Shares of PLX, owned by the Vietnam National Petroleum Group (Petrolimex), have surged for the sixth consecutive session, adding 14% in value in just one week of trading. The current market price stands at 40,000 VND per share, surpassing the peak in September last year and marking the highest level in nine months (since August 2023).

Along with the price increase, trading in PLX has been relatively active, with liquidity in the last two sessions ranging from 3 to 4 million units per session, valued at hundreds of trillions of VND, a significant improvement from the tens of billions in the previous period.

PLX’s rally occurs just before the upcoming dividend payout for 2023. Specifically, on May 15, Petrolimex will finalize its list of shareholders eligible for a 15% cash dividend (equivalent to 1,500 VND per share). The dividend payment is expected to be made on May 28.

With over 1.27 billion shares currently in circulation, Petrolimex is estimated to require approximately 1,906 billion VND to complete this dividend payment to its shareholders.

The State Capital Investment Corporation (SCIC), which holds nearly 76% of Petrolimex’s capital, is expected to receive about 1,440 billion VND. Additionally, Eneos Vietnam, a major shareholder from Japan with over 13% of the charter capital, will receive approximately 247 billion VND.

Strong first-quarter performance, achieving half of the annual profit plan in just three months

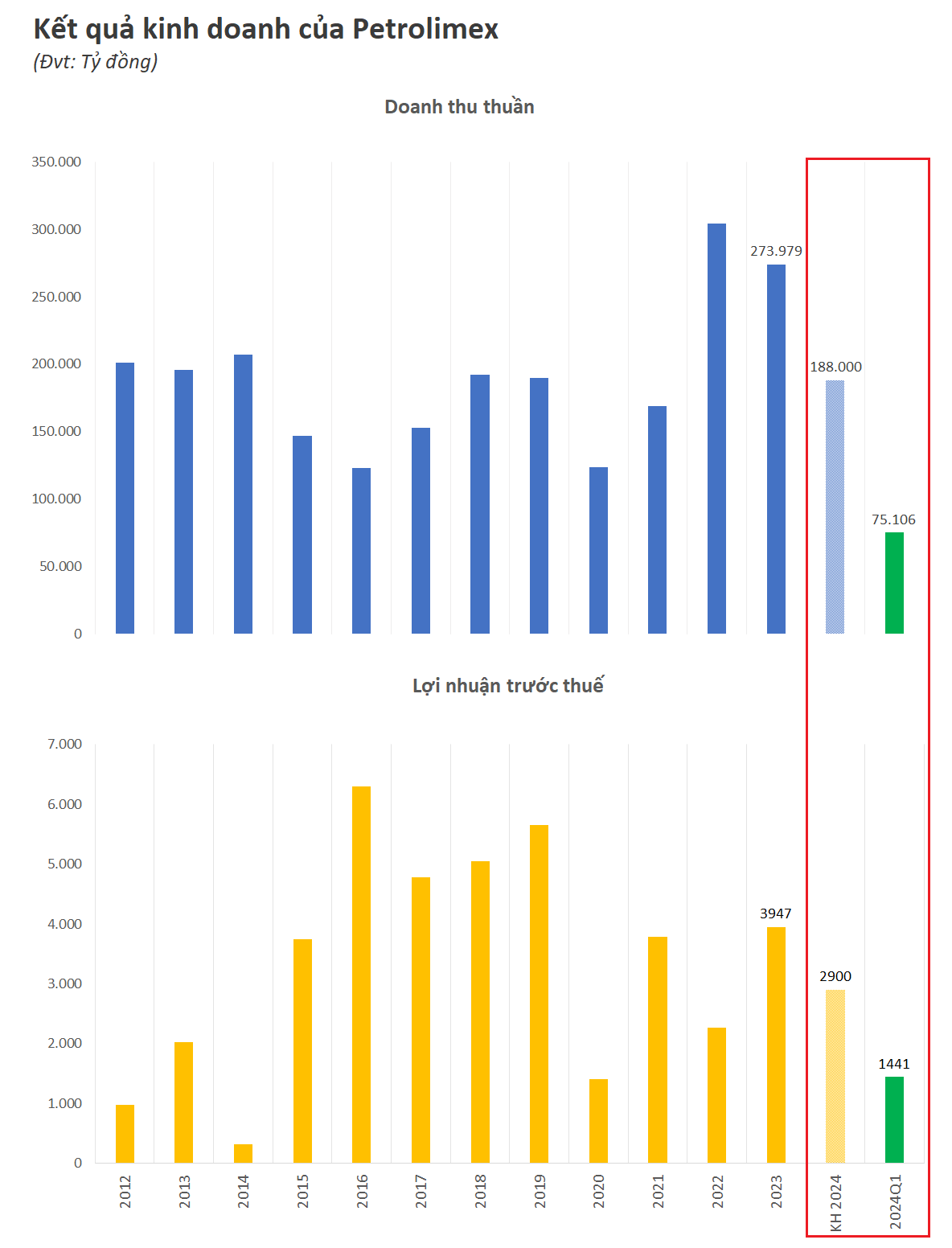

Petrolimex is currently the largest retailer of gasoline and petroleum products in Vietnam, with 17,000 stores nationwide, accounting for over 50% of the market share in the country’s gasoline and petroleum retail industry. The company’s robust financial results may also be a driving force behind PLX’s sustained uptrend. According to the consolidated financial statements for Q1 2024, Petrolimex’s revenue increased by 11% year-on-year to 75,106 billion VND. Gross profit reached 4,669 billion VND, a 31% increase compared to the same period last year.

