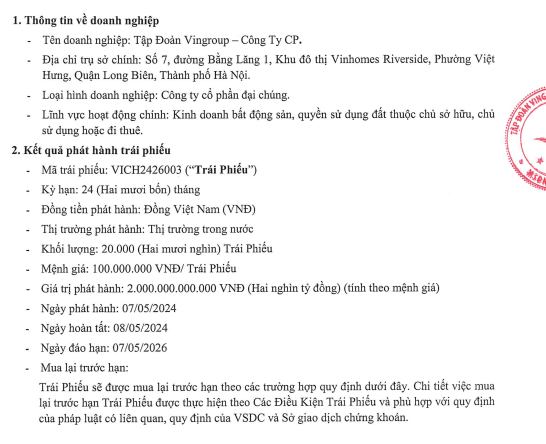

In a recent disclosure by HNX, Vingroup successfully issued VICH2426003 corporate bonds in the domestic market, totaling VND 2,000 billion on May 9. The bonds have a face value of VND 100 million each, with an interest rate of 12.5% per annum, a term of 24 months, and were issued on May 7, 2024, maturing on May 7, 2026.

Source: HNX.

Prior to this, Vingroup’s Board of Directors had resolved to issue corporate bonds in the form of private placement, totaling VND 8,000 billion. These are non-convertible, non-warrant-attached, unsecured bonds with direct debt obligations of the issuer.

The group plans to conduct four issuances from April to June 2024. The proceeds will be used to restructure the issuer’s debts.

Thus, from the beginning of April up until now, Vingroup has successfully raised VND 6,000 billion through three bond issuances, including VICH2426001, VICH2426002, and VICH2426003. All three bond packages have a term of 24 months and an interest rate of 12.5% per annum.

In related news, Vinhomes JSC has also successfully issued VHMB2426004 bonds worth VND 2,000 billion. This bond lot was issued on April 25, 2024, and will mature on April 25, 2026.

Since the beginning of the year, VHM has also successfully raised VND 8,000 billion from four bond issuances, with an interest rate of 12% per annum.