The 2024 Annual General Meeting of Shareholders (AGM) was held on April 24, where the leadership of the Vietnam Construction and Import-Export Corporation (Vinaconex, HOSE: VCG) shared information about the Cat Ba Amatina project.

Mr. Dao Ngoc Thanh – Chairman of VCG said that the project was stalled for more than a decade and was only restarted in 2020. The project has completed legal procedures, all apartments are sold out, and basic infrastructure construction is done.

Mr. Nguyen Xuan Dong – CEO of Vinaconex informed that Cat Ba Amatina is a large resort project, while this segment is not an urgent need for people nowadays, so the market is relatively weak. VCG has agreed with the Board of Directors of Vinaconex Tourism and Investment Development Corporation (Vinaconex ITC, UPCoM: VCR) to plan sales in 2024, but depending on the market, they may sell in bulk or part of the project, with the condition that the selling price must ensure a profit.

Mr. Dong went on to emphasize that VCG is still the parent company holding 51% of the project as well as VCR, so it will continue to inject capital into the project because VCR is a project company, and if the project is not sold, there will be no money. However, Mr. Dong mentioned that if the project is sold now, it will not fetch a high price. Besides, the process of applying for planning procedures, issuing red books, basic construction design, appraisal, and then building permits and sales is very difficult. In the short term in 2024, VCG will try to find partners and record part of the project’s revenue in the year.

Chairman Dao Ngoc Thanh also affirmed that the project is basically complete and ready to be put into operation in 2024 if the market allows. “This is the most important issue because the market is stagnant, so we must consider carefully.”

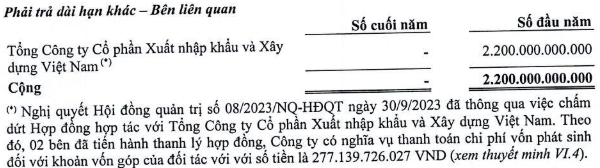

Regarding the issue of VCR returning VND 2,200 billion to Vinaconex, Mr. Dong explained that this is a cooperation fund to build 2 hotel blocks, but due to the weak market, VCG issued bonds (VND 2,200 billion in 2021) to contribute capital for construction. However, the market situation makes it that if the buildings are built and not sold, the capital cost will increase significantly. Therefore, Vinaconex decided to withdraw the money, temporarily not build the 2 hotel blocks, and pay off the bonds; when the market improves, they will start the construction. “We affirm that Vinaconex is not withdrawing from the Cat Ba Amatina project”, emphasized Mr. Dong.

Perspective of Cat Ba Amatina. Source: VCG

|

How much have the two parties invested in Cat Ba Amatina?

VCR was established by 3 founding shareholders including VCG, Eximbank (EIB) and Agriseco (AGR) in March 2008.

After going public and being listed on the stock exchange, as of December 29, 2023, VCR has 1,299 individual shareholders holding about 47.94% of the shares and 10 institutional shareholders holding the remaining 52.06%. In which, VCG is the only major shareholder and the parent company holding 51%.

The 2023 audited financial statements show that in the past year, VCG has liquidated the cooperation contract with VCR and has recovered the entire long-term receivable amount of VND 2,200 billion.

Besides, VCG has approximately VND 1,996 billion of short-term costs of production and business in progress at the Cat Ba Amatina project and nearly VND 5,266 billion of long-term construction in progress costs of the project, an increase of more than VND 500 billion after a year. Thus, the total construction in progress cost of Cat Ba Amatina amounts to VND 7,262 billion.

VCG said that the assets arising from this project are used to secure long-term bank loans and bonds. Specifically, VCG borrowed from Sacombank (STB) – Ho Chi Minh City branch with an outstanding balance of VND 1,832 billion, an interest rate of 11.7-13.2%/year, secured by a part of the land use rights of Cat Ba Amatina. The Sacombank loan was originated in the first quarter of 2022 with an initial value of more than VND 2.3 trillion and a loan term until October 2027.

Last year, the Company fully repaid VND 1,700 billion of the remaining bonds of the VND 2,200 billion lot issued to TPBank in June 2021, with a maturity date of June 2028, an interest rate of 9.9-10.6%/year, the secured assets are all rights and interests arising from the business cooperation contract with VCR; infrastructure items, land use rights, and assets attached to the land, together with all ownership rights of VCR on the land plots belonging to Cat Ba Amatina.

At the end of 2023, VCG had VND 1,600 billion of bond debt (interest rate of 10.5-10.51%/year, decreased from 12.1-12.3%/year in mid-year) due in June 2024, the secured assets are shares of VCG owned by Pacific Holdings Investment Corporation.

As for VCR, its total assets in the past year decreased by VND 2,200 billion to VND 4,956 billion, this decrease is the amount that VCR paid to VCG according to the Resolution of the Board of Directors on September 30, 2023 through the termination of cooperation with VCG, the two parties liquidated the contract and VCR is obliged to pay the capital cost incurred for the capital contribution of VCG in the amount of over VND 227 billion (recorded in financial expenses during the year).

Source: VCR

|

|

In addition to the two companies liquidating the contract, the Chairman of VCG Dao Ngoc Thanh also resigned as the Chairman of the Board of Directors of VCR from January 23, 2024. |

As of the end of 2023, VCR recorded VND 3,553 billion of long-term construction in progress costs and nearly VND 14 billion of short-term costs at Cat Ba Amatina, including 5 BT4 villas scheduled to be handed over to customers in 2024. Regarding the outstanding debt of VND 1,832 billion of VCG at Sacombank – Ho Chi Minh City branch mentioned above, VCR said that the project has a loan limit of VND 2.5 trillion, a loan term of 7 years from October 2020 to October 2027.

What will the future of Cat Ba Amatina be?

In the first three months of this year, VCR recorded