Vietnam’s Vast Rubber Land Bank

Vietnam’s rubber plantations are concentrated in the Southeast region, with the three largest natural rubber-growing provinces being Binh Phuoc, Binh Duong, and Tay Ninh, accounting for over 50% of the country’s total area and nearly 60% of the country’s total natural rubber production.

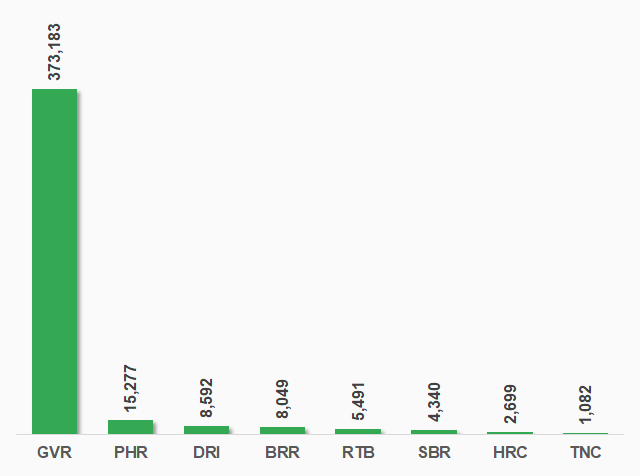

GVR controls many listed rubber companies with large land banks, such as Phuoc Hoa Rubber (PHR), Dong Phu Rubber (DPR), Tan Bien Rubber (RTB), and Ba Ria Rubber (BRR), as well as unlisted companies such as TNHH MTV Dong Nai Rubber, TNHH MTV Dau Tieng Rubber, and Phu Rieng Rubber. It is evident that GVR’s land bank surpasses that of its competitors.

According to the writer’s statistics on the land banks of some rubber companies in Vietnam, GVR tops the list with over 373,000 hectares of rubber tree plantations, including more than 259,000 hectares in Vietnam, mainly in the Southeast and Central Highlands regions; the remaining nearly 114,000 hectares are located in Cambodia and Laos.

|

Land bank of some listed rubber companies (in hectares)

Including area of rubber trees for exploitation, replanting, and basic construction

Source: Writer’s compilation as of December 31, 2023

|

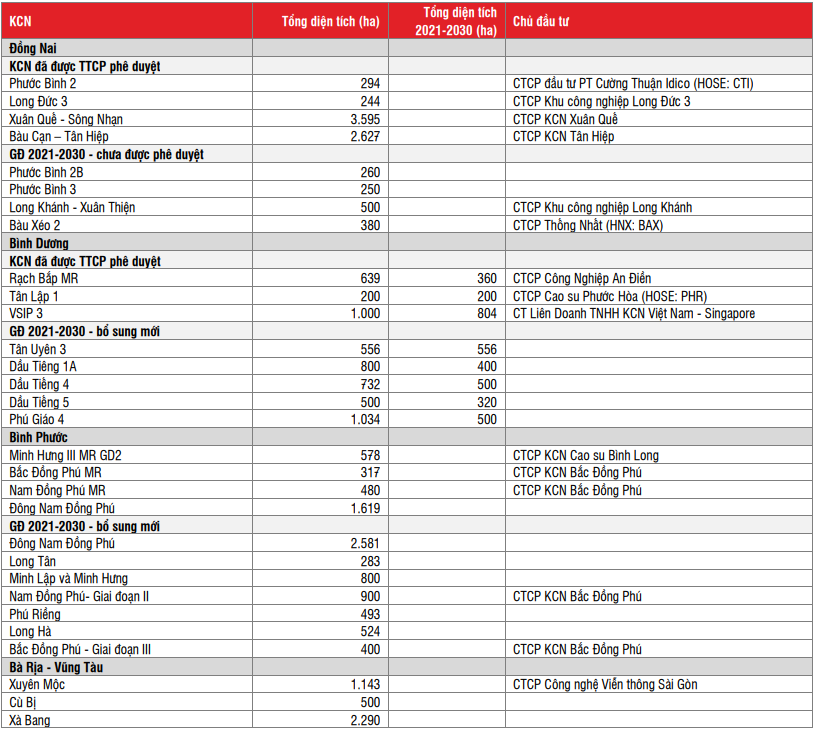

The Main Driver for Industrial Park Development

In the period of 2021-2030, the supply of industrial parks (IPs) in the South will mostly come from rubber land. According to the IP planning in Dong Nai province, the area of IPs approved by the Prime Minister to use converted rubber land will reach 6,760 hectares (accounting for 91% of the total area) by 2025 and 2,000 hectares in the period of 2025-2030 (accounting for 48% of the total area). In other Southeast provinces such as Binh Duong, Binh Phuoc, and Ba Ria – Vung Tau, the respective estimated areas are 3,084 hectares, 2,994 hectares, and 3,933 hectares by 2025.

