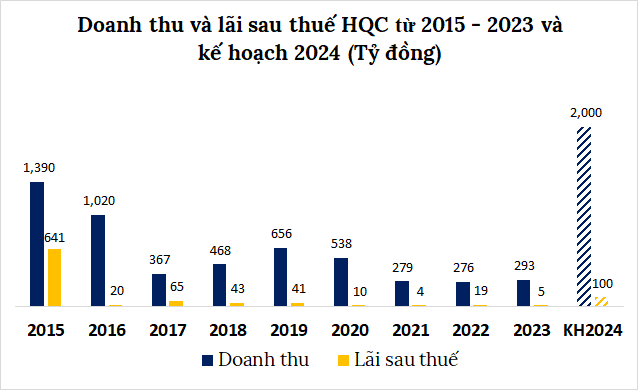

An Ambitious Business Plan

According to documents, Hoang Quan Trading Consulting Services Real Estate Joint Stock Company (HOSE: HQC) has set an ambitious 2024 plan with a revenue target of 2,000 billion VND, 6.2 times higher than in 2023. The main sources of revenue are expected to be the Golden City project (500 billion VND), the Ham Kiem Industrial Park project (400 billion VND), and the Golden Grand project (300 billion VND), among others. If successful, this will be the highest revenue in the company’s history since its listing on HOSE in 2010.

The target after-tax profit for 2024 is 100 billion VND, 19.2 times higher than the previous year’s performance, and the highest in the last 9 years (since 2016).

Source: VietstockFinance

|

HQC shared that to achieve this plan, the company aims to complete at least 50 social housing projects with approximately 50,000 products and renovate or rebuild at least 10 old apartment buildings in Ho Chi Minh City, Dong Nai, and Long An.

In addition to social housing, HQC is pushing for investment, joint investment, and business development in commercial real estate, industrial real estate, and resort real estate. For example, the company is currently focusing on implementing the Ham Kiem 1 Industrial Park project in Binh Thuan and the Binh Minh Industrial Park project in Vinh Long.

Issuing 30 Million Shares to Restructure Debt

Hoang Quan Real Estate also proposed to shareholders a plan to privately issue a maximum of 30 million shares (a ratio of 5.2% of the total outstanding shares) to creditors to restructure HQC’s debts, aiming to restructure the company’s debts and improve its financial situation. The expected timeline for this proposal is 2024-2025.

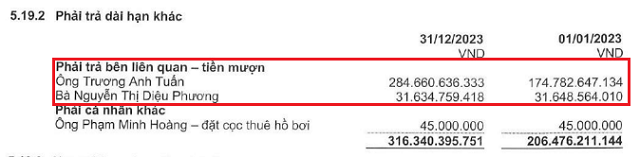

The criteria for selecting creditors for debt restructuring include having HQC’s debts presented in the audited consolidated financial statements for 2023.

According to the audited financial statements, as of the end of 2023, HQC had nearly 2,935 billion VND in payables, an increase of 2% compared to the beginning of the year. Notably, long-term payable debts include loans from Mr. Truong Anh Tuan, Chairman of the Board of Directors of HQC, and Ms. Nguyen Thi Dieu Phuong, Vice Chairman of the Board of Directors (Mr. Tuan’s wife), totaling more than 316 billion VND.

Source: HQC

|

The issuance of shares to restructure debt is not a new strategy, as HQC has previously issued shares for debt restructuring more than two years ago.

HQC plans to issue shares to restructure the debt of Chairman Truong Anh Tuan

On May 7, three non-executive members of the Board of Directors of Hoang Quan Real Estate, including Ms. Phuong, simultaneously submitted their resignations.

Wife and brother of Truong Anh Tuan want to leave the Board of Directors of Hoang Quan Real Estate

Returning to the issuance plan, the issue price is 10,000 VND/share (corresponding to 10,000 VND of debt exchanged for 1 new share), expecting HQC to receive a maximum of 300 billion VND. With this issue price, creditors must exchange at a price 2.6 times higher than the market price of 3,850 VND/share at the close of May 10.

Price Movement of HQC Shares Since the Beginning of 2024

The company stated that the book value of HQC shares according to the audited consolidated financial statements as of the end of 2023 was 9,158 VND/share, and according to the company’s self-prepared financial statements for the first quarter of 2024 as of the end of March, it was 9,307 VND/share.

The privately issued shares for debt restructuring will be restricted from transfer for one year from the end of the issuance period.

Accordingly, after the debt-to-equity swap, the debts will be eliminated, and the creditors will become shareholders of the company, with HQC no longer having any obligations regarding the restructured debts.

At the same time, the value of the debts converted into shares will be accounted for to increase owners’ equity. If successful, HQC’s charter capital will increase from 5,766 billion VND to 6,066 billion VND.

HQC Chairman Truong Anh Tuan takes the “hot seat” at the Golden City and the strange move that followed

Thanh Tu