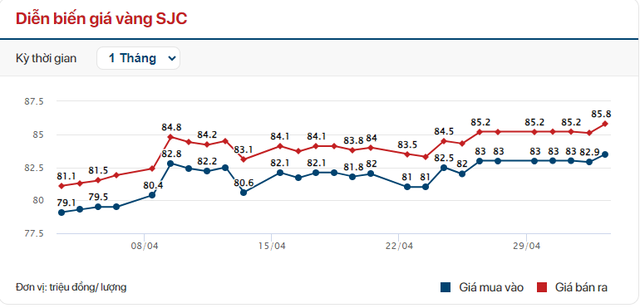

This afternoon, May 3, gold businesses have raised the selling price of SJC gold to nearly 86 million VND/tael – the highest level in history. Specifically, Saigon Jewelry Company listed the SJC gold price at 83.5-85.8 million VND/tael (buy-in-sell-out). Phu Nhuan Jewelry Company (PNJ) also anchored the SJC gold price at a similar level. Meanwhile, VietinBank Gold has adjusted the gold price up to 83.5-85.82 million VND/tael.

Previously, on April 15, the SJC gold price also established a peak (up to that point) of 85.5 million VND/tael. However, this milestone did not last long and immediately after that fell to around 83-84 million VND/tael.

The price of gold in the country has increased sharply in contrast to world gold when the world price is plummeting and has dropped below the 2,300 USD/ounce mark. At 6:00 p.m. on May 3, the gold price was only around 2,297 USD, equivalent to about 70.5 million VND/tael. The time lag and inverse fluctuations have widened the gap with the domestic gold price to 15 million VND.

SJC gold price movement in the last month. Chart: CAFEF.

The price of gold in the country and the world has fluctuated in opposite directions many times and the difference is very large. Before this development, from April 19, the State Bank issued an announcement about organizing the first gold bar auction on April 22. However, the first gold auction in more than a decade was canceled due to insufficient number of participating businesses. On April 23, the State Bank continued to hold an auction of SJC gold bars and only 2 members won the auction with a total volume of 34 lots (equivalent to 3,400 taels of gold) out of a total of 16,800 taels offered.

After that, the State Bank continued to issue two more notices to auction gold bars, but both times were canceled. Thus, out of 4 times the State Bank has called for bids up to this point, 3 times have failed due to the lack of sufficient number of participating businesses.

The gold auction of the State Bank has had a significant impact on the gold price trend. Specifically, in the days when the State Bank announced the organization of the auction, the SJC gold price all experienced a sharp decrease in the early morning session, then reversed to increase sharply again (after the announcement of the auction cancellation or the sale of a small amount).

Experts say that gold bar auctions are not yet an effective solution to reduce the gap between domestic and world gold bar prices. With the current geopolitical developments, the domestic gold price still has the impetus to increase. On the other hand, due to the sharp increase and decrease in gold price, the trend of people is still pouring money into this investment channel to “surf the waves”. The high demand for gold from the people continues to push up the SJC gold price.

Regarding the forecast of gold prices in the coming time, according to Dr. Nguyen Tri Hieu, gold is still an investment channel that attracts money. Hieu said that, for investors, profit is only part of the motivation that makes people put down money. In the context of the stock market still fluctuating erratically, real estate facing difficulties and low deposit interest rates, investors choose gold as a safe haven with easy liquidity. Meanwhile, the profit of gold currently fluctuates around 10%.

This expert analyzed that when the economy is stable, other investment channels such as real estate and securities recover, the gold price tends to decrease or move sideways. Conversely, when the economy is in difficulty, other investment channels are not attractive, the price of gold will increase due to the psychology of Vietnamese people who love to buy gold for accumulation.

Hieu also predicts that gold prices will continue to rise in the near future. If Decree 24 is not amended and the intervention from management agencies does not solve the supply and demand, the gold price will continue to increase.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)