Perspective of Phuoc Thien Township KDC project.

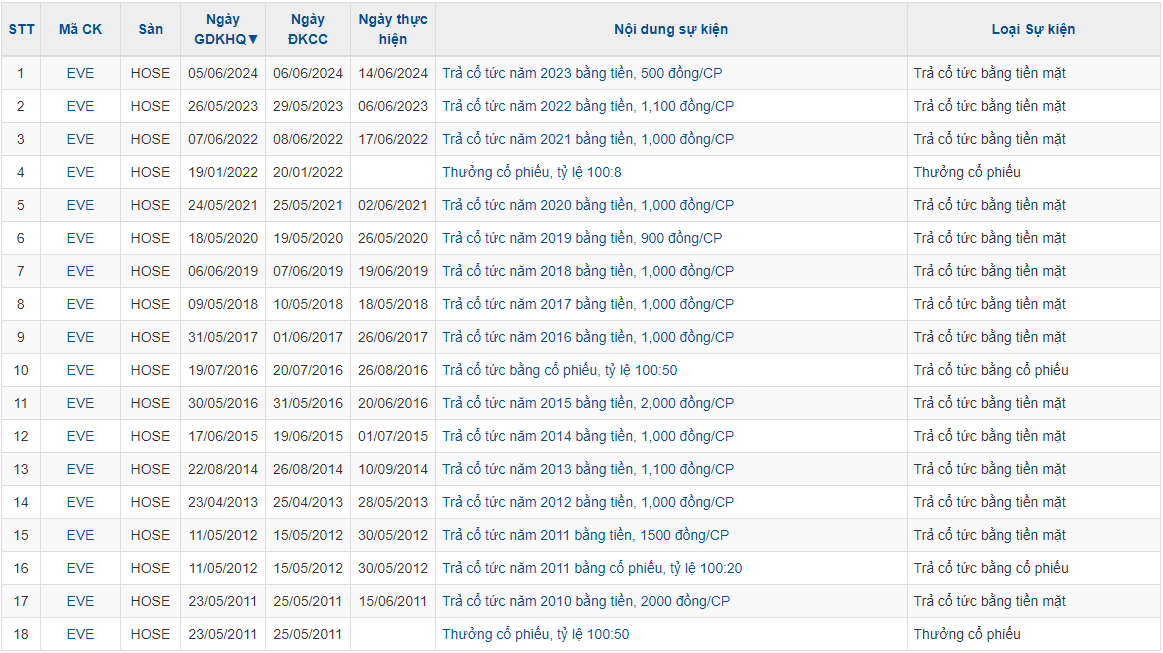

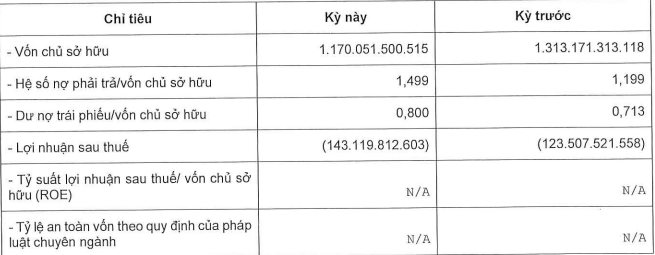

According to information from the Hanoi Stock Exchange (HNX), Dien Vi Investment and Real Estate Company Limited (Dien Vi Real Estate) has just announced periodic information on the financial situation in 2023. Accordingly, this real estate company continues to report a loss of 143 billion VND.

Previously, Dien Vi Real Estate reported a loss of VND 123.5 billion in 2022 and a loss of VND 42.3 billion in 2021.

In terms of the company’s financial health, as of the end of 2023, the company’s equity was VND 1,170 billion, down nearly 11% compared to the beginning of the year.

The ratio of debt to equity increased from 1.199 times (equivalent to VND 1,574 billion) at the beginning of the year to 1.499 times (equivalent to VND 1,753 billion). In which, the remaining bond debt is VND 936 billion, accounting for 53.4% of the company’s outstanding debt.

Dien Vi Real Estate has a second year of reporting a loss of over a hundred billion VND.

