**Vietnam Stock Market: UPCoM Soars, Overshadowing HoSE Listings**

The Vietnamese stock market has witnessed significant fluctuations since the beginning of the year, reshuffling the list of the most valuable companies across the three exchanges. Notably, two representatives from the UPCoM market, Airport Corporation (ACV) and Viettel Global (VGI), have emerged as strong performers, eclipsing many established names listed on the HoSE.

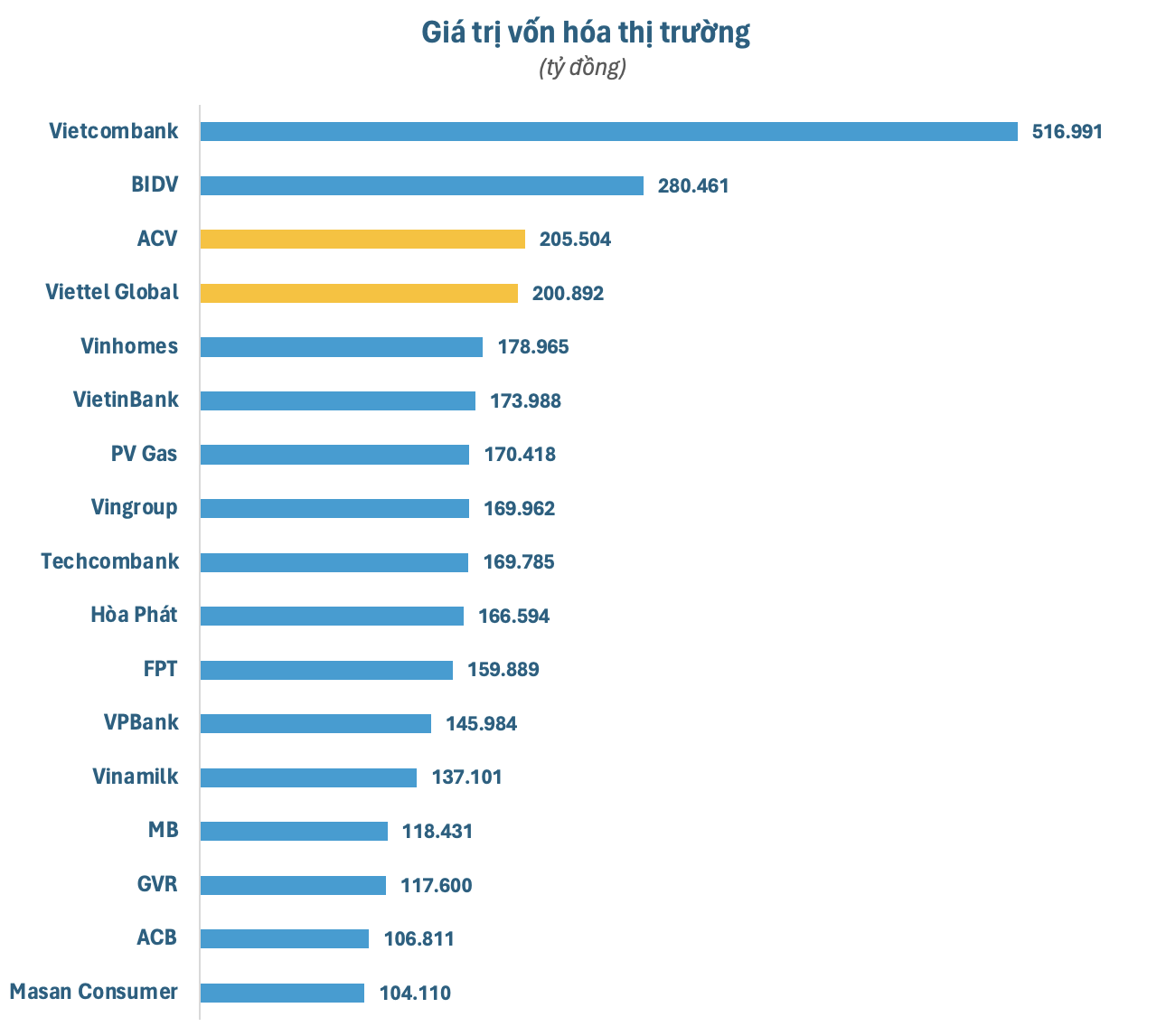

Since the start of 2024, ACV’s stock price has surged by 43%, while VGI has more than tripled its market value. The robust growth has propelled ACV and Viettel Global’s market capitalization to record highs above 200,000 billion VND. This feat elevates the two UPCoM giants above Vingroup, Vinhomes, Hoa Phat, FPT, and Vinamilk, ranking them second only to Vietcombank and BIDV on the list of most valuable companies on the stock exchange.