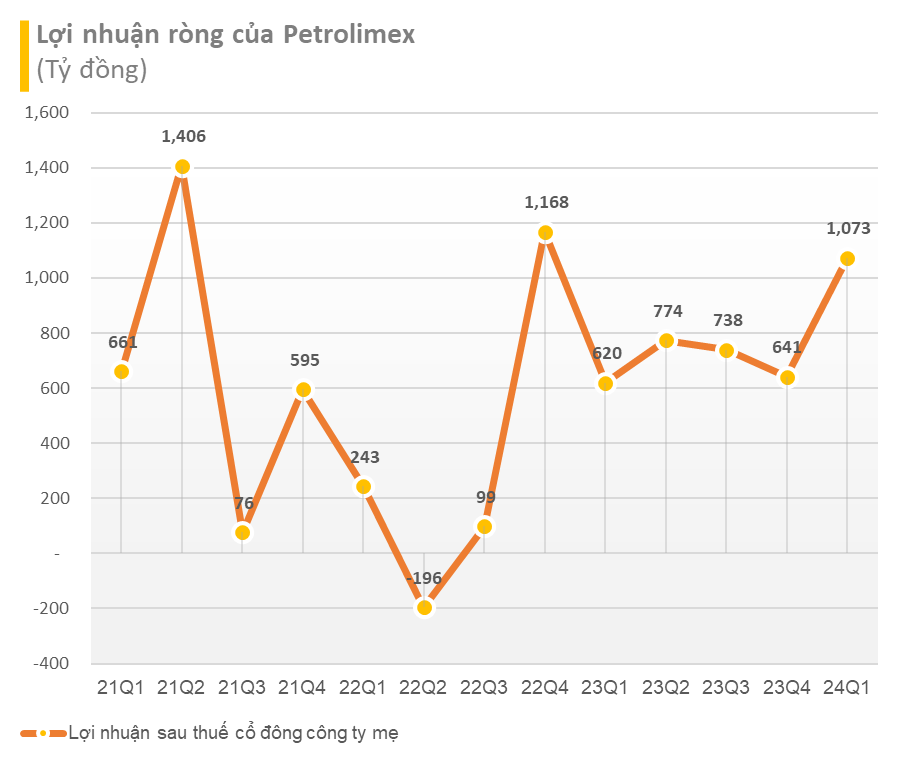

After deducting expenses, Petrolimex recorded a pre-tax profit of 1,441 billion VND, a nearly 72% increase year-on-year. Its after-tax profit stood at 1,133 billion VND, a 70% surge compared to the previous year’s first quarter.

Petrolimex attributed the increase in after-tax profit for Q1 2024 compared to the same period in 2023 primarily to the improved performance in its core gasoline and petroleum business. The company’s operations in other fields also remained stable and showed growth.

According to Petrolimex, the global energy supply and oil prices have been stable, without the significant fluctuations witnessed in previous years. The domestic supply of gasoline and petroleum products from local refineries has been relatively steady, and traders have been importing gasoline and petroleum in line with their plans while ensuring profitability.

The company’s financial income also increased compared to the previous year due to dividend income, which was absent in the same period last year; the effective use of foreign exchange rate insurance contracts to mitigate losses from exchange rate differences; and improved operational efficiency, leading to increased cash flow and higher interest income from cash utilization.

For the full year 2024, Petrolimex has set a cautious target, with consolidated revenue expected to reach 188,000 billion VND, a 32% decrease compared to the actual results of 2023. The consolidated pre-tax profit target is set at 2,900 billion VND, a 26% drop from the previous year’s performance. Thus, after just the first quarter, the company has already achieved nearly 50% of its annual profit goal.