According to Pham Xuan Hong – The Chairman of Ho Chi Minh Textile – Embroidery – Knitting Association, in the second quarter of 2024, the number of orders is estimated to recover at a moderate rate, about 10-15%. “The orders are still not many, but the diverse range of products makes the production easier for manufacturers,” Mr. Hong said.

Tran Nhu Tung, Chairman of Thanh Cong Textile – Investment – Trading Joint Stock Company, said that his enterprise has received more than enough orders for quarter III of 2024. It is predicted that the number of orders for the last quarter of 2024 will increase, as that is the peak of the production season to meet the market demand for holidays and Tết.

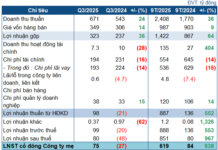

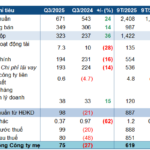

Mr. Tung estimates that in the second quarter of 2024, the company will record growth in both revenue and profit compared to the same period of 2023. In which, in April 2024, the revenue and profit are expected to increase about 15%.

With the improvement in the number of orders, companies have shown high expectation for this positive signal and wish that it will last until the end of the year. The enterprises are speeding up production to fulfill their orders.

As for Dong Xuan Knitwear One Member Co., Ltd, the FOB orders from Japanese customers have met the requirements up until the end of quarter III of 2024. However, the general price level has not improved compared to 2023, which is similar to many other enterprises in the industry.

This year, several of Dong Xuan’s customers such as Aeon, Itochu, Organ have increased their orders. In terms of product quality, Aeon highly appreciates Dong Xuan’s products compared to FOB products from competitors in the area. As for Itochu, even though the growth rate is slow, they are still a potential customer for special products targeted for the Japanese market.

Textile and garment orders increase 10-15%. Photo: Can Dung

Despite the improvement in the number of orders in the second quarter of 2024, according to Mr. Hong, the situation is still not positive. Brands are still “cautious” in their decisions regarding orders as many importers are monitoring the effect of political changes around the world and the recovery of some major consumer countries.

Regarding the impact of the Red Sea conflict, the leader of the Ho Chi Minh City Textile – Embroidery – Knitting – Dyeing Association stated that the influence on textile and garment enterprises has decreased. The supply of materials and export have been “adapted” and gradually stabilized. The current issue is price competition, therefore, to achieve the best price, businesses must increase productivity and minimize costs.

Agreeing with the above statement, Nguyen Dang Loi, General Director of Dong Xuan Knitwear One Member Co., Ltd, also said that the enterprises are facing a number of internal difficulties as the labor competition in Hung Yen becomes increasingly fierce. After the Lunar New Year, the number of employees leaving exceeds the number of new recruits.

In addition, although equipment and facilities have been deeply invested, there are still plenty of outdated, low-capacity ones… The enterprises are making decisions to divest, liquidate, and continue investing in new equipment for production. At the same time, they are actively trying to increase productivity in order to meet customer requirements.

In contrast to clothing items, according to Dau Phi Quyet – Deputy General Director of Viet Thang Group – Joint Stock Company, the export market for woven fabrics has witnessed relatively fierce competition. Many customers have put the prices of Vietnamese finished fabrics and gray fabrics on the scales with that of suppliers from China, India, and Bangladesh, forcing enterprises to find solutions to seek opportunities for supplying fabrics to the domestic market.

However, under the pressure of prices from cheaper suppliers, the enterprises are having to find solutions to reduce prices of finished fabric products in order to provide the best pricing policy for domestic customers with the aim of retaining old customers and expanding more new customers.

The increase in orders has helped textile and garment companies overcome the crisis and gradually recover after an extremely difficult 2023. In 2024, the Ministry of Industry and Trade has taken many initiatives to support the textile and garment community’s early recovery. Aside from trade promotion and extending the international market, the Ministry of Industry and Trade also organizes and participates in trade fairs and large-scale exhibitions in the country to attract textile and garment investors to Vietnam.

A typical example is the 2024 Vietnam International Textile and Garment Industry and Textile Technology Exhibition (VIATT 2024), according to the Ministry of Industry and Trade, the exhibition provided a favorable condition for textile and garment businesses in Vietnam to connect with international enterprises, participate in global textile and garment production chains, and establish links throughout the value chain from raw material production to finished products. At the same time, it will encourage global leading brands to transfer technologies, management experience, and participate in the development of supply chain for raw materials to establish a domestic supply chain.

“The exhibition, organized by the Ministry of Industry and Trade, was held at a time when the market was showing improvement and has created a significant impact by “pulling” multiple brands and investors to Vietnam. It has helped domestic textile and garment enterprises sign orders and connect with suppliers of raw materials for production,” said Mr. Hong.