Data as of May 3, 2024

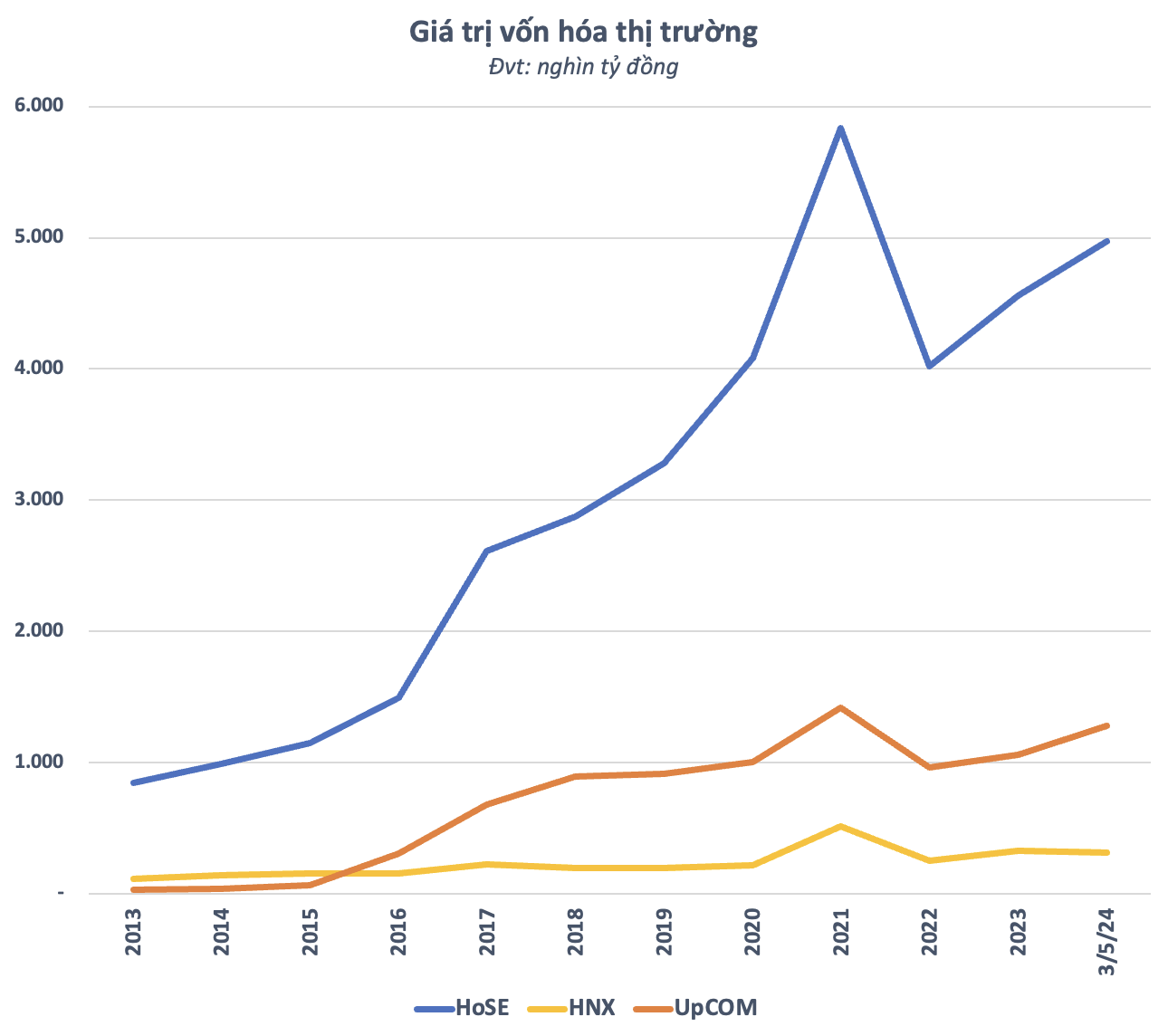

Currently, the combined market capitalization of ACV and Viettel Global exceeds 406,000 billion VND, surpassing the total value of over 300 companies listed on the HNX. However, this amount represents only about one-third of the UPCoM market’s capitalization. The rise of ACV and Viettel Global exemplifies the remarkable growth of the UPCoM market.

Previously perceived as a “second-tier market,” UPCoM primarily listed stocks of lesser quality or companies that had been delisted from higher exchanges. However, the exchange’s liquidity was low, and its market capitalization dwarfed that of the two established exchanges, HoSE and HNX.

Over a decade ago, at the end of 2013, UPCoM’s market capitalization was less than a quarter of HNX’s, standing at around 26,000 billion VND. By 2016, it had soared to over 300,000 billion VND, double that of HNX. As of May 3, 2023, with a market capitalization of nearly 1.28 million billion VND, UPCoM’s size was over four times that of HNX and equivalent to about a quarter of HoSE’s.

Data as of May 3, 2024

UPCoM’s significant leap in both quantity and quality resulted from the issuance of Circular 180/2015/TT-BTC (Circular 180) by the Ministry of Finance, guiding the registration of securities trading on the over-the-counter (OTC) market. The introduction of Circular 180 triggered a wave of state-owned enterprises (SOEs) privatizing and listing on UPCoM.

In addition to ACV and Viettel Global, numerous prominent companies such as Vietnam Airlines (HVN), VEAM Corp (VEA), Becamex (BCM), Viet Tien (VGG), Viettel Post (VTP), Viettel Construction (CTR), Binh Son Refining and Petrochemical (BSR), PV Oil (OIL), VIMC (MVN), and Vinatex (VGT) also joined the exchange. Some of these companies have since moved their listings to HoSE, but many remain on UPCoM and serve as its pillars.

Beyond SOEs, UPCoM has welcomed several large private sector companies, including Masan Consumer (MCH), Masan High-Tech Materials (MSR), Masan MEATLife (MML), Gelex Electric (GEE), Quang Ngai Sugar (QNS), and Minh Phu Seafood (MPC). These additions have further fueled trading activity on UPCoM.

