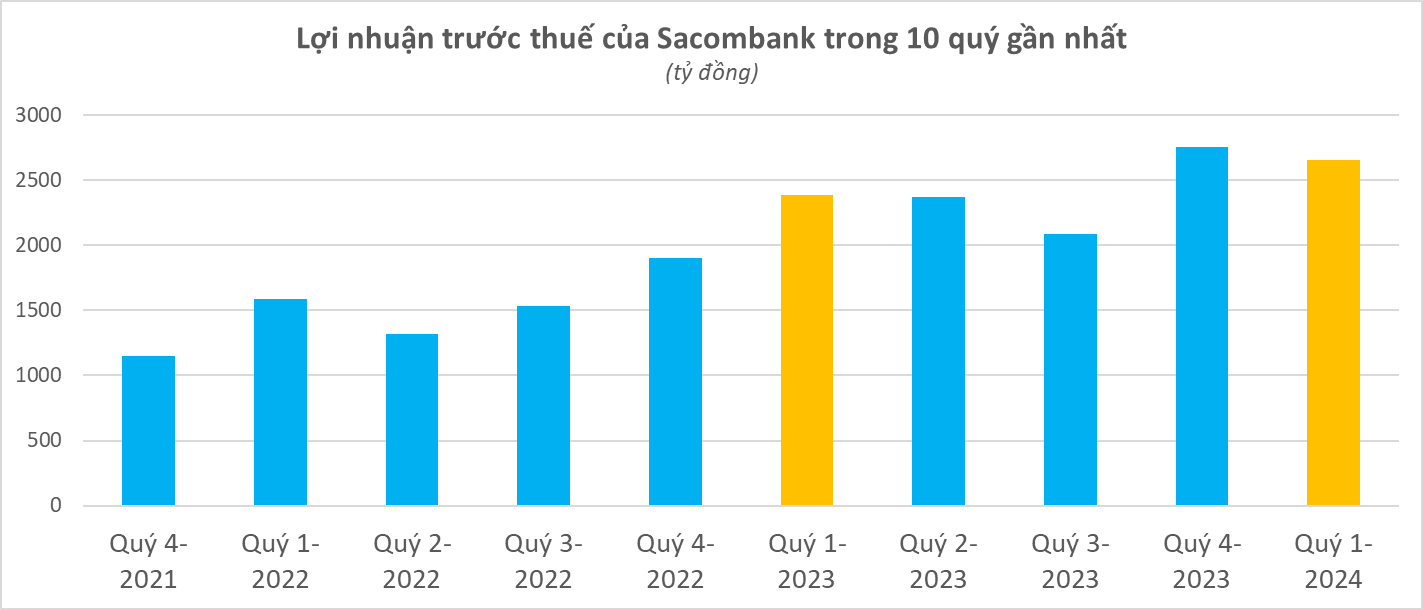

According to the first-quarter financial report of 2024 of Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank – STB), the bank recorded a consolidated pre-tax profit of 2,654 billion VND in the first quarter, an increase of 11.4% compared to the same period in 2023.

The main growth driver of the profit is the significant decrease in risk provision expenses compared to the same period last year, at 677 billion VND, a decrease of 32% compared to the first quarter of 2023.

Meanwhile, Sacombank’s net business profit (before provision) decreased slightly by 1.5% compared to the same period, reaching 3,332 billion VND. Total operating income reached 6,875 billion VND, an increase of 1.1%; operating expenses were at 3,542 billion VND, an increase of 3.7%.

Most of Sacombank’s business segments saw positive growth compared to the same period last year, however, the growth was not significant, leading to almost flat total revenue. Specifically, the bank’s net interest income increased by 2%, reaching 5,951 billion VND. Foreign exchange trading profit increased by 19%, reaching 307 billion VND. Profit from the trading of securities reached 21 billion VND, an increase of 15 billion VND. Service activities, however, performed poorly, with a profit of 578 billion VND, a decrease of 12.2%.

As of March 31, 2024, Sacombank’s total assets were 693,535 billion VND, an increase of 2.8% compared to the beginning of the year. Customer loans increased by 3.7% to 500,408 billion VND. Customer deposits increased by 4.4% to 533,358 billion VND.

In terms of asset quality, the financial report shows that Sacombank’s bad debt increased by 3.8% in the first three months of the year to 11,402 billion VND. The ratio of bad debt to loans remained unchanged at 2.28%. Currently, group 5 debt (debt with a high risk of loss) is 6,282 billion VND, an increase of 28% in the first quarter.

Sacombank’s bad debt coverage ratio improved from 69% to 73%.

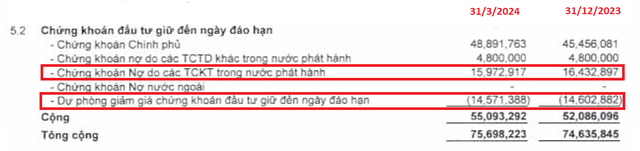

The special bonds issued by VAMC continued to decrease to 15,973 billion VND (a decrease of 460 billion VND compared to the end of 2023). Of which, the bank has set aside a provision of 14,571 billion VND.

Sacombank’s accounts receivable decreased by more than 9,000 billion VND in the first three months of the year (equivalent to a decrease of 21.7%) to 32,910 billion VND. Interest and fees receivable decreased by 3.2% to 5,503 billion VND.

It is known that Sacombank has stepped up the handling of bad debts and outstanding issues in recent times in order to complete the Restructuring Plan. At the 2024 Annual General Meeting of Shareholders, Sacombank’s leaders said that in 2023, the bank had recovered and handled 7,941 billion VND of bad debts and non-performing assets, of which 4,487 billion VND were debts under the Restructuring Plan, reducing the proportion in total assets to 3% (compared to 28.6% in 2016). Sacombank has successfully auctioned the Phong Phu Industrial Zone project debt, recovering 20% of the value. The winning bidder will continue to make payments to Sacombank as the project’s legal documents are completed.