Quốc Cường Gia Lai JSC (QCGL), a Vietnamese real estate company listed on the stock exchange with the ticker QCG, has released its consolidated financial statements for the first quarter of 2024. The company reported a revenue of VND 39 billion, a decrease of three-fourths compared to the same period last year. Gross profit also took a hit, falling to just under VND 6 billion. After deducting expenses, QCGL recorded a net profit of over VND 1.3 billion for the quarter.

As of March 31, 2024, QCGL’s total assets stood at VND 9,516 billion, with the majority tied up in inventory, specifically unfinished real estate projects valued at over VND 6,500 billion. The company’s cash balance was VND 29.6 billion.

On the liabilities side, QCGL had a total debt of VND 5,161 billion, including short-term payables of VND 4,304 billion. This includes VND 2,883 billion received from Sunny for the Phuoc Kien project, which is now subject to a court case involving Truong My Lan and has been ordered to be returned.

Additionally, the court has also ordered the continued seizure of 16 properties in Phuoc Kien, Nha Be district, Ho Chi Minh City, as part of the ongoing investigation into the case. These properties have an area of approximately 1 hectare and are part of the North Phuoc Kien Residential Area project.

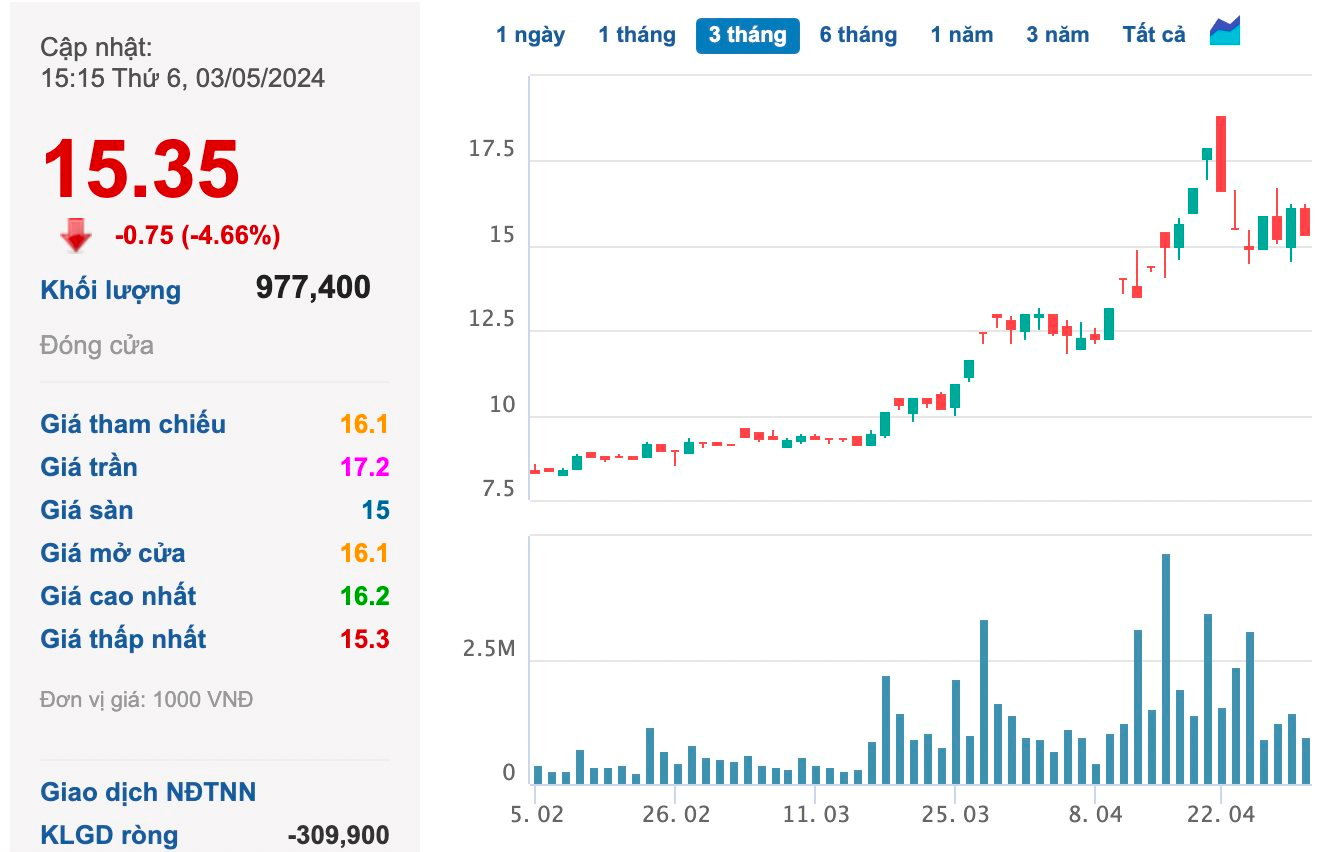

In recent trading, QCG stock has seen a surge in price and volume, with consecutive sessions of reaching the maximum allowed increase and a buying frenzy, leaving no sellers. This unusual activity follows the news of the court’s decision regarding the VND 2,883 billion repayment to Truong My Lan. The share price has risen to VND 15,350 per share, the highest level in seven months, pushing the market capitalization to nearly VND 4,237 billion.

With the sharp rise in QCG’s share price, the wealth of CEO Nguyen Thi Nhu Loan has increased by VND 612 billion in just over a month, reaching VND 1,571 billion.

According to the company’s governance report as of December 31, 2023, Loan holds nearly 102 million QCG shares. Her children also have significant holdings: Nguyen Quoc Cuong owns 537,500 shares, Nguyen Ngoc Huyen My holds over 39 million shares, and son-in-law Lau Duc Duy has over 10.5 million shares. Additionally, Loan’s sisters, Nguyen Thi Anh Nguyet and Nguyen Thi Bich Thuy, hold 9.7 million and 81,750 shares, respectively. The total number of shares held by Loan’s family reaches 166 million QCG shares, and their collective wealth has increased by nearly VND 1,000 billion in the past month to VND 2,556 billion.