The VN-Index had a challenging session upon returning to trading after a 5-day holiday break. The benchmark index fluctuated throughout the day, often dipping below the reference level. The morning session lacked positivity, with weak liquidity and substantial net selling by foreign investors, pushing the VN-Index into negative territory.

However, the market started to recover from around 1:30 pm, led by industrial zone stocks. Several stocks in this sector recorded impressive gains, including IDC, BCM, PHR, SZC, and ITA.

In a cautious trading environment, lacking supportive news, electricity stocks unexpectedly surged. The catalyst for this rally was the Ministry of Industry and Trade’s completion of a decree on the direct power purchase agreement (DPPA) mechanism. POW, the top gainer in the VN30 basket, rose 5.7%, while HND increased by 5.5%. REE, GEG, and BCG also saw gains of over 3%.

Several electricity and industrial zone stocks led the market rally.

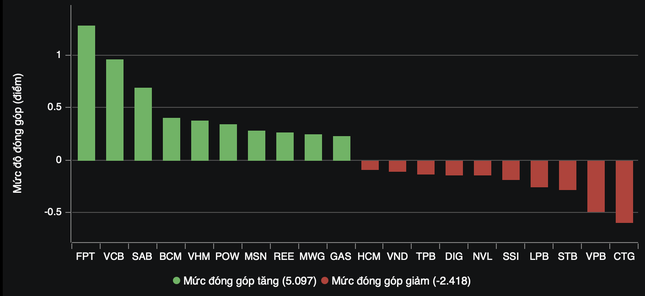

Although POW and REE were among the market leaders, their impact on the VN-Index was limited due to their small market capitalization and liquidity. FPT remained the main contributor to the benchmark’s gains.

Other VN30 constituents, such as VCB, SAB, BCM, VHM, and MSN, provided additional upward momentum to the VN-Index. The index closed up 6.84 points at 1,216.36.

Despite the VN-Index’s positive close, nearly 200 stocks on the HoSE still ended the day in the red. Securities stocks were particularly hard hit, with influential names like SSI, VIX, SHS, VND, VCI, and HCM all declining. However, the losses were relatively modest, mostly in the range of 1-2%.

The much-anticipated KRX system’s delayed launch once again disappointed the market. The Securities Commission stated that there wasn’t enough basis to approve HoSE’s request to officially operate the KRX system on May 2. Consequently, HoSE has requested securities companies to halt the transition to the KRX system.

At the close, the VN-Index rose 6.84 points (0.57%) to 1,216.36, the HNX-Index increased 0.67 points (0.3%) to 227.49, and the UPCoM-Index climbed 0.94 points (1.06%) to 89.70.

Foreign investors net sold a substantial VND950 billion, focusing on BWE with an exceptional net sell value of VND514 billion. FUESSVFL, SSI, and other stocks also experienced net selling of over VND100 billion each.