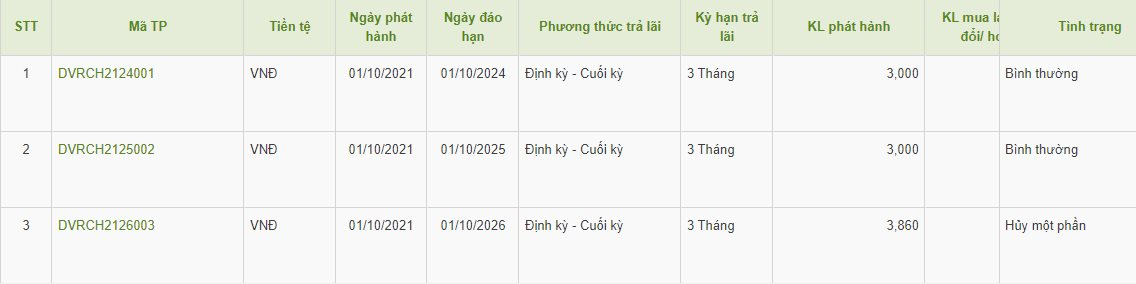

The remaining bond debt corresponds to the total volume of 3 bonds that Dien Vi Real Estate issued in October 2021.

Specifically, on October 1, 2021, Dien Vi Real Estate issued 3 bond tranches consisting of bond tranche DVRCH2124001; bond lot DVRCH2125002 and bond tranche DVRCH2126003, with terms of 3, 4 and 5 years respectively, and with values of VND 300 billion, VND 300 billion and VND 386 billion respectively. Thus, bond tranche DVRCH2124001 will mature on October 1st, the remaining two tranches will mature in 2025 and 2026.

In terms of interest rates, the above bond tranches are all 11%/year for the first interest calculation period. In the following interest calculation periods, the interest rate will be equal to the sum of the reference interest rate and the spread of 4%/year, but not lower than 11%/year.

These are all non-convertible bonds, not attached to warrants and secured by assets. With the secured assets being the property rights arising from the assignment contract together with all the expected contributed capital owned by Dien Vi Real Estate at Khang An – Nhon Trach Real Estate Investment Company Limited.

Regarding the purpose of issuance, Dien Vi Real Estate said that the entire amount of capital raised from the issuance of bond tranche DVRCH2126003, with a value of VND 386 billion, will be used by this real estate company to receive the transfer of 70% of the contributed capital at Khang An – Nhon Trach Real Estate Investment Company Limited pursuant to the assignment contract signed with Mr. Nguyen Hoang Minh.

The capital mobilized from bond tranche DVRCH2124001 and bond tranche DVRCH2125002, with a total value of VND 600 billion, is also used by Dien Vi Real Estate for the purpose of receiving the transfer of contributed capital at Khang An – Nhon Trach Real Estate Investment Company Limited.

Thus, it can be seen that Dien Vi Real Estate has spent a total of 986 billion VND for the above M&A transaction.

Outstanding bonds of Dien Vi Real Estate. (Source: HNX)

According to research, Khang An – Nhon Trach Real Estate Investment Company Limited has a charter capital of VND 2,116 billion and is the investor of a residential area project in Phuoc Thien Commune, Nhon Trach District, Dong Nai Province. This project is built on a land area with a total planning area of 380,331m2, with a construction density of 35%, Phuoc Thien Residential Area consists of villas, townhouses and high-rise apartments.

On the side of Dien Vi Real Estate, this company was established in August 2020 (until it successfully mobilized nearly 1,000 billion VND in bonds, it was just over 1 year old). The company is headquartered at 81 Cach Mang Thang Tam, Ben Thanh Ward, District 1, Ho Chi Minh City. The company’s main business line is real estate business. Data from HNX, this real estate company currently has a charter capital of VND 20 billion.

The company’s legal representative is Chairman of the Board of Directors Le Thanh Liem. In addition, Mr. Le Thanh Liem is also the legal representative of many companies such as: Khang An – Nhon Trach Real Estate Investment Company Limited, Saigon – Binh Chau Tourism Joint Stock Company, Phu Vinh Investment Consulting Service Joint Stock Company, TNHH Vung Tau Beach City, ….