SMC Grapples with Bad Debt, Aims to Resolve by Mid-Year

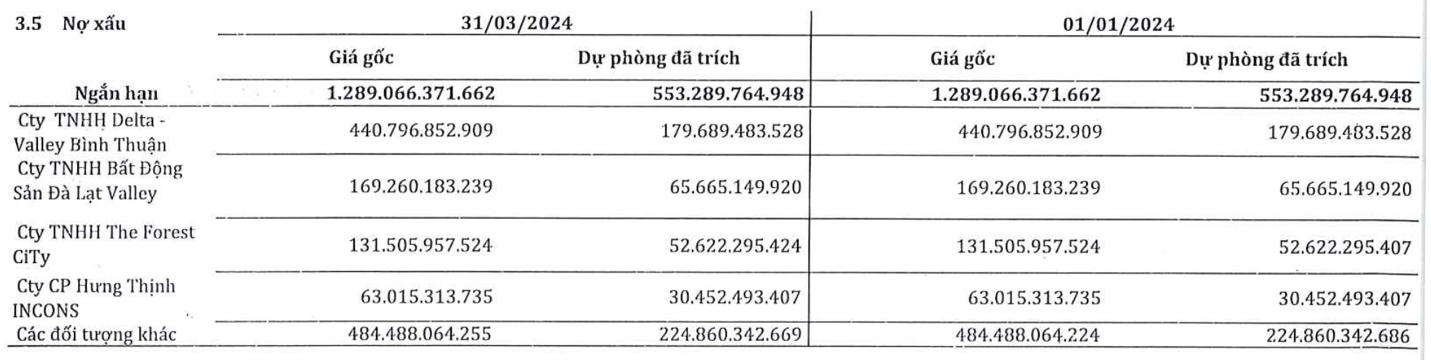

According to the consolidated financial statements for the first quarter of 2024 released by SMC Trading Investment JSC (stock code SMC), non-performing loans (NPLs) remained unchanged at over VND 1,300 billion, with 98% being short-term loans and the Company having made provisions of over VND 570 billion. The majority of NPLs originate from real estate companies affiliated with Novaland.

’Failure to Manage NPLs will Require VND 300 Billion Provision in 2024’

This issue was raised by concerned shareholders during the company’s 2024 Annual General Meeting of Shareholders (AGM) held last weekend. In response, Vice Chairwoman of the Board of Directors Ms. Nguyen Ngoc Y Nhi stated that in the first quarter, SMC **did not need to make additional provisions** for the loans. However, if the NPLs remain unresolved, SMC will need to recognize an additional VND 90 billion provision in the second quarter and a total of nearly VND 300 billion for the entire year 2024.

“This provision will impact profits, so SMC is working closely with Novaland and other partners,” the Vice Chairwoman noted.

She emphasized that SMC must resolve the issue this year, possibly before June 30. NPL resolution strategies include cash collection, debt-to-equity swaps, and accepting assets to offset debt. SMC is open to all feasible options, with the goal of resolving the issue this year to avoid additional provisions.

Regarding the VND 105 billion debt owed by HBC, SMC has signed an agreement to convert the debt into shares. Specifically, SMC expects to receive over 10 million HBC shares at a conversion price of VND 10,000 per share.

Steel market remains challenging

Profits from Sale of NKG Shares

Mr. Dang Huy Hiep, SMC’s General Director, added that the Company achieved after-tax profit of VND 183 billion in the first quarter of 2024, primarily driven by a VND 215 billion profit recognized from the sale of NKG shares.

However, the company’s trading segment continues to face challenges due to the impact of the real estate market and has required adjustments to business plans. SMC’s previous strength was in construction projects, but has now shifted to the residential segment, where profitability is lower and the focus is on maintaining market share and customer base. The steel pipe and coated steel production segments have registered losses and are reducing production scale. The processing segment has been the most stable for SMC.

According to Mr. Hiep, production volume in the processing segment is comparable to 2023, at about 800,000 tons, contributing VND 8 billion in the first quarter of 2024. While profitability is not yet high, it has improved compared to previously.

Steel processing contributes 56% of total revenue, while trading and steel production contribute 10% and 25%, respectively.

In the second quarter, SMC expects to generate additional profit from the transfer of its office building on Dien Bien Phu Street, according to Ms. Y Nhi. The transfer price is VND 170 billion, and after deducting expenses, SMC anticipates a profit of approximately VND 100 billion from this transaction.

Significantly, the SMC Phu My plant (which specializes in processing washing machine and refrigerator casings for Samsung) is expected to start contributing to profits from April 2024. Mr. Hiep stated that SMC is a 100% domestic supplier for Samsung, marking its entry into the global production chain. The plant will produce 2 million products in 2024. SMC is also actively seeking new customers for this plant.

For 2024, the Company has set conservative business targets of VND 13,500 billion in revenue and VND 80 billion in after-tax profit, with total sales volume expected to reach 900,000 tons.

In assessing the current market landscape, SMC’s management team summarized it in three keywords: “risk, uncertainty, caution.” For the steel industry, SMC believes that recovery will be gradual, mainly occurring in the second half of 2024, due to challenges posed by the real estate market and pressure from imported steel.