Converting rubber land into IPs will create new supply in the context of high occupancy rates in southern IPs such as Dong Nai and Binh Duong, which are above 93%.

As the leading company in the industry, GVR is at the forefront of the trend of reducing rubber-growing areas and converting part of the land into IPs. At the 2024 Extraordinary General Meeting of Shareholders, Mr. Do Huu Phuoc, Deputy General Director of GVR, shared: “The Group is developing a plan to build IPs in the Southeast region, including the three provinces that have been approved by the Prime Minister for planning: Tay Ninh, Ba Ria – Vung Tau, and Binh Phuoc, along with Binh Duong and Dong Nai, which are being approved by the National Appraisal Council, with a total land conversion area of approximately 25,000 hectares.”

|

DPR, in collaboration with Binh Phuoc Rubber Joint Stock Company and Nam Tan Uyen Joint Stock Company (NTC), established the Bac Dong Phu Industrial Park Joint Stock Company in 2009 to manage the Bac Dong Phu and Nam Dong Phu Industrial Parks. Bac Dong Phu Industrial Park Joint Stock Company currently has a charter capital of VND 200 billion, mainly held by two members of the GVR Group: DPR (51%) and NTC (40%). |

Among GVR’s subsidiaries, Phuoc Hoa Rubber (PHR) stands out with its Tan Lap 1 Industrial Park, which has been approved by the Prime Minister with an area of 200 hectares for the period of 2021-2030. The Bac Dong Phu Industrial Park expansion of 317 hectares and the Nam Dong Phu expansion of 480 hectares, both belonging to Bac Dong Phu Industrial Park Joint Stock Company, are also notable. Additionally, the Bac Dong Phu Industrial Park (phase 3) with an area of 400 hectares and the Nam Dong Phu Industrial Park (phase 2) with an area of 900 hectares, which are new additions for the period of 2021-2030, are also under the management of Bac Dong Phu Industrial Park Joint Stock Company.

|

Planning of IPs in the southern provinces converted from rubber tree plantations

Source: SSI Research’s Industrial Real Estate Report for March 2024

|

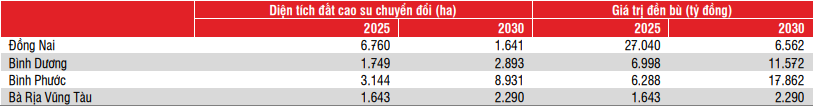

Compensation for Rubber Tree Land Expected to Increase from 2025

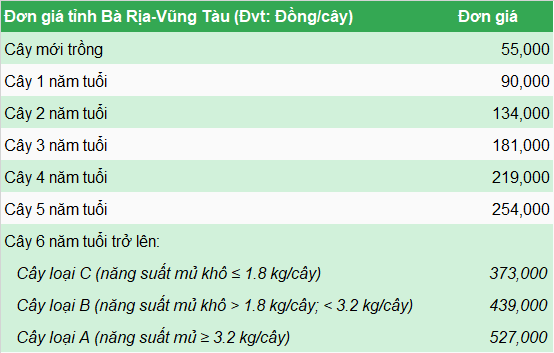

According to the decision of the People’s Committee of Ba Ria – Vung Tau province dated January 15, 2024, on the regulation of compensation and support prices for crops when the state recovers land in the province in 2024, the compensation price is determined based on the age of the crop, from newly planted trees to trees over 6 years old. For trees over 6 years old, they are classified into 3 types (A, B, and C) according to their latex yield, with prices ranging from VND 373,000 to VND 527,000 per tree.

Source: People’s Committee of Ba Ria – Vung Tau Province, effective from January 25, 2024

|

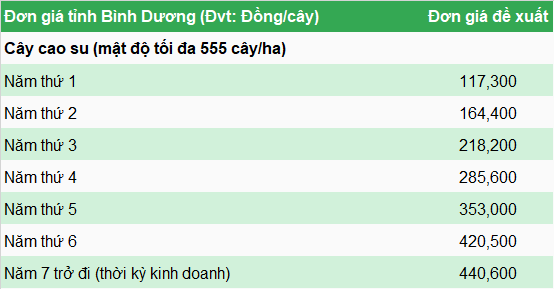

In Binh Duong province, according to the decision issued on April 13, 2023, on the regulation of compensation and support prices for assets when the state recovers land in the province, the compensation price for rubber trees (with a maximum density of 555 trees/hectare) gradually increases from VND 117,300 per square meter to VND 440,600 per square meter, corresponding to the first year to the seventh year and onwards (business period).

