Photo: Thanh Liêm/TTXVN

In An Giang, according to the provincial Department of Agriculture and Rural Development, prices for most rice varieties remain unchanged: Đài thơm 8 at 8,000 – 8,200 VND/kg, OM 18 at 7,800 – 8,000 VND/kg, Nàng Hoa 9 at 7,600 – 7,700 /kg, Japanese rice at 7,800 – 8,000 VND/kg, IR 50404 at 7,400 – 7,500 VND/kg, OM 5451 at 7,600 – 7,700 VND/kg…

With regard to retail rice in An Giang, regular rice is priced at 14,000 – 16,000 VND/kg; fragrant long-grain rice at 19,000 – 20,000 VND/kg; Jasmine rice at 17,500 – 19,000 VND/kg; common white rice at 17,000 VND/kg, Nàng Hoa rice at 19,500 VND/kg…

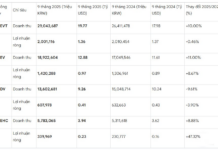

Looking back at rice prices in April 2024, there were mixed developments depending on each variety. The purchase price of wet IR50404 rice in An Giang reached 7,450 VND/kg, a drop of 90 VND/kg compared to March but an increase of 1,305 VND/kg (21.2%) compared to the same period in 2023. Meanwhile, the price of OM5451 rice in An Giang and Kien Giang reached 7,489 VND/kg (up 33 VND/kg) and 7,400 VND/kg (up 25 VND/kg) respectively, marking increases of 18% and 16.8% compared to the same period in 2023.

Regarding exports, traders said that 5% broken Vietnamese rice was offered at 577 – 580 USD/ton on May 2, a slight increase compared to a week earlier.

In the first four months of 2024, rice exports reached 3.23 million tons, an increase of 11.7% with 2.08 billion USD, an increase of 36.5% compared to the same period last year. This result is attributed to an average rice export price of 644 USD/ton since the beginning of the year, an increase of 22.2%.

According to the Ministry of Agriculture and Rural Development, the country’s rice output in 2024 is estimated to reach 43 million tons. This output will ensure domestic consumption needs and export more than 8 million tons.

A rice store in Chennai, India. Photo: AFP/TTXVN

In the Asian rice market, Indian rice prices are at their lowest level in three months due to weak demand and ample supply, while Thai rice prices have risen to their highest level in over a month due to strong domestic demand.

Indian 5% broken rice is offered at 528 – 536 USD/ton this week, unchanged compared to last week. An exporter in the southern Indian state of Andhra Pradesh said the market has not seen much movement, with buyers postponing purchases as rice prices are being adjusted in all major exporting countries.

Meanwhile, the price of Thai 5% broken rice has increased slightly to 588 – 595 USD/ton, from 580 – 585 USD/ton last week. A trader in Bangkok said rice prices will remain high due to strong domestic demand and activity. In addition, drought could also keep rice prices high.

Meanwhile, in Bangladesh, a prolonged heat wave due to high temperatures and low rainfall is likely to affect the rice crop in the country’s main rice-growing area during the summer this year.

Regarding the US agricultural market, soybean and corn futures on the Chicago Board of Trade (CBOT) both increased in the May 2 session and are headed for a second consecutive week of price increases, due to flooding that has disrupted harvesting in Brazil, the leading exporter, and the negative impact of fall armyworms on Argentina’s corn crop.

Meanwhile, wheat futures also rose, but are headed for a weekly decline, as traders grew less concerned about the potential impact of dry weather in Russia and the US on crop yields and supplies.

Farmers harvesting soybeans on a farm in Scribber, Nebraska, USA. Photo: AFP/TTXVN

The price of nearby soybean futures on the CBOT rose 0.5% to 12.045 USD/ bushel, while corn rose 0.7% to 4.6275 USD/bushel and wheat rose 1.2% to 6.1125 USD/ bushel (1 bushel wheat/soybean = 27.2kg; 1 bushel corn = 25.4kg). Soybean prices have reached their highest level since March 26 and are headed for a 2.3% increase for the week. Corn prices also recorded their highest level since January 8, and have increased 2.8% in the past week. Meanwhile, wheat has declined 1.8% compared to the closing price of the previous week’s session.

However, prices for all three commodities have been hovering near four-year lows recorded earlier this year due to ample supplies and speculators are still betting on the possibility of lower prices.

The crop in Rio Grande do Sul, Brazil’s second-largest soybean and sixth-largest corn producing state, has been ravaged by floods during the final stages of harvesting. Meanwhile, hot and dry weather in central Brazil is damaging the corn crop, which is nearing harvest and at a critical stage of development.

In addition, due to the spread of fall armyworms and adverse weather, the Buenos Aires grain exchange has reduced its estimate of Argentina’s 2023/24 corn production by 3 million tons to 46.5 million tons. Argentina is the world’s third-largest corn exporter.

However, forecasts of rain in the US and Canada are improving yield prospects in those countries, offsetting the situation in South America.

Coffee powder processing at Vuong Thanh Cong Production and Trading Co., Ltd. in Buon Ma Thuot city, Dak Lak province. Illustrative photo: Vu Sinh/TTXVN

Regarding the global coffee market