At the annual General Meeting of Shareholders of Hoang Anh Gia Lai International Agricultural Joint Stock Company (HAGL Agrico – Code: HNG) held on the morning of May 4th, shareholders questioned the company’s board of directors about the risk of delisting from the HoSE stock exchange after three consecutive years of losses.

Mr. Tran Ba Duong, Chairman of HAGL Agrico’s Board of Directors, responded by stating that the company must abide by the law and manage and operate the business honestly, ensuring transparency and accountability.

“Shareholders worry about delisting, but I believe transparency and establishing real value are crucial. Even if we are delisted to the UPCoM, the share price can still rise if we perform well,” said Mr. Tran Ba Duong.

He also added, “The company has a capital of 11,000 billion VND but has lost 8,000 billion VND. Thaco still supports our investment. I have great faith in agriculture in general and HAGL Agrico in particular.”

Mr. Tran Ba Duong shared that his view is that real value includes tangible asset value, potential value, and trust. He also indicated that HAGL Agirco has developed a model, and the next step is to manage operations to generate profits. The company is hopeful it will be able to invest in construction this year, and by 2025, it will have stable revenue and begin generating profits.

“The company is committed to creating real value and disclosing information so that the share price reflects the company’s true worth,” said Mr. Tran Ba Duong.

As the head of HAGL Agrico, Mr. Tran Ba Duong affirmed that he has no intention to merge the company. According to him, HNG shares will retain their value regardless of whether they are delisted or relisted. However, the company will explore solutions to make a quick return. Mr. Duong emphasized that he prioritizes the interests of minority shareholders over those of the company’s leadership.

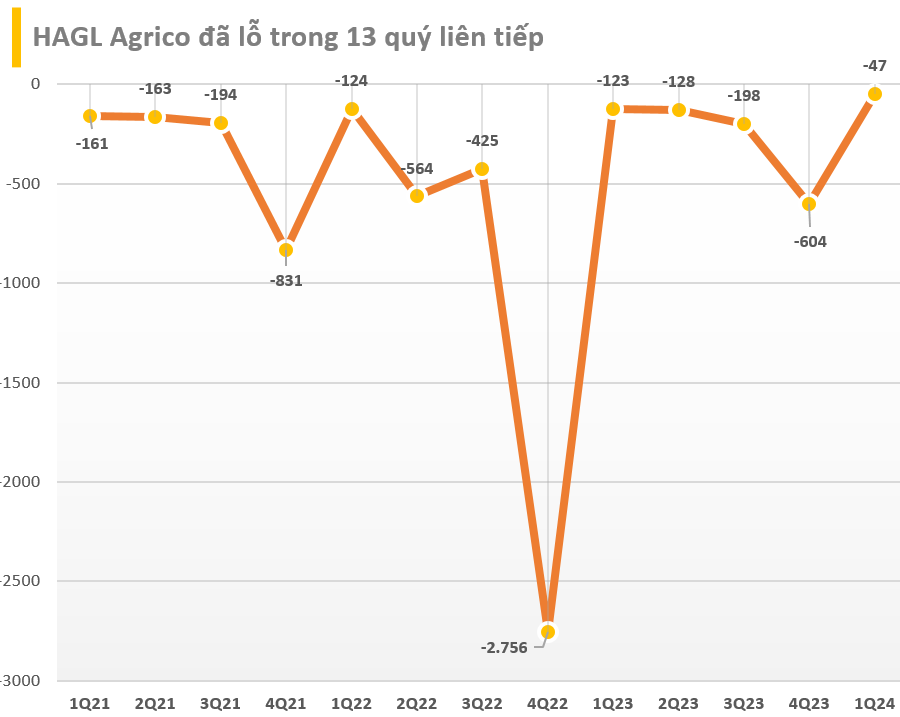

HAGL Agrico recently released its Q1 2024 business results, showing a 26% decrease in net revenue to 93.5 billion VND. Operating below cost, coupled with other expenses, led to a 47 billion VND post-tax loss. Nonetheless, this loss was lower than the 112 billion VND loss in the same period in 2023. This was the company’s 13th consecutive quarter of losses, although the magnitude of the losses has reduced to double digits.

At the end of Q1 2024, the company’s total assets were 14,247 billion VND. HAGL Agrico had an accumulated loss of 8,149 billion VND, reducing its equity capital to 2,487 billion VND. The total debt at the end of the period was over 8,800 billion VND, including 2,543 billion VND in long-term debt. HAGL Agrico owes 6,040 billion VND to Truong Hai Agriculture Joint Stock Company (a member of Thaco), 1,120 billion VND to HAGL, and the remaining debt to banks.