Louis City Hoang Mai Project Investors Urged to Settle Land-Use Fee Debt

Mr. Nguyen Trung Vu – Cre Chairman of the board, stated that the Hoang Van Thu New Urban Area project (commercial name Louis City Hoang Mai) owned by the Hoang Mai Urban Development and Investment JSC, has to pay approximately 1.4 trillion VND in land use fees for phase 3.

As of April 25th, the investor had paid around 758 billion VND, leaving a balance of over 668 billion VND. CRE is awaiting the investor’s next move by May 31st, 2024. Once the investor completes the payment, project sales will commence, estimated to begin in Q3 2024.

Vu emphasized that CenLand and customers are proactively urging the investor to arrange funds to settle the outstanding land-use fee. If the investor fails to mobilize sufficient funds or encounters delays, then CRE and the investor will collaborate with clients to explore viable alternatives, including the potential of raising capital from the customers themselves. Currently, the investor is negotiating and soliciting assistance from customers.

According to Vu, clients have thus far paid only 30–50% of the transaction value for this project, with the remaining amount pending bank loan approvals. If banks approve the disbursement, the company will receive a substantial revenue stream from this project and plans to utilize it to repay the company’s outstanding bonds.

Regarding the underlying cause, Vu explained that the investor is facing challenges in securing funds for the land-use fee due to risks associated with the government’s land policies, resulting in significantly higher land-use fees than anticipated.

Consequently, CenLand will exercise greater caution in the secondary investment segment, prioritizing projects with clear legal statuses and particularly those for which the government has approved land prices, to mitigate risks similar to the Louis City Hoang Mai project – phase 3, which incurred significantly higher land-use fees compared to the initial plan.

CRE is currently evaluating projects in Quang Ninh and Bac Giang that meet these criteria.

The Louis City Hoang Mai project covers an area of 22.3 hectares, with a total investment capital of approximately 2,068 billion VND. The overall construction density is 33%, and the project comprises 609 townhouses and 72 villas. It is situated across Hoang Van Thu, ThinhLiet, and Yen So wards in Hoang Mai district, Hanoi.

For this project, CRE, Galaxy Land Real Estate JSC, and Trustlink Investment and Services JSC pooled their funds to invest and make down payments to the investor, totaling nearly 1,358 billion VND.

CRE and Galaxy Land contributed 70% of the capital, while Trustlink contributed 30%. However, according to the agreement between CRE and Galaxy Land, CRE will contribute the entire 70% of the contracts’ capital value. As of the end of 2023, CRE had invested nearly 1,168 billion VND in the project.

Perspective of Louis City Hoang Mai project

|

Turning a Loss into Profit in the First Quarter

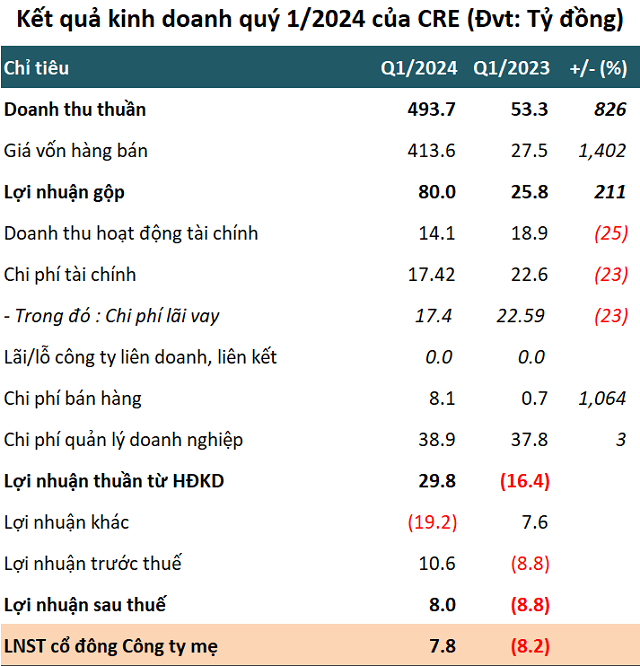

At the end of the first quarter, CRE reported revenue of 494 billion VND, more than 9 times higher than the same period last year. Net profit was nearly 8 billion VND, compared to a loss of over 8 billion VND in the same period.

This is largely attributed to the recovery in revenue from real estate brokerage and investment services, which amounted to over 466 billion VND, 7 times higher than the same period last year. CRE reported that the real estate market has shown positive signs in Q1, with transactions gradually picking up, leading to increased revenue and profits.

Source: VietstockFinance

|

CRE’s 2024 Annual General Meeting of Shareholders approved an ambitious business plan with a net revenue target of 3,250 billion VND and a pre-tax profit of 220 billion VND, representing a 3.5-fold and nearly 45-fold increase compared to 2023, respectively.

The company has achieved 15% of its revenue target and 5% of its pre-tax profit target after the first quarter, relative to the plan.

CRE shares under control, CenLand plans to earn pre-tax profit of 220 billion VND