A stunning visual of a diamond glittering on a mirrored background, symbolizing the brilliance and value of FPT Corporation.

In the vibrant landscape of the Vietnamese stock market, amidst the frenzy of popular stocks like the national favorite HPG and banking giants, one name stands out as a favorite among investment funds, especially open-ended funds: FPT.

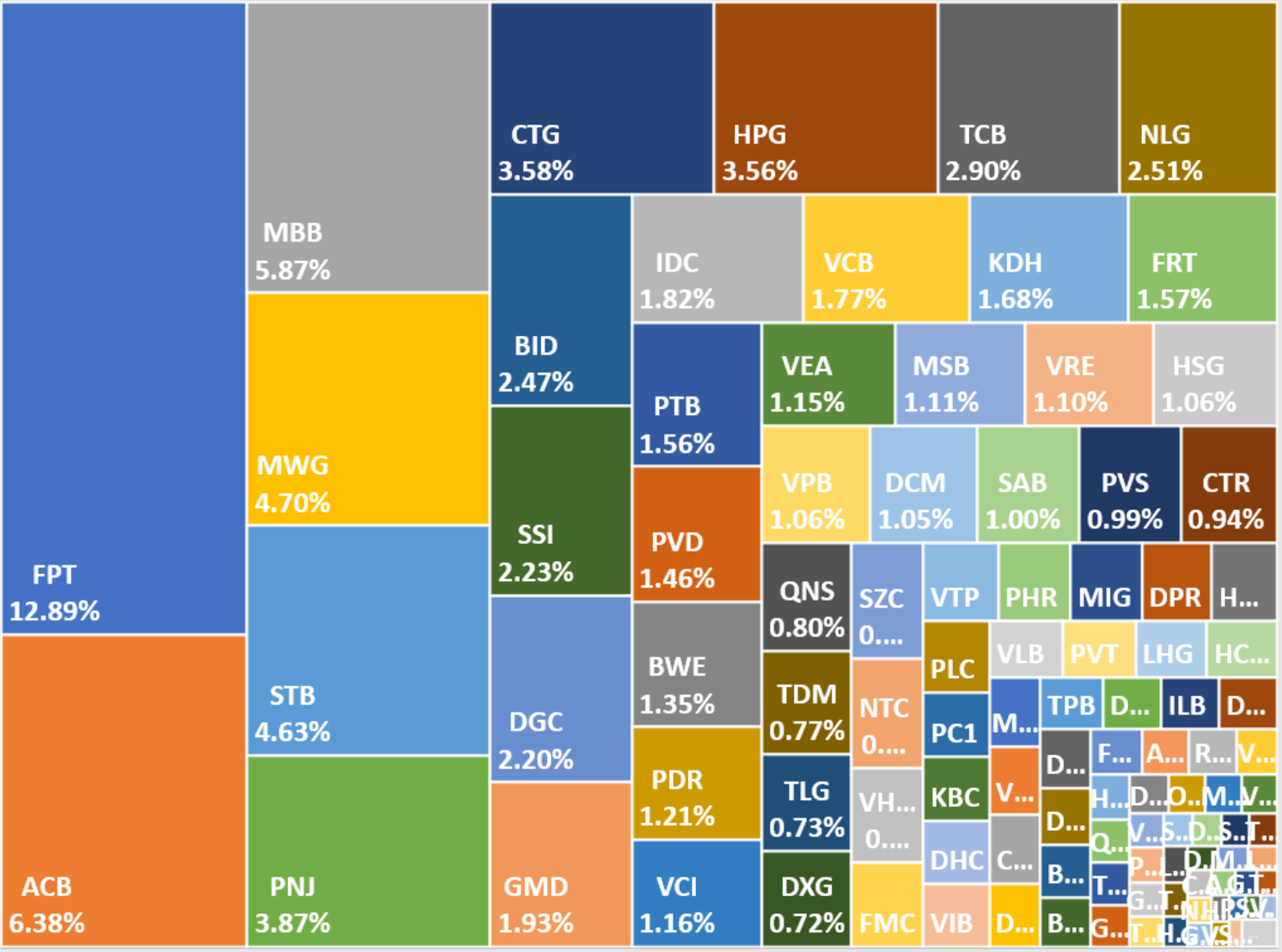

IPAAM’s report highlights FPT as the top stock holding for open-ended funds in Vietnam as of Q1 2024.

