The Vietnamese stock market continued its upward trajectory on May 7, with the VN-Index closing at a high of 1,248.63, marking its fifth consecutive session in the green. Foreign investors net bought shares worth VND144 billion.

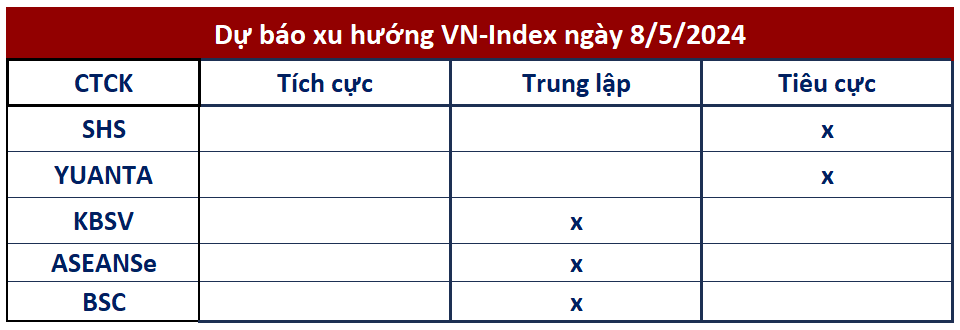

As the index nears the 1,250 mark, most securities companies anticipate increased volatility and stronger corrective pressures. Investors are advised to exercise caution and patience.

According to SHS Securities, the market is following a positive scenario after forming a W-shaped bottom. The VN-Index is approaching the mid-term resistance zone around 1,250 points, and further volatility and corrections are expected as the index tests this mid-term resistance.

Short-term investors are advised to remain cautious and refrain from investing at current price levels. Meanwhile, medium and long-term investors should continue to hold their portfolios and wait for a correction before considering additional investments, as current price levels are less attractive.

Yuanta Securities shares a similar sentiment, suggesting that the market is likely to experience a correction in the next session as the VN-Index trades at the 50-session moving average. The market remains in a short-term accumulation phase, and corrections may continue to occur intermittently in the upcoming sessions. Many large-cap stocks have entered the overbought zone, increasing the potential for profit-taking. Investors are advised to avoid chasing these stocks and instead focus on risk management.

Short-term investors are recommended to maintain a high proportion of stocks in their portfolios and take advantage of corrections to buy or increase their holdings.

KBSV, on the other hand, predicts that the VN-Index will soon face another challenge around the 1,260 (+-10) point mark, which is considered a crucial barrier to surpassing the 1,29x-point peak. As a result, strong volatility is expected in this region.

KBSV advises investors to avoid buying on rallies, continue selling down trading positions as the index approaches resistance levels, and only buy back partially during the subsequent correction.

AseanSe Securities attributes the limited upward momentum to the cautious approach taken by both buyers and sellers. Sector divergence is increasing amid a fluctuating and indecisive market sentiment. However, with narrow trading ranges and moderate selling pressure, the possibility of continued gains remains open.

Investors are advised to take advantage of corrections to restructure their portfolios, especially considering the low liquidity and concentrated nature of the current market. They should continue to selectively add to their positions, focusing on stocks with strong first-quarter earnings growth in 2024.

Similarly, BSC believes that the VN-Index’s recovery momentum is facing resistance at the 1,250-point level. While the index’s performance is positive, investors should remain cautious as profit-taking may occur at this resistance level, especially given the low trading volume.