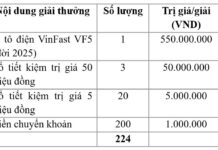

Specifically, DTG plans to issue nearly 1.1 million shares as a 2023 dividend to its shareholders. The issuance ratio is 15%, meaning that for every 100 shares owned, shareholders will receive 15 new shares.

The share dividend is expected to be implemented in 2024, after the State Securities Commission announces the receipt of complete reporting documents for the issuance.

Following the completion of the issuance, DTG’s charter capital is expected to increase by nearly VND 11 billion, from VND 73 billion to VND 84 billion.

|

DTG’s capital increase process. Unit: Billion VND

Source: VietstockFinance

|

DTG shared that with a small-scale capital of nearly VND 73 billion, the company needs to increase capital to supplement working capital and invest in machinery and equipment for its factories, as well as expand its distribution system. The company will increase its capital through share dividend issuance and additional share offerings, creating momentum to boost revenue and aiming for the top 10 in the Vietnamese pharmaceutical industry.

In 2023, the company achieved net revenue of nearly VND 373 billion, an increase of over 25% compared to the previous year. Moreover, thanks to well-controlled expenses, the company’s net profit reached nearly VND 31 billion, an increase of 69%. This helped DTG break its 2022 record, achieving the highest profit in its operating history. Earnings per share (EPS) exceeded VND 4,219/share, a high level compared to pharmaceutical companies operating on the stock exchange.

|

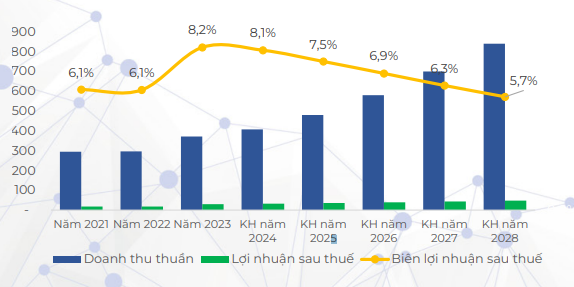

DTG’s business plan for the period of 2024-2028. Unit: Billion VND

Source: DTG’s 2023 Annual Report

|

For 2024, DTG has carefully constructed its business plan considering the volatile business environment and fierce competition, with many companies offering similar product portfolios and quality. Accordingly, the company projects net revenue of VND 406 billion and a net profit of VND 33 billion for the year.

| DTG’s financial results for Q1/2024 |

In the first quarter of 2024, the company recorded net revenue of VND 67 billion and a net profit of over VND 4 billion, down 24% and 39%, respectively, compared to the same period last year. Compared to the plan, the company achieved 16% of its revenue target and 13% of its profit target for the year.

Khang Di