According to the latest market update from IPA Asset Management (IPAAM), FPT remains the most-held stock by open-ended funds in Vietnam, with a total value of 1,967 billion VND as of the end of Q1 2024. This accounts for 12.89% of their total investment portfolios, a significant lead over other stocks.

Following FPT, we find a strong presence of bank stocks such as ACB, MBB, STB, CTG, and TCB. Banking is the sector favored by open-ended funds, making up 31% of their portfolios. Other sectors like technology, real estate, and retail trail behind, with retail stocks like MWG, PNJ, and FRT being notable exceptions.

Breakdown of stock holdings by open-ended funds as of Q1 2024, according to IPAAM’s statistics.

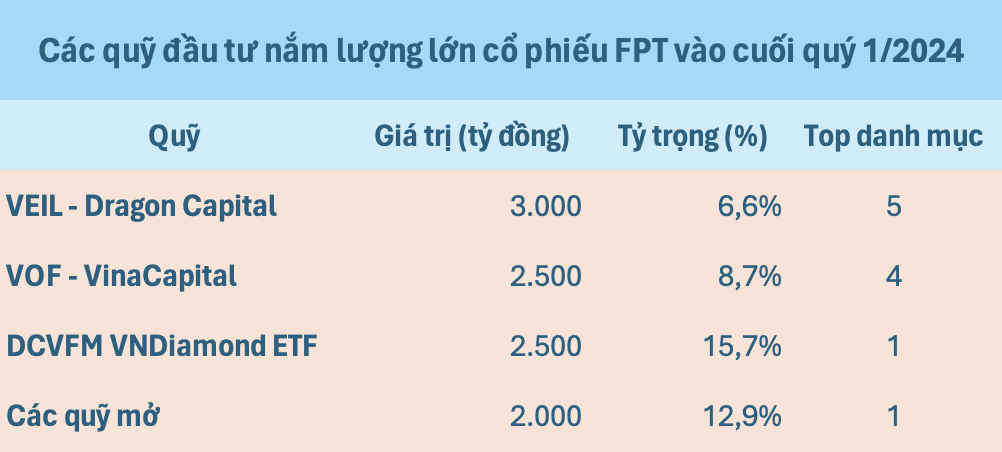

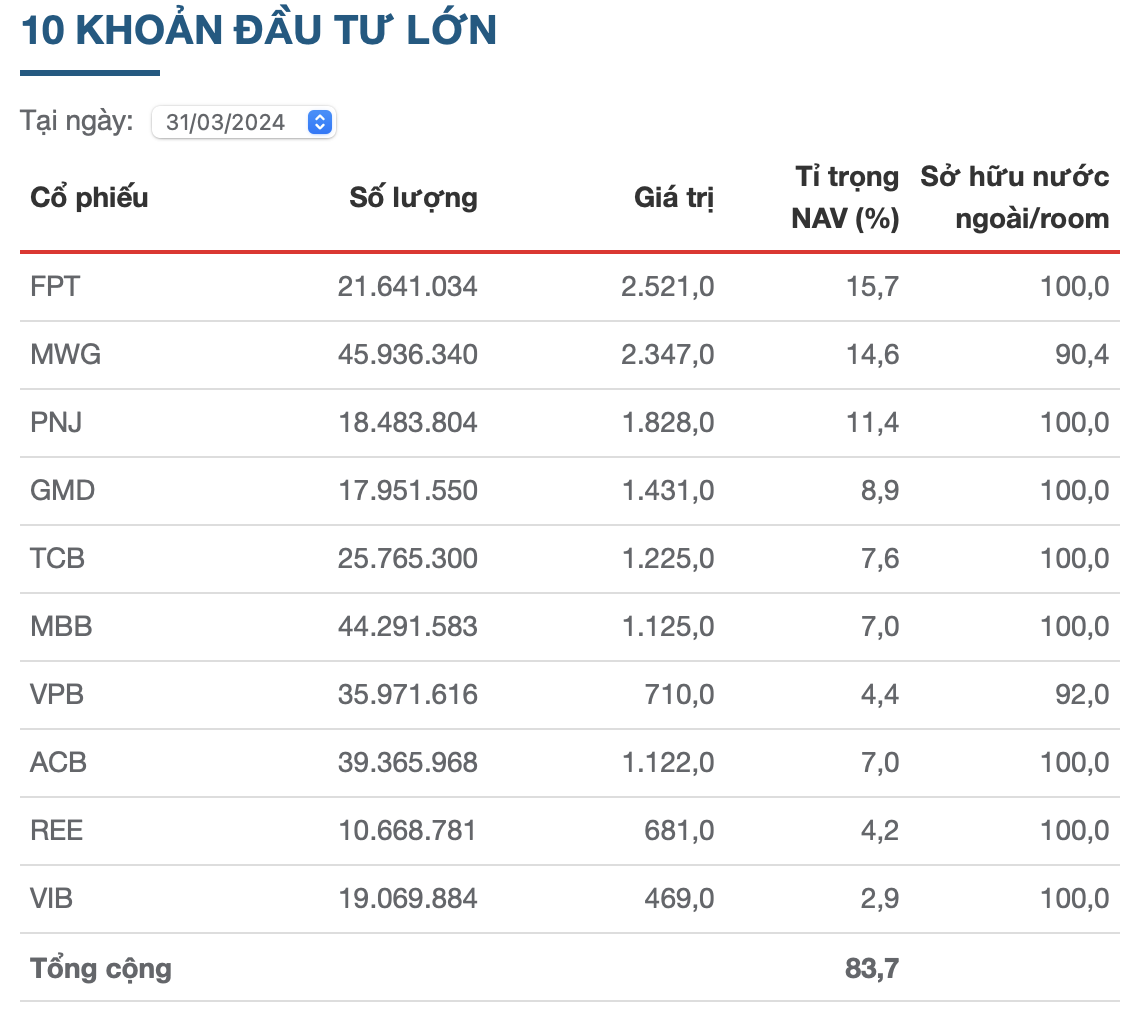

At the end of Q1, FPT was also the largest diamond in the DCVFM VNDiamond ETF’s portfolio, with a weight of 15.7%. As the largest domestic ETF in the market, with a net asset value (NAV) of over 16,000 billion VND, DCVFM VNDiamond ETF is estimated to have allocated around 2,500 billion VND to FPT as of March 31.

While bank stocks dominate the DCVFM VNDiamond ETF’s portfolio, the largest weights are given to stocks from other sectors, including technology, retail, port services, and energy.

Top 10 stocks by weight in the DCVFM VNDiamond ETF’s portfolio as of Q1 2024.

