**The Vietnamese Stock Market**

**MWG Soars on ETF Restructuring, Foreign Buying**

The Vietnamese stock market witnessed a particularly active trading session last Friday, with shares of Mobile World Investment Corporation (MWG) taking center stage. Trading volume reached nearly 30 million units, a record high in the company’s listing history. The corresponding transaction value reached approximately VND 1,700 billion, the highest on the stock exchange on May 3rd.

Foreign investors also traded actively in this stock, net buying nearly 10 million units with a net purchase value of over VND 545 billion, making MWG the stock with the highest foreign net buying on the market that day.

The influx of funds pushed MWG’s share price to VND 55,700 per share, its highest level in almost 8 months since mid-September last year. The corresponding market capitalization exceeded VND 81,500 billion, double what it was a year ago.

MWG’s sudden liquidity surge stemmed primarily from the Q1 2024 ETF restructuring activity. Specifically, MWG shares were officially removed from the VNDiamond index, with BMP added in their place. Currently, there are 4 ETFs on the market using the VNDiamond index as a reference, including DCVFMVN DIAMOND, MAFM VNDIAMOND, BVFVN DIAMOND, and the newly listed ETF KIM GROWTH VN DIAMOND, with a combined net asset value of approximately VND 16,000 billion. The new indices will take effect from May 6th, 2024, and these ETFs need to restructure their portfolios by the deadline of May 3rd, 2024.

It is estimated that the aforementioned ETFs held approximately 50 million MWG shares in their portfolios and needed to sell all of them. It is highly likely that the restructuring activity was carried out over the past few sessions, as liquidity at MWG was also relatively high in the previous session on May 2nd, with a trading volume of nearly 22 million units.

Despite receiving somewhat unfavorable news, MWG is once again receiving attention from foreign capital after a long period of continuous selling in late 2023. Foreign investors have been actively returning for about a month now, aggressively injecting billions into this retail stock. Most recently, Dragon Capital Group bought a total of nearly 4.7 million MWG shares on April 23rd, increasing its ownership to 6.25%.

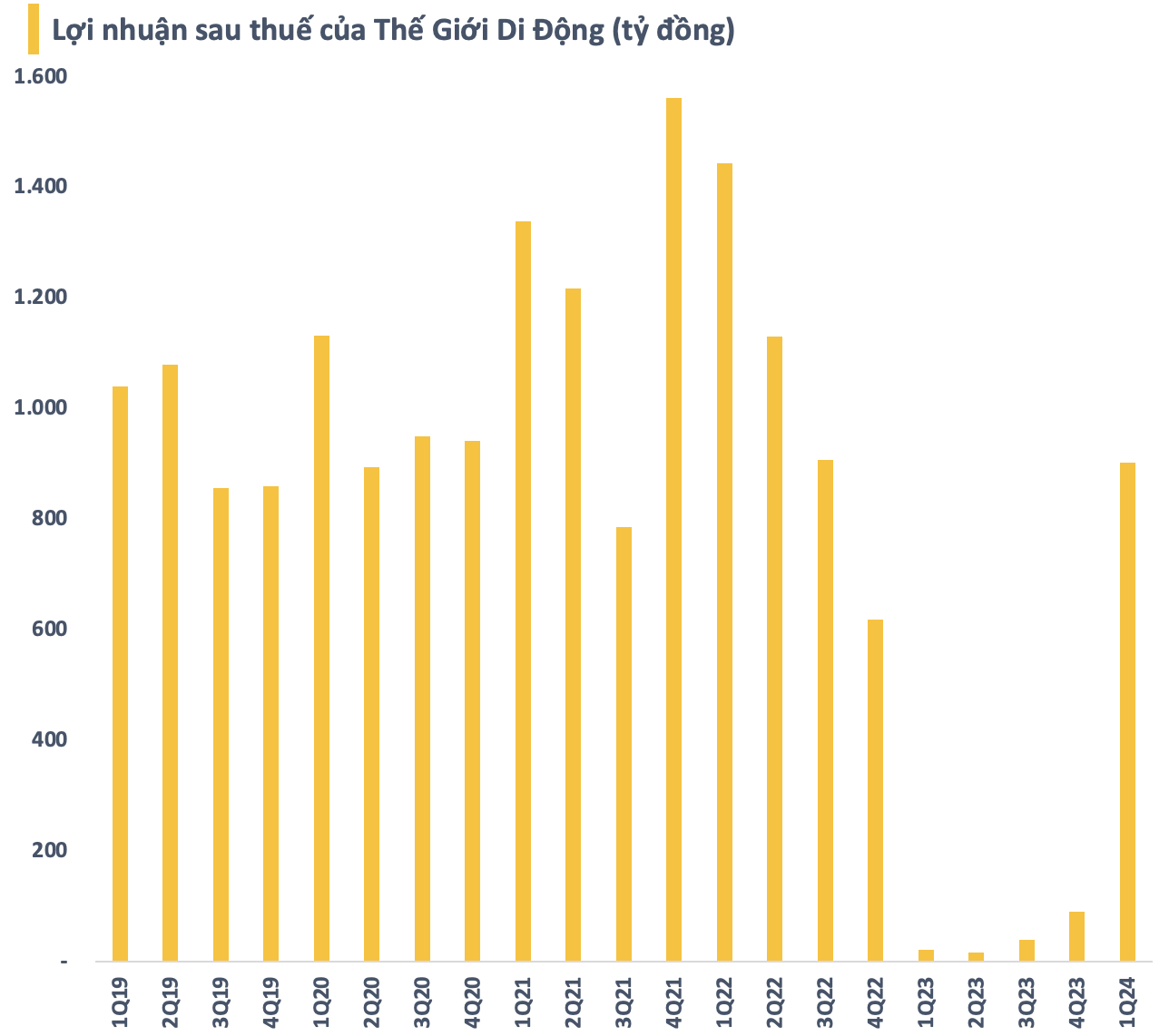

Strong business recovery is thought to be the catalyst that has made MWG attractive again. In Q1 2024, net revenue reached VND 31,486 billion, an increase of over 16% compared to the same period last year, fulfilling 25% of the full-year revenue plan. After deducting expenses, MWG recorded a net profit of VND 902 billion, 43 times higher than the same period in 2023 and the highest it has been in 6 quarters since Q3 2022.

According to MWG, the main growth driver came from the home appliance segment with a double-digit revenue increase, with air conditioners being a standout product, increasing by approximately 50% compared to the same period last year. The gross profit margin for both the TGDĐ and ĐMX chains improved significantly in Q1 2024 due to the home appliance segment’s increased contribution to total revenue, as this product group has a stable profit margin.

For Bach Hoa Xanh, Q1 revenue reached over VND 9,100 billion, an increase of 44% compared to the same period last year. Average revenue reached VND 1.8 billion per store per month, with revenue growth driven by both the fresh food and FMCGs segments, continuing to maintain breakeven status after all expenses, in line with current operating practices. The average number of transactions reached approximately 500 bills per store per day, a 40% growth, and the average value per bill increased slightly compared to the same period last year.

This year, MWG has set ambitious plans for revenue of VND 125,000 billion and after-tax profit of VND 2,400 billion in 2024. Chairman of the Board of Directors Nguyen Duc Tai said that the company is prepared to cope with market fluctuations, has room to grow, and is determined to achieve its targets. The company has reason to be optimistic, as after the first quarter of the year, it has already achieved over 25% of its revenue plan and nearly 38% of its profit target for the entire year.