The latest VN Diamond index adjustment for April 2024 by HoSE has caught attention with the departure of leading retail stock, The Gioi Di Dong (MWG). The exclusion of a top-weighted stock in the basket has caused significant changes to the Diamond index’s composition.

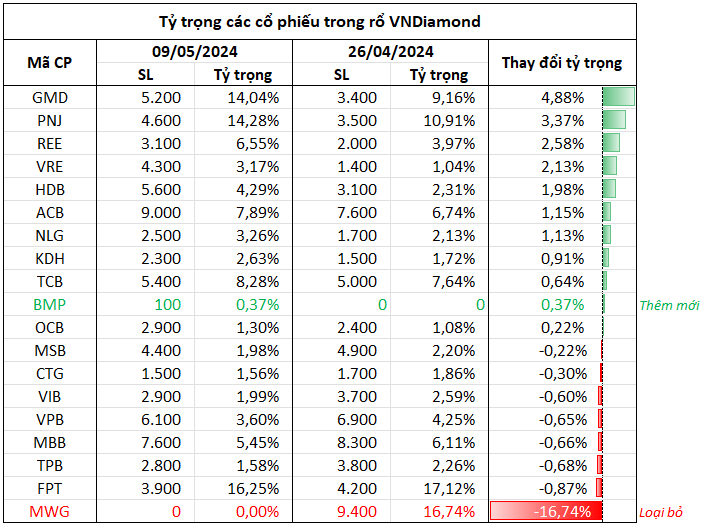

According to the latest announcement from DCVFM VN Diamond ETF – the largest ETF in the market referencing the Diamond index with a NAV of nearly VND 14,200 billion – MWG accounted for 16.74% of the portfolio before its official exclusion on April 26. After the adjustment, BMP Plastic JSC replaced MWG but with a modest weight of 0.37% – the lowest in the index. Stocks already in the Diamond basket that saw increased weights include GMD (new weight of 14.04%), PNJ (new weight of 14.28%), and REE (new weight of 6.55%).

Additionally, FPT remains the stock with the largest weight in the Diamond portfolio at 16.25%, followed by PNJ, GMD, and TCB.

Weights of “Hot” Sectors Surge

Notably, GMD, owned by Gemadept – a leading Vietnamese port and logistics company, saw its weight increase to nearly 4.9%, becoming the third-largest stock in the Diamond portfolio. Gemadept’s business comprises port operations, contributing 70-80% of revenue, and logistics services.

In Northern Vietnam, Gemadept owns two ports: Nam Dinh Vu and ICD Nam Hai. In the South, the company operates Gemalink – Vietnam’s largest deep-water port capable of accommodating the largest vessels – and ICD Phuoc Long, another container port. Additionally, they also own a bulk cargo port in Dung Quat.

These factors contribute to Gemadept’s position as a leading logistics company with impressive business growth. Moreover, its stock, GMD, has been on a steady upward trajectory, consistently reaching new highs.

Similarly, PNJ, a leading retailer with outstanding growth performance, saw its weight increased to 14.28% – the second-highest in the portfolio, only after FPT. Despite the challenges faced by the industry, PNJ achieved impressive results in 2023, with total revenue of VND 33,137 billion and a record-high profit after tax of VND 1,971 billion, a 9% increase from the previous year.

PNJ’s success can be attributed to its expansion of customer base and growing number of stores. Additionally, the company’s financial position strengthened as it repaid over VND 3,500 billion in borrowings in Q1/2024 while taking on new loans of nearly VND 1,500 billion, resulting in a significant reduction in short-term financial lease liabilities by VND 2,000 billion (85%) compared to the beginning of the year.

Regarding FPT, the stock with the largest weight in the portfolio, the DCVFM VN Diamond ETF holds a substantial amount of VND 2,300 billion worth of this stock. FPT has consistently delivered solid financial performance and witnessed a steady rise in its share price. It is also one of the few stocks that foreign investors are willing to pay a premium of 7% for on the stock exchange.

Overall, the Diamond index continues to showcase a high-quality portfolio with stocks that have strong growth potential, backed by their impressive business performance. The increased weights of leading stocks in “hot” sectors such as retail, technology, and logistics underscore the optimism for these sectors’ recovery in 2024, making the Diamond index appealing not only to domestic but also foreign investors.