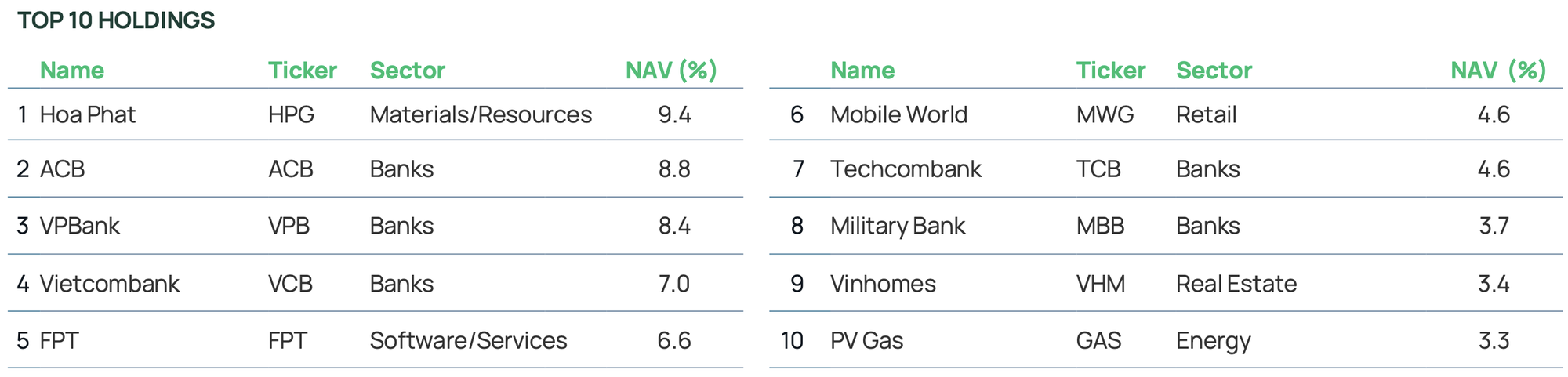

FPT’s appeal extends beyond open-ended funds, as it is also a significant holding for some of the largest closed-ended funds in Vietnam. As of the end of Q1, FPT was the 5th largest investment for VEIL – Dragon Capital, a 1.9 billion USD fund, with a weight of 6.6%. This translates to an estimated investment value of approximately 125 million USD (~3,000 billion VND) in FPT.

VEIL’s top investments include other blue-chip stocks like HPG, MWG, VHM, and GAS, as well as a strong presence of bank stocks. Banking makes up nearly 40% of their portfolio, followed by real estate, commodities, retail, and technology.

Top 10 investments in VEIL – Dragon Capital’s portfolio as of Q1 2024.