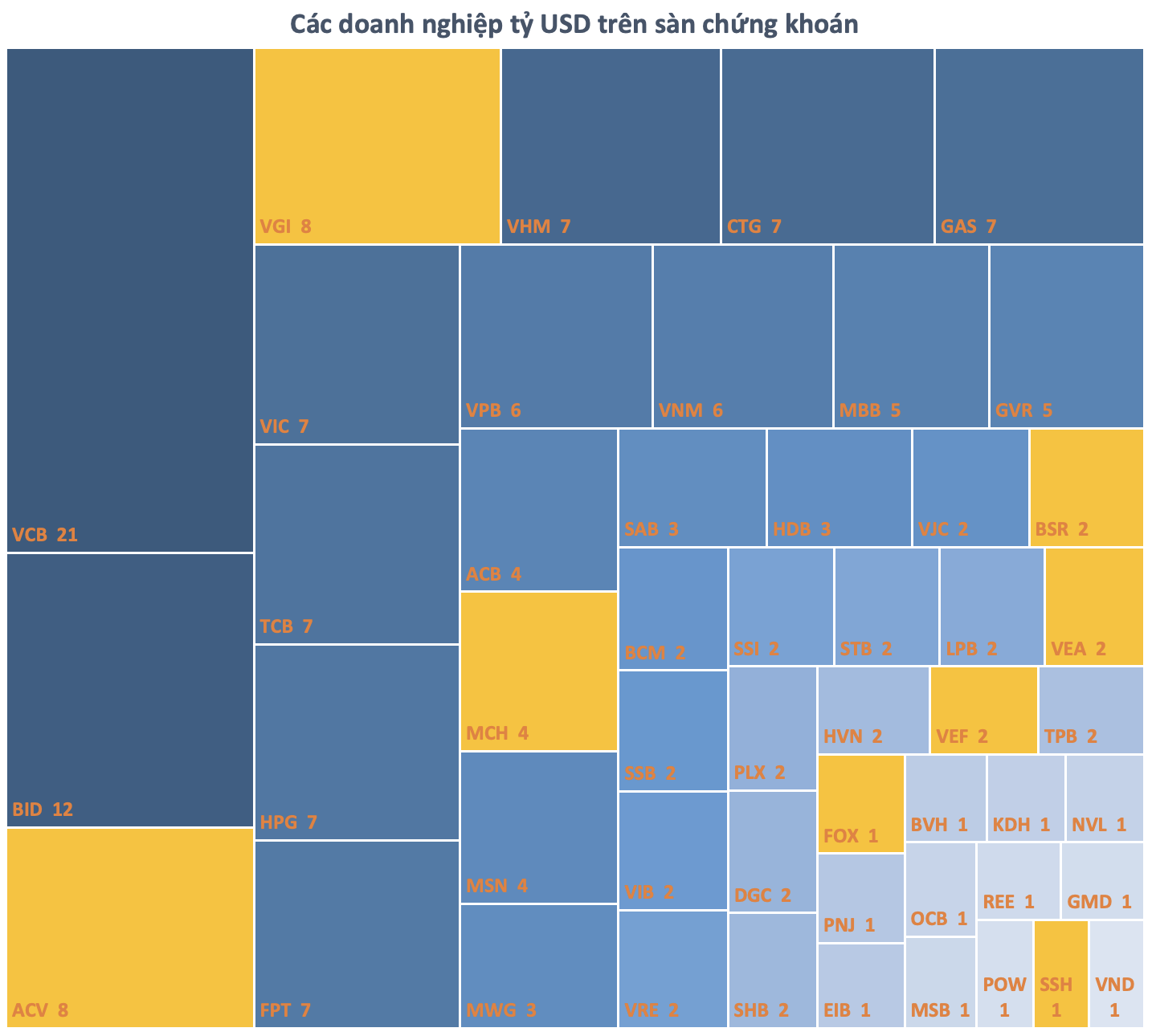

Presently, UPCoM boasts eight representatives among the 50 most valuable companies on the stock exchange (valued at over a billion USD), while HNX has none. There are 16 companies with market capitalizations exceeding 10,000 billion VND trading on UPCoM, significantly more than on HNX. With its extensive list of high-quality stocks, it is no exaggeration to say that UPCoM is a “treasure trove” of potential.

Data as of May 3, 2024. Yellow highlights companies listed on UPCoM.

It is important to note that many of the leading stocks on UPCoM still meet the listing requirements for HoSE or HNX. For various reasons, such as not having the need to raise capital or ownership issues, these companies choose to trade on UPCoM instead of being listed on a higher exchange.

Moreover, some companies opt to list on UPCoM as an intermediate step before transitioning to a higher exchange in the future. Stocks that are anticipated to become “blockbusters” upon listing are not scarce on UPCoM, but investors should be prepared to accept certain risks to capitalize on these trends.

Circular 180 stipulated that all public companies (CTDC) established before January 1, 2016, that are not listed on a stock exchange must register to trade on the UPCoM system within a year of January 1, 2016. For CTDCs established after January 1, 2016, the registration process must be completed within 30 days of the State Securities Commission (SSC) issuing an official confirmation of the CTDC’s registration or from the end of the public offering of securities.

For SOEs privatizing through a public offering, Circular 180 also specified that companies must complete the process of registering their securities with the Vietnam Securities Depository (VSD) and registering to trade within 60 days of receiving confirmation of the offering results from the SSC.