| SGP’s Quarterly Business Results in Recent Years |

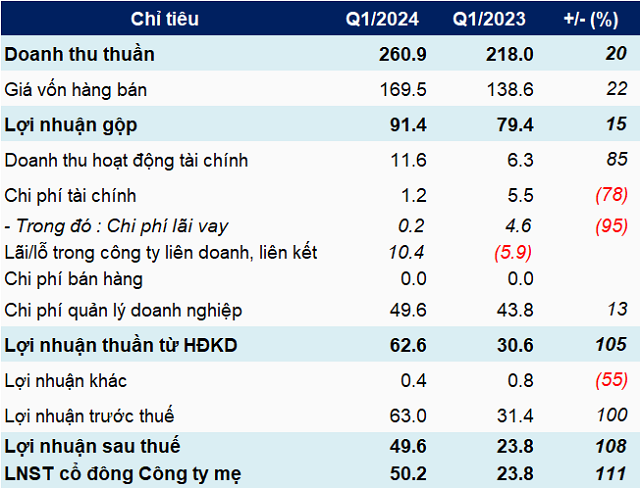

In the first quarter of 2024, SGP’s net revenue reached nearly 261 billion VND, a 20% increase compared to the same period last year. Port operation services contributed 69% to this revenue.

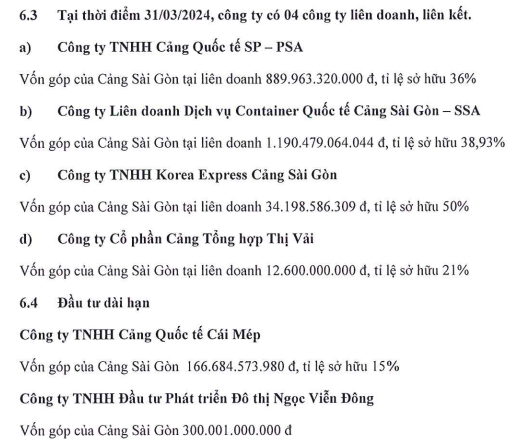

Remarkably, revenue from related parties surged by 70% to almost 62 billion VND, accounting for 24% of SGP’s revenue. It exceeded the 17% in the same period last year. A large portion of the related party revenue came from Saigon Port – SSA International Container Terminal Joint Venture Company Limited, with over 26 billion VND, and Cai Mep International Port Co., Ltd., with over 17 billion VND.

After deducting the cost of goods sold, SGP’s gross profit was over 91 billion VND, up by 15%.

The financial operations showed efficiency, resulting in a profit of over 10 billion VND, 13 times higher than the same period last year. This was largely due to increased revenue from interest on deposits and loans, while interest expenses on loans significantly decreased.

Another highlight was SGP’s shift to a profit of over 10 billion VND from its joint ventures and associates, as opposed to a loss of nearly 6 billion VND in the same period last year – a difference of over 16 billion VND. According to the Company’s explanation, in the first quarter, Thi Vai綜合Port Joint Stock Company’s profit increased by 2.32 billion VND, Saigon Port – SSA International Container Terminal Joint Venture Co., Ltd., by over 14 billion VND and SP – PSA International Port Co., Ltd., decreased slightly by 157 million VND.

Somewhat pressuring the results, the management expenses increased by 13% to approximately 50 billion VND due to higher provisions for doubtful accounts receivable and other management expenses. But with the significant increase in revenue as mentioned above, the management expenses, although higher, only accounted for 19% of revenue, a decrease of 1 percentage point.

As a result of these developments, SGP’s pre-tax profit was 63 billion VND, 100% higher than the same period last year. This accounted for 27% of the year’s plan. After deducting taxes and minority interests, SGP’s net profit was over 50 billion VND, an increase of 111%.

|

SGP’s Business Results in the First Quarter of 2024

Unit: Billion VND

Source: VietstockFinance

|

As of March 31, 2024, SGP’s total assets reached nearly 5,379 billion VND, relatively unchanged from the beginning of the year. Half of this is fixed assets (28%) and long-term financial investments (21%) in joint ventures and associates, as well as capital contributions to other entities.

Source: SGP’s Q1 2024 Financial Statements

|

On the other side of the balance sheet, SGP has a total of nearly 2,615 billion VND in liabilities, a 4% increase compared to the beginning of the year, representing 49% of the total capital sources. SGP does not have much debt, with the majority being in the form of other long-term debt, close to 1,783 billion VND. Notably, it owes 850 billion VND to Ngoc Vien Dong Urban Development Investment Co., Ltd., and 599 billion VND to the Ministry of Finance, both related to the advance capital for the Saigon – Hiep Phuoc Port project. In addition, there is a loan guarantee of almost 250 billion VND from SP-PSA International Port.

Source: SGP’s Q1 2024 Financial Statements

|

The debt to Ngoc Vien Dong Company is related to SGP’s receipt of capital advances during 2013-2015, which were approved by the Ministry of Transport for the construction and operation of the Saigon – Hiep Phuoc Port Project Phase 1. According to the agreement dated August 31, 2017, Ngoc Vien Dong Company agreed for SGP to continue managing, operating, and doing business in the Nha Rong – Khanh Hoi area during the period when the Saigon – Hiep Phuoc Port project has not been completed.

SGP is responsible for completing the relocation and disposal of assets on condition that Ngoc Vien Dong completes the legal procedures for the land. Moreover, from the date of signing the agreement, SGP is not liable for any related expenses during the period of land use. After the relocation is completed, the settlement of this capital advance will be made between the Company, the Ministry of Finance, and Ngoc Vien Dong Company.

As for the payable to the Ministry of Finance, SGP is expected to repay it when the construction of the project is completed.

|

On May 16, 2009, the Saigon – Hiep Phuoc Port was officially built as an international seaport. According to the initial plan, the first phase of the project was located on the Soai Rap River, Nha Be District, Ho Chi Minh City, with an area of 54 hectares, including 16.8 hectares belonging to the Hiep Phuoc Logistics Service Area project. The total investment capital for the port was 2,735 billion VND, constructed with three berths 800m long and two floating berths allowing for vessels with a tonnage of 30,000 DWT to 50,000 DWT. There is also a 1,000-ton barge berth at the upstream and downstream approach bridges, a container yard, a general cargo yard, a warehouse… The total cargo volume through the port is about 8.7 million tons/year. Currently, the Saigon – Hiep Phuoc Port project is managed by Saigon Hiep Phuoc Port Joint Stock Company, which is also a subsidiary of SGP. Although the initial plan was to complete the project in 2011, it is still under construction.

|