Image source: VGG

|

VGG, a well-known clothing manufacturer in Vietnam, has announced that May 23rd is the record date for shareholders to receive a 25% cash dividend for the year 2023 (1 share receives VND 2,500). With 44.1 million shares outstanding, VGG is expected to spend over VND 110 billion on dividends.

The ex-dividend date is May 22nd, and the payment date is anticipated to be June 28th, 2024. Since its listing on the UPCoM in early 2016, VGG has consistently paid out cash dividends to its shareholders at a relatively high rate. In 2019, VGG paid a dividend of up to VND 4,000 per share and maintained a rate of VND 2,500 per share for 2022-2023. For 2024, the company plans to lower the dividend to VND 2,000 per share.

However, VGG’s liquidity has been modest, with an average matched volume of less than 9,000 shares per session since the beginning of the year. This is due to VGG’s concentrated shareholder structure.

As of January 30, 2024, VGG’s major shareholders included the Vietnam Textile and Garment Group (Vinatex), which held over 13.4 million shares (a 30.39% stake). This was followed by related organizations of insiders such as Tan Thuan Tien Joint Stock Company and Xuan Hong Limited Liability Company, which held 19.95% and 7.54% of the capital, respectively.

On the stock market, VGG’s share price has been trading sideways in the VND 37,000 range, a slight 3% increase since the beginning of the year.

| VGG’s share price movement since the beginning of the year |

Impressive first-quarter performance

VGG, a member of Vinatex with a long history, is the preferred choice for mid-range consumers, office workers, and professionals. The company consistently generates revenue in the thousands of billions of VND annually.

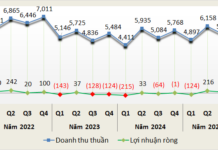

In the first quarter of 2024, VGG recorded net revenue of nearly VND 1,832 billion, a slight decrease of 1% compared to the same period last year. The cost of goods sold decreased more than revenue, leading to a 12% increase in gross profit to nearly VND 192 billion; the gross profit margin improved to 10.5%, up from 9.3% in the previous year.

A notable improvement was the 91% increase in financial income to over VND 27 billion, along with a profit of nearly VND 10 billion from joint ventures and associates (compared to a loss of VND 4 billion in the same period last year). Despite increases in various expenses, the overall impact on the final results was minimal.

Ultimately, VGG’s net profit nearly doubled from the previous year, reaching VND 35.5 billion. This was the highest first-quarter profit in the past five years since 2020.

| VGG’s first-quarter profit from 2019 to 2023 |

For 2024, the company set a target of VND 8,360 billion in total revenue and VND 200 billion in pre-tax profit, a decrease of 3% and 5%, respectively, compared to the actual figures for 2023. This is based on the expectation that challenges will persist. By the end of the first quarter, VGG had achieved 23% of its annual plan, with a pre-tax profit of VND 45.5 billion.

On the balance sheet, as of March 31, 2024, VGG’s total assets amounted to approximately VND 5,495 billion, an increase of 11% from the beginning of the year. This was mainly due to a surge in term deposits from VND 27 billion at the beginning of the year to VND 233 billion, with cash holdings of about VND 3 billion. Inventory increased significantly by 69% to nearly VND 1,937 billion, mainly consisting of nearly VND 100 billion in work-in-progress.

On the liabilities side, accounts payable increased by 17% from the beginning of the year to nearly VND 3,460 billion. The company recorded a new short-term loan from a commercial bank of nearly VND 125 billion.