Foreign Capital Outflow of Thousands of Billions

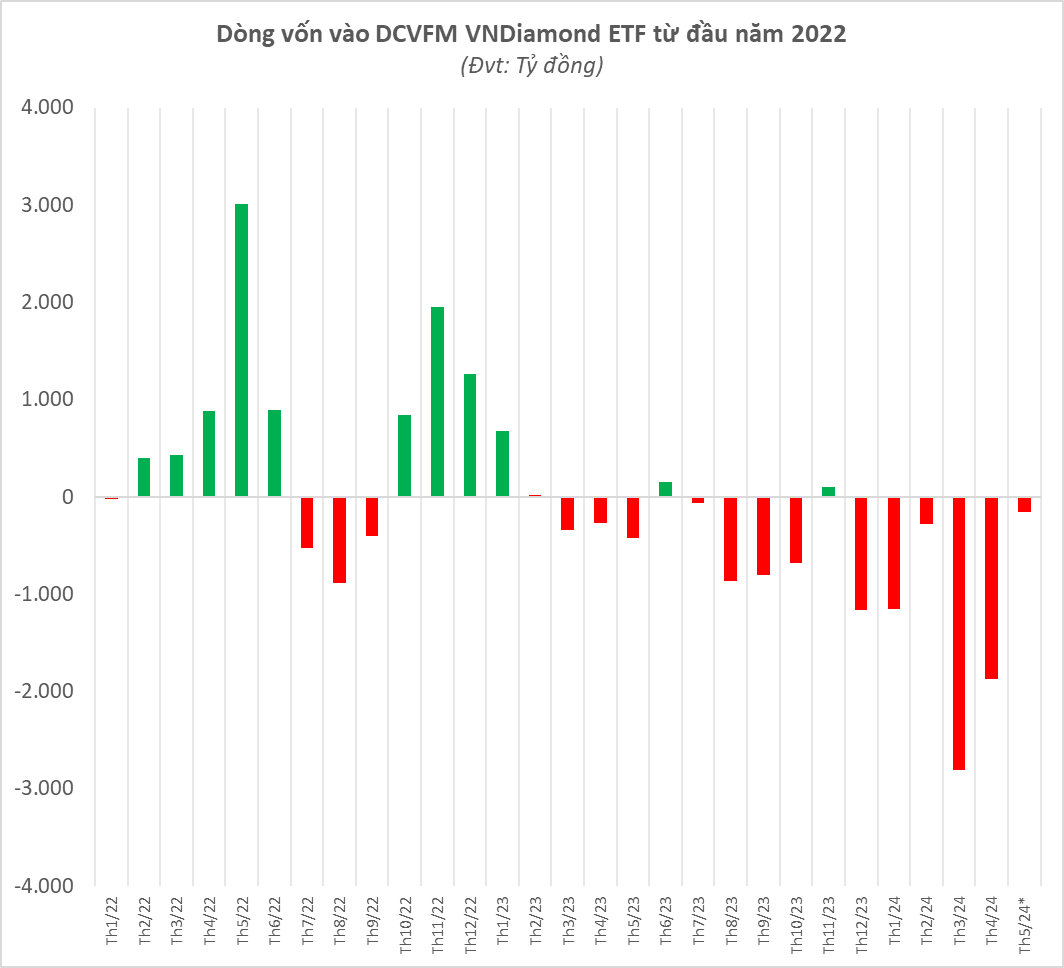

However, it is worth noting that there has been a significant outflow of capital from the Diamond index in recent times. Since the beginning of 2024, the DCVFM VN Diamond ETF has witnessed a net outflow of nearly VND 6,300 billion, and this trend doesn’t seem to be slowing down.

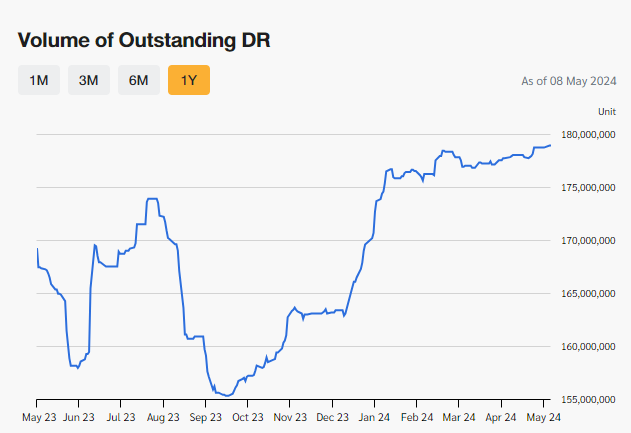

This outflow trend persists even as capital inflows from Thai investors into depository receipts – DRs of the VN Diamond ETF increase steadily. As of May 8, the number of depository receipts (DRs) based on DCVFM VN Diamond ETF certificates (FUEVFVND) issued by Bualuang Securities exceeded 179 million units, an increase of over 9.3 million units compared to the beginning of 2024.

Steady increase in DRs based on FUEVFVND certificates

The Diamond index was once considered a magnet for foreign capital due to its composition of fully foreign-owned stocks (FOL ratio above 95%) and representation of iconic sectors with high growth potential, such as retail, utilities, technology, and banking. However, most of these expectations are future-oriented, and the current economic situation still poses risks of recession, casting a shadow over the growth prospects of these sectors and making the index slightly less attractive.

In the case of MWG, experts attribute its exclusion from the Diamond index to its failure to meet certain critical criteria, particularly the P/E ratio. The company’s 2023 performance fell short of expectations, as weak consumer demand pushed profits down to their lowest level since listing, resulting in a significant increase in MWG’s P/E ratio.