In the international market, the USD-Index fell below 106 points, down 1.01 points from last week, to 105.08 points.

The USD has depreciated significantly after the FED’s decision to keep interest rates unchanged, as the fight against inflation has become more difficult in recent times.

Specifically, the Federal Open Market Committee (FOMC) – the Fed’s policy-making body – decided to keep interest rates at 5.25%-5.5%. The Fed’s interest rates have remained at this level since July 2023.

At a press conference on May 02 (Vietnam time), Chairman Jerome Powell acknowledged that inflation this year has been higher than the Fed had anticipated, in part because consumer spending has remained strong over the past few quarters despite higher interest rates. However, he ruled out the possibility of a rate hike this year.

According to Chairman Powell, it may take longer than previously expected for the Fed to feel comfortable about inflation. Powell again highlighted the risks on both sides of the equation, noting that keeping rates too high for too long could weaken the economy, while loosening too soon could allow inflation to reaccelerate.

Powell also said: “There is a path to getting rates down or not, it all depends on data”.

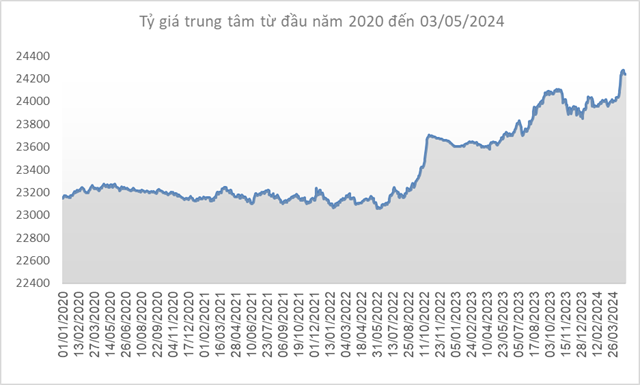

Source: SBV

|

In Vietnam, the central rate of VND against USD has also decreased slightly by 5 VND/USD compared to last week (April 26), to 24,241 VND/USD on May 03.

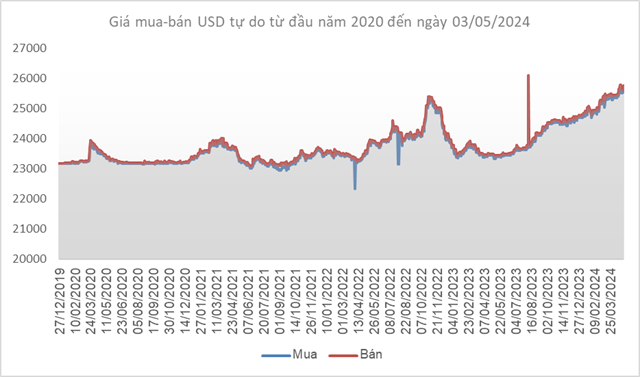

The State Bank of Vietnam (SBV) kept the immediate purchase price unchanged at 23,400 VND/USD. Besides, the operator also kept the immediate selling price at 25,450 VND/USD since April 19. This is the intervention selling price that SBV announced to sell USD to banks with a negative foreign exchange status to bring the foreign exchange status to 0.

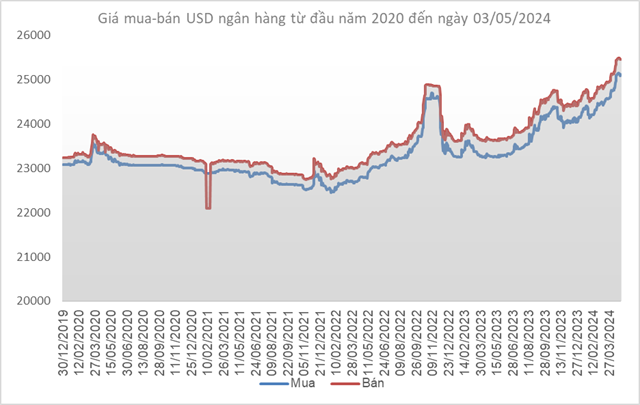

Source: VCB

|

The listed exchange rates at Vietcombank increased by 26 VND/USD in the buying direction but decreased by 4 VND/USD in the selling direction after 1 week, at 25,114 VND/USD (buying) and 25,454 VND/USD (selling).

Source: VietstockFinance

|