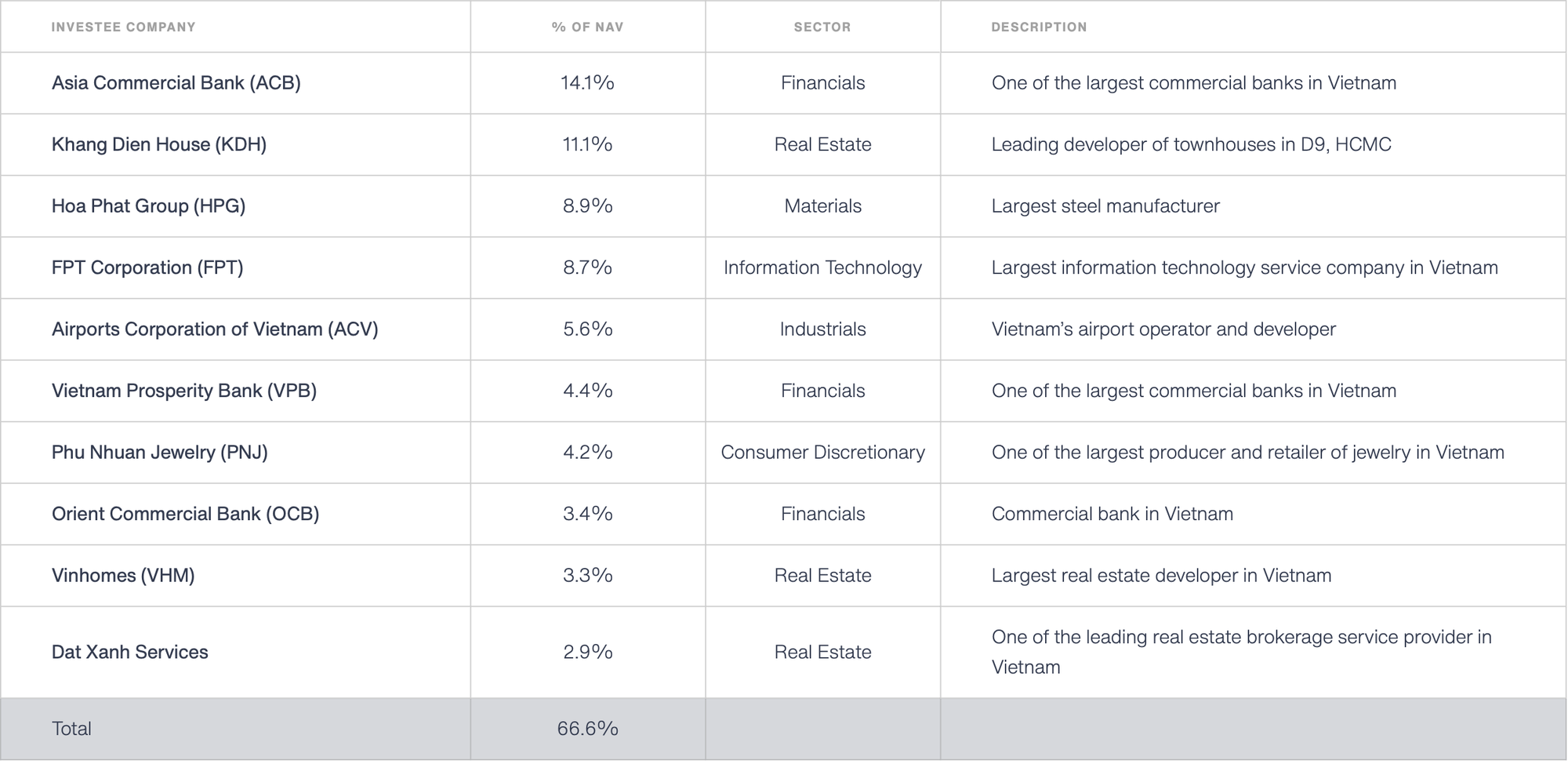

VOF – VinaCapital, another leading closed-ended fund, also has a substantial allocation to FPT, with an 8.7% weight as of the end of Q1. FPT is their 4th largest holding, after ACB, KDH, and HPG. VOF’s portfolio is more diverse, including mid-cap stocks like DXS and pre-IPO stocks like ACV, but their largest investments remain focused on the financial and real estate sectors.

Top 10 investments in VOF – VinaCapital’s portfolio as of Q1 2024.

