SSI Research reports that MWG has recently raised VND 1,770 billion (5% equity) from its subsidiary Bach Hoa Xanh (BHX) through a private placement. The valuation, equivalent to a 2023 P/S of 1.1 times, is considered reasonable by SSI analysts.

Looking at the long-term perspective of 3-5 years, SSI Research believes that BHX’s improving profits will be the main growth driver for MWG from 2026 onwards, while profit growth in the phone and appliance chain will return to normal after strong growth in 2024-2025. The estimated CAGR for net profit in 2026-2028 is 15-20%.

In Q1/2024, MWG recorded remarkable revenue and net profit, reaching VND 31,500 billion (up 16%) and VND 903 billion (up 4,143%), respectively, surpassing SSI’s expectations. This outstanding performance was attributed to exceptional revenue from air conditioners and faster-than-expected profit margin growth in the phone, appliance, and grocery segments.

Given the better-than-expected revenue and profit in the phone and appliance segment in Q1/2024, SSI estimates revenue for 2024-2025 to be VND 89,200 billion (up 7% year-on-year due to recovering mobile phone demand and surging air conditioner sales) and VND 95,700 billion (up 6% thanks to replacement cycle post peak spending on phones in 2020-2021). The estimated pre-tax profit margin for 2024-2025 is 5.0% – 5.3%.

In the long run, SSI anticipates the pre-tax profit margin to return to the level of Q4/2022 (when non-essential consumption started to decline along with the economy), although regaining the peak of Q3/2022 seems challenging due to expected increasing competition from e-commerce.

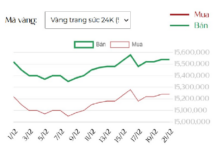

MWG stock has been on a seven-month winning streak on HOSE.

In the stock market, MWG’s closing price on May 6 was the highest since October 2022. The stock’s price movement has been resilient, even as domestic ETFs tracking the VN Diamond index had to sell off MWG for portfolio restructuring last week. Counting May, MWG has now posted seven consecutive months of price increases.