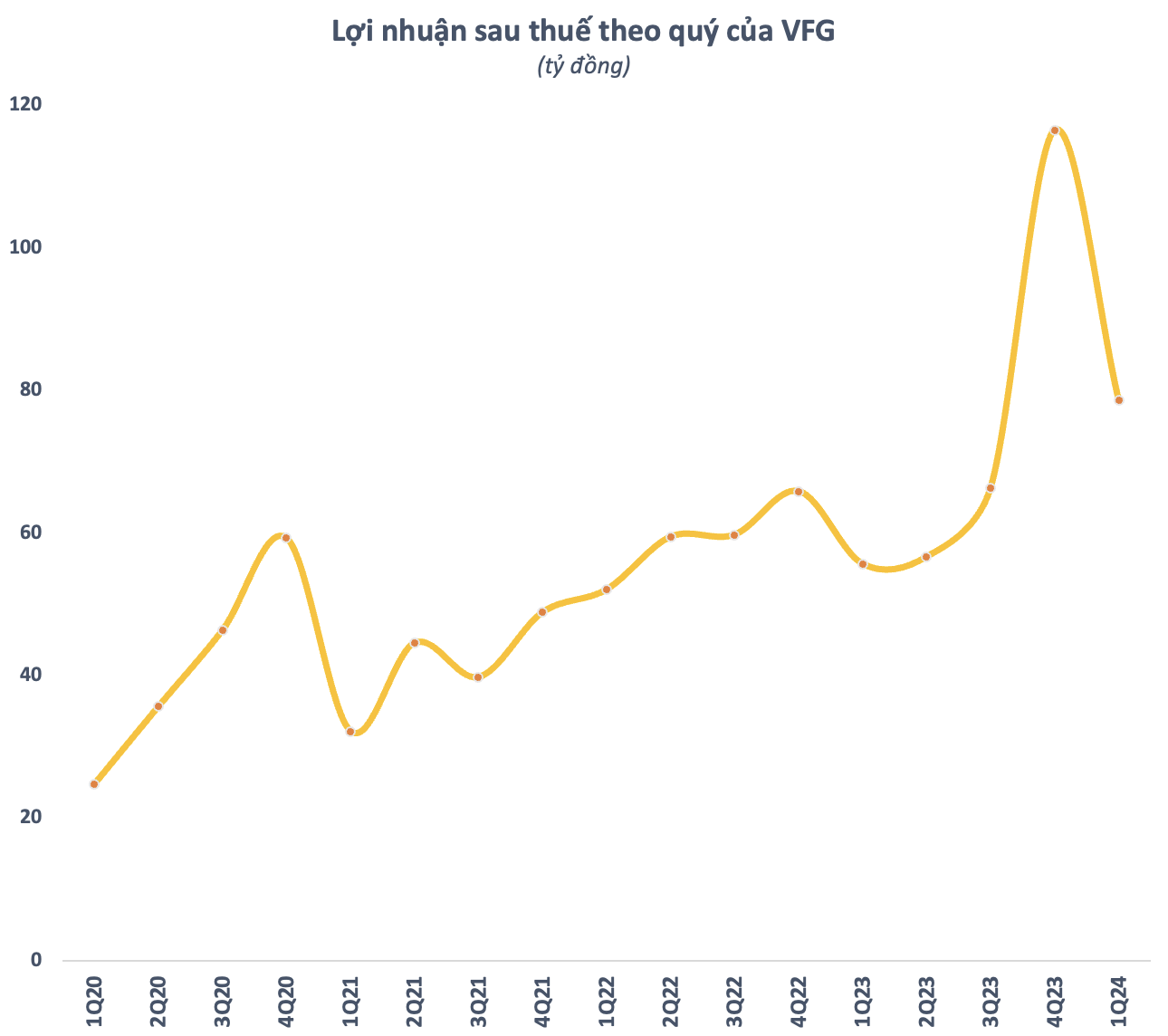

In 2024, VFG plans to set business targets with revenue of VND 3,690 billion, an increase of 13% and after-tax profit of VND 300 billion, a slight increase of 1% compared to 2023. If the plan is completed, the company will break the record for revenue and profit of the previous year. With the results achieved after the first quarter of the year, VFG has completed about 26% of the set targets.

With its main business activities being fumigation services and pesticide trading (pesticides, herbicides, fungicides and fertilizers), VFG used to have a period of many years with net profit hovering around VND 150 billion before unexpectedly making a large profit in the past 2 years. In 2023, the company’s after-tax profit reached over VND 296 billion, up 29% compared to 2022 and exceeding 18% of the plan.