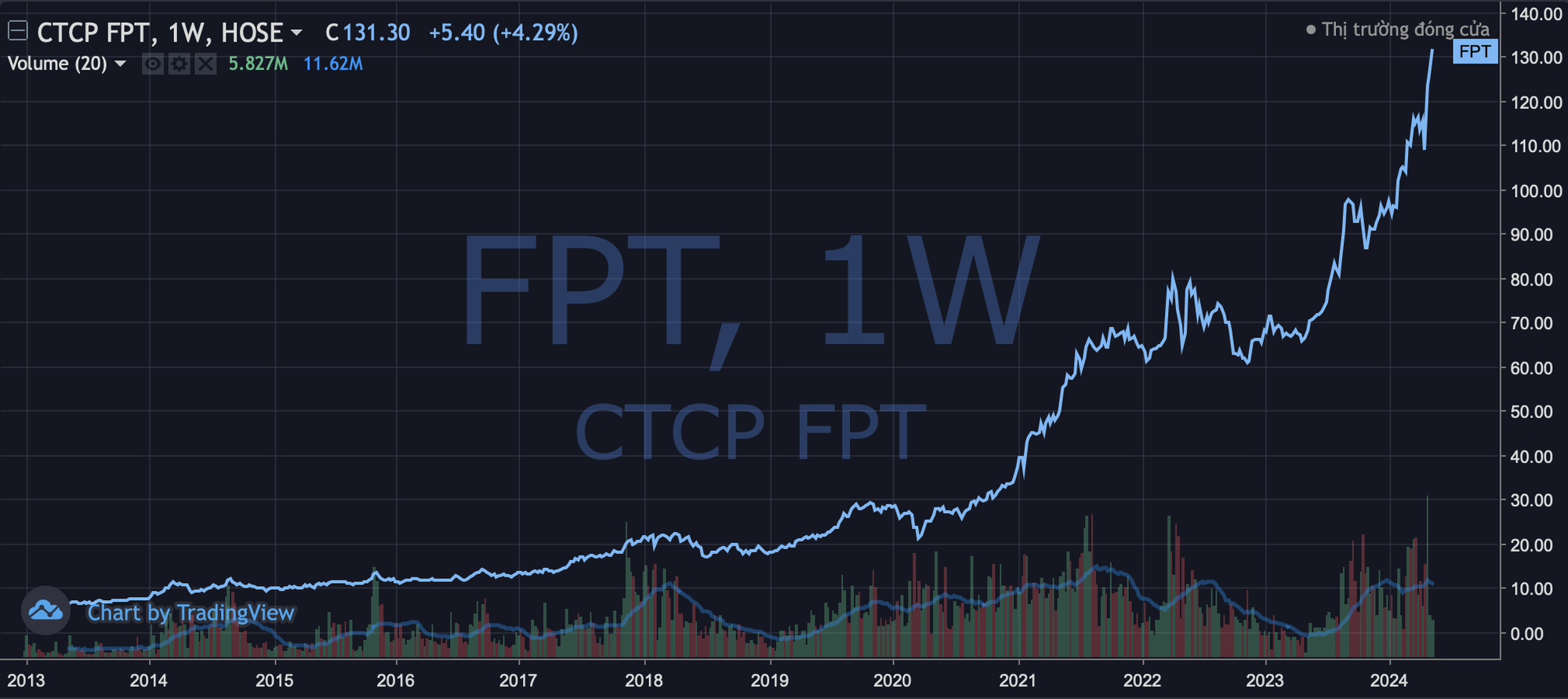

FPT’s consistent and impressive performance on the Vietnamese stock market has brought joy to long-term investors, from large funds to individual retail investors. However, it has also been a source of regret for those who lacked patience and sold their holdings too soon, lured by the allure of short-term gains in other “hot” stocks.

Currently, FPT is trading at an all-time high of 131,300 VND per share, reflecting a 37% increase since the beginning of 2024. Its market capitalization has soared to nearly 167,000 billion VND (~7 billion USD), double that of a year ago, propelling FPT into the top 10 listed companies in the market.

FPT’s impressive performance has propelled it into the top 10 listed companies in Vietnam by market capitalization.

