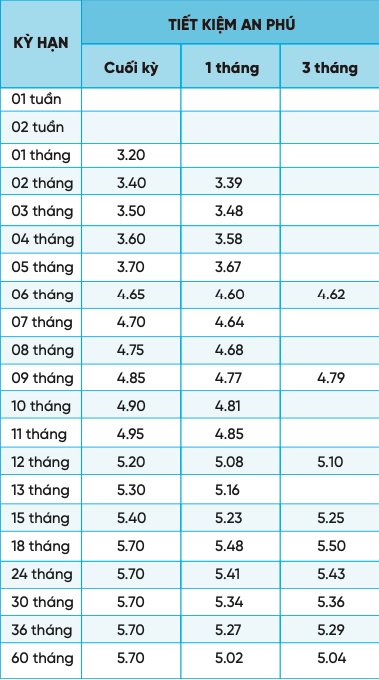

On May 4th, National Citizen’s Bank (NCB) adjusted the interest rates on its savings accounts for various terms, with an average increase of 0.1-0.2 percentage points.

Specifically, the latest savings interest rates at NCB for the 6-month term increased by 0.2 percentage points to 4.65% per annum.

The savings interest rate for the 7-month term rose by 0.2 percentage points to 4.7% per annum.

The savings interest rate for the 8-month term increased by 0.2 percentage points to 4.75% per annum.

The savings interest rate for the 9-month term increased by 0.2 percentage points, quoted at 4.85% per annum.

The savings interest rate for the 10-month term was also adjusted upwards by 0.2 percentage points to 4.9% per annum.

The savings interest rate for the 11-month term increased by 0.1 percentage points to 4.95% per annum.

The savings interest rate for the 12-month term increased by 0.2 percentage points to 5.2% per annum.

The savings interest rate for the 13-month term increased by 0.2 percentage points to 5.3% per annum.

The savings interest rate for the 15-month term increased by 0.2 percentage points to 5.4% per annum.

The savings interest rate for terms ranging from 24-60 months increased by 0.2 percentage points to 5.7% per annum. This is the term with the highest interest rate offered by the bank.

For terms less than 6 months, NCB maintained the same savings interest rates. Previously, the bank had raised interest rates twice in April.

Chart of the latest savings interest rates at NCB. Source: NCB

Earlier on May 3rd, Vietnam Oil and Gas Bank (GPBank) also adjusted its interest rates upwards for certain terms. Specifically, GPBank’s savings interest rates for terms ranging from 6 -36 months were raised by an average of 0.2-0.3 percentage points. The interest rates for other terms remained unchanged by the bank.

Accordingly, the online savings interest rates for the 6-month and 9-month terms increased by 0.2 percentage points, corresponding to 4.35% per annum; 4.6% per annum respectively. The interest rate for the 12-month term increased by 0.3 percentage points to 5.15% per annum. The bank also adjusted up by 0.3 percentage points to 5.25% per annum for the 18-36 month term.

On the first day back to work after the holiday, ACB Joint Stock Commercial Bank also raised its interest rates. Specifically, ACB’s savings interest rates increased by 0.2 percentage points for terms ranging from 1 to 3 months for all deposit amounts. ACB maintained the same interest rates for other terms.

For deposits below VND200 million, the interest rates for 1-3 months currently stand at 2.5%-2.9% per annum. The current 12-month savings interest rate at ACB is 4.5% per annum. Compared to the savings interest rate chart for deposits under VND200 million, this bank added a corresponding 0.1 percentage point of interest for deposits from VND200 million to under VND1 billion for each term, an additional 0.15 percentage points of interest for deposits from VND1 billion to under VND5 billion, and an additional 0.2 percentage points of interest for deposit accounts of VND5 billion or more.