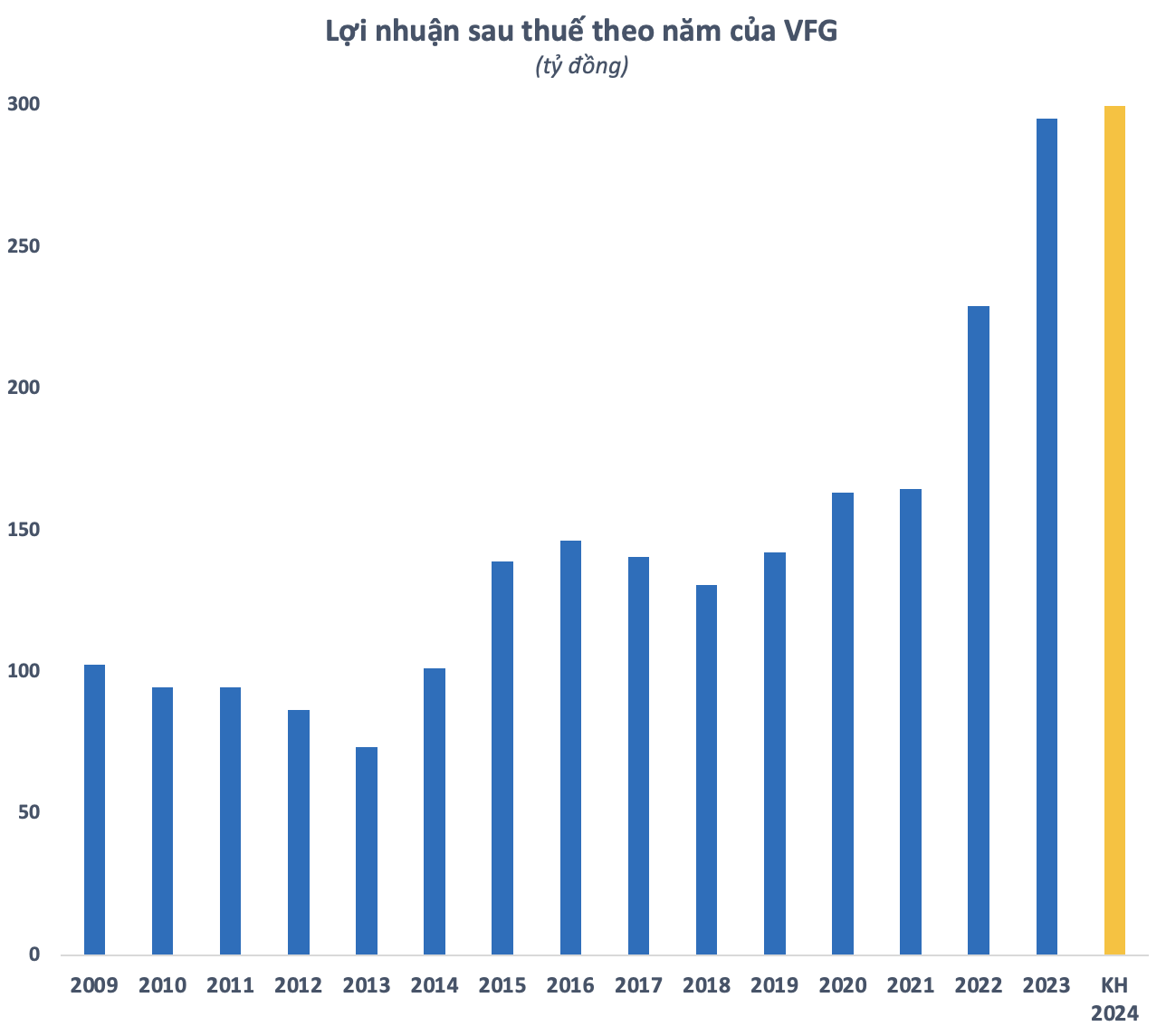

With the results achieved, VFG’s shareholders have approved a plan to distribute a 30% cash dividend for 2023. Previously, VFG had made two interim dividend payments to shareholders with a total ratio of 20% in cash. Thus, the company will have one more dividend payment with a ratio of 10%, corresponding to an expected amount of nearly VND 42 billion.