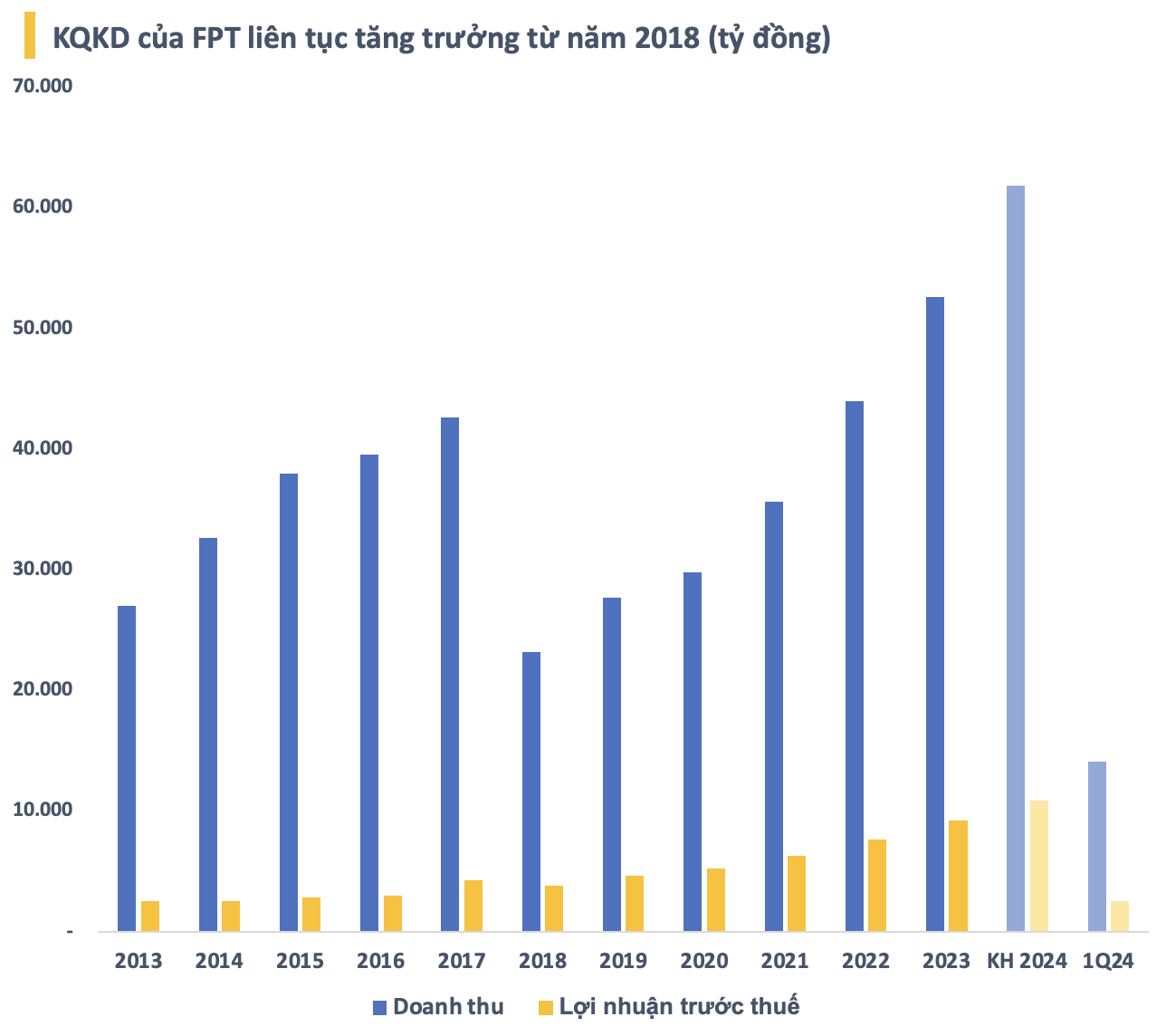

FPT Corporation is a leading technology conglomerate in Vietnam, ranking among the top 3 internet service providers in the country. With 3 international-standard data centers and a network of high-quality educational institutions, FPT has established a strong presence in 30 countries worldwide. In 2023, FPT achieved a remarkable milestone, reaching 1 billion USD in IT services revenue from overseas markets, and was recognized as one of the top 8 IoT consultants in the Asia-Pacific region.

For 2024, FPT aims high, targeting revenues of 61,850 billion VND (~2.5 billion USD) and pre-tax profits of 10,875 billion VND, representing an approximate 18% increase from 2023. With the first quarter already behind them, FPT has executed approximately 23% of their ambitious plan.

FPT’s impressive performance and ambitious plans make it a standout in the Vietnamese market.

FPT has recently taken a significant step forward by partnering with NVIDIA, a global leader in AI and computing technologies. This strategic collaboration aims to establish an AI Factory, develop high-quality human resources, and become a preferred services partner within NVIDIA’s global network. As part of this initiative, FPT plans to invest 200 million USD in building an AI Factory to provide a cloud computing platform for AI research and development in Vietnam.

The AI Factory will be equipped with supercomputers utilizing NVIDIA’s cutting-edge technology. This project is expected to enhance Vietnam’s capacity to provide AI and cloud technology solutions on a global scale and elevate the country’s tech talent to new heights. “We are committed to making Vietnam a global AI development hub,” affirmed FPT Chairman Truong Gia Binh.