Source: People’s Committee of Binh Duong Province, effective from May 1, 2023

|

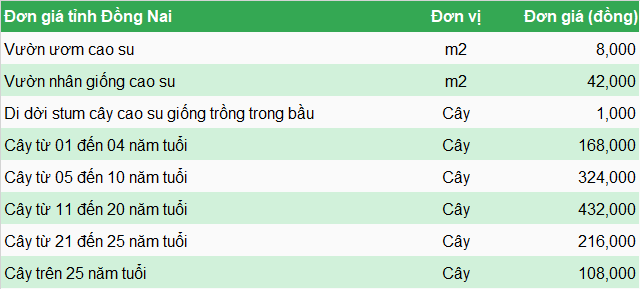

In Dong Nai province, according to the decision issued on September 28, 2022, the lowest compensation price is VND 1,000 per rubber tree seedling when relocating; while rubber trees aged 11-20 years have the highest compensation price of VND 432,000 per tree. For rubber tree nurseries and propagation gardens, the compensation prices are VND 8,000 per square meter and VND 42,000 per square meter, respectively.

Source: People’s Committee of Dong Nai Province, effective from October 8, 2022

|

The compensation cost for rubber tree land consists of two components. The first is the compensation price for rubber trees, which is determined by the Provincial People’s Committee. The second is the support component, which includes support for assets on the land, support for remaining investment costs in the land, support for unemployment allowances, and support to ensure housing, stable life, and production, as well as fairness for those whose land is recovered. In terms of structure, the support cost accounts for 70-80%.

According to the amended Land Law, which will take effect from 2025, the price of land for long-term crops will be determined based on 4 methods linked to market transaction prices. According to SSI Research’s analysis, the income method is the most suitable, consisting of 3 factors: revenue from the exploitation of the garden in the last 3 years, exploitation costs of the garden in the last 3 years, and the discount rate according to the 12-month term deposit interest rate of the state-owned banks with a stake of over 50%.

The compensation cost for rubber tree land is expected to increase by 30-50% compared to the cost of past transactions and will be applied according to the pricing methods from the amended Land Law.

This pricing basis will serve as a reference for calculating the land payment to the state for IP projects, facilitating a faster land transfer process from rubber companies to IP developers compared to the past (which usually took 3-5 years).

|

Expected compensation value for rubber tree land for the period of 2025-2030

Source: SSI Research

|

In reality, determining the compensation amount is not a quick and easy task. Regarding the issue of compensation when converting rubber land into IPs, Mr. Tran Cong Kha, Chairman of GVR, stated that rubber land leased from the state on an annual basis is not subject to land compensation but only to compensation for assets on the land, remaining investment costs in the land, and other support. The level of compensation and support depends on each locality, so there is no specific price.

As for the conversion timeline, Mr. Kha said that it depends on many objective factors, and each project has a certain timeline that cannot be determined at this time.

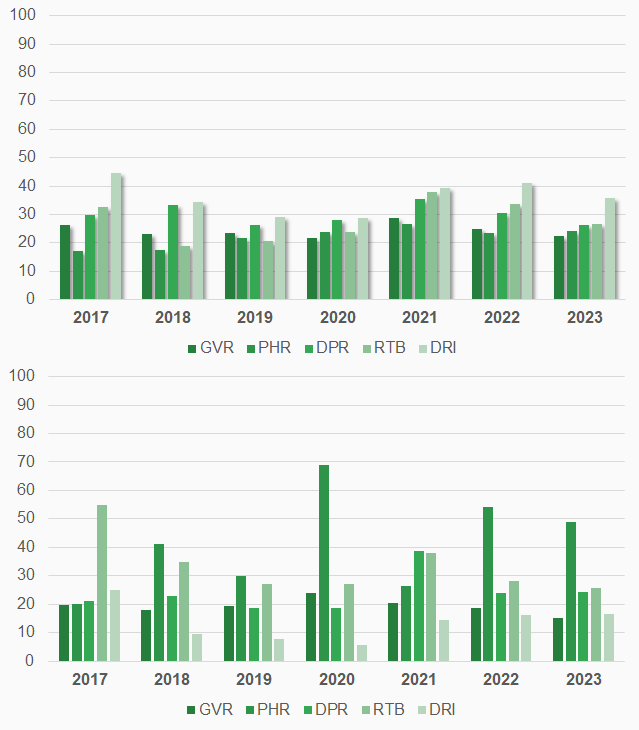

Observations show that the profit margins of rubber companies mostly move in the same direction as natural rubber prices, as exemplified by GVR’s gross profit margin decline during 2017-2020 when rubber prices dropped and its improvement after rubber prices rebounded. However, there are also periods when the IP segment significantly impacts the profit margins of rubber companies. This is evident in the case of PHR, whose gross profit margin showed an upward trend mainly during 2017-2023 due to one-time revenue recognition from IPs. DPR followed a similar pattern.

Additionally, the net profit margins of PHR and DPR surged from 2018 onwards due to receiving land compensation support from transferring land to the People’s Committee for IP development.

|

Profit margins of rubber companies during 2017-2023 (in %)

Source: VietstockFinance

|

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)