VFG is a company with a tradition of paying high annual dividends. Since its listing on the stock exchange at the end of 2009, the company has never failed to pay cash dividends, with the rate often fluctuating in the range of 25-30%. In 2024, VFG plans to pay a dividend of 20%. If the plan is completed, it is possible that the actual payout ratio may be higher than the plan.

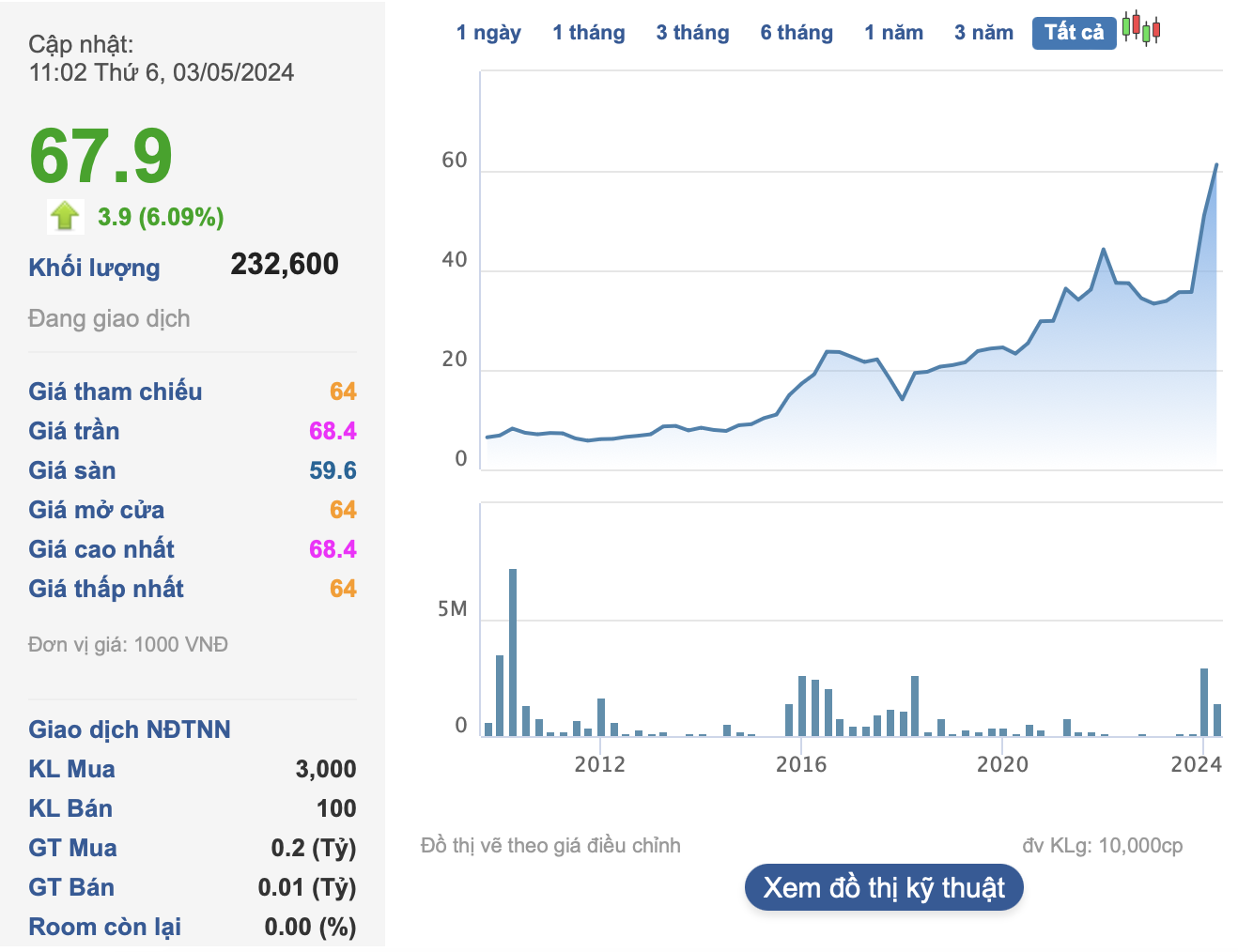

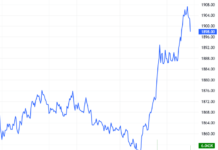

With the improved business situation and regular dividends, VFG’s stock price on the stock market also surged strongly to a new peak of around VND 68,000/share. The corresponding market capitalization value is about VND 2,800 billion, nearly double compared to the beginning of 2024.