The first quarter of 2024 financial report of Ba Ria-Vung Tau Housing Development Joint Stock Company (HOSE: HDC) recorded a significant drop in revenue and profits, reaching VND 58 billion and VND 25 billion, respectively. As of the end of March 2024, the company’s total liabilities were VND 2,776 billion, of which financial debt accounted for VND 1,708 billion, or 61% of the total liabilities.

In a recent announcement, HDC plans to offer 20 million shares to existing shareholders through a rights issue, with a ratio of 1,000:148 (one share entitles the holder to one right, and 1,000 rights allow the purchase of 148 new shares). This plan was approved at the 2023 Annual General Meeting of Hodeco in April 2023. The registration and payment period for the share purchase will be from May 10 to June 5, 2024.

Notably, the offering price is set at VND 15,000 per share, half of the closing price on May 9, which was VND 29,000 per share. With 20 million shares on offer, Hodeco expects to raise VND 300 billion. The proceeds will be used to repay principal and interest on eight of the company’s loan agreements (to be executed in Q1-Q3 2024).

According to the announcement, HDC intends to repay VND 75 billion to BIDV, VND 91 billion to PGBank, VND 54 billion to TPBank, and VND 80 billion to Vietcombank. As of December 31, 2023, HDC’s total debt outstanding on these loan agreements was nearly VND 958 billion.

Prior to Hodeco, in early 2024, No Va Real Estate Investment Corporation (HOSE: NVL) also approved a plan to issue 200 million shares to professional securities investors, with a one-year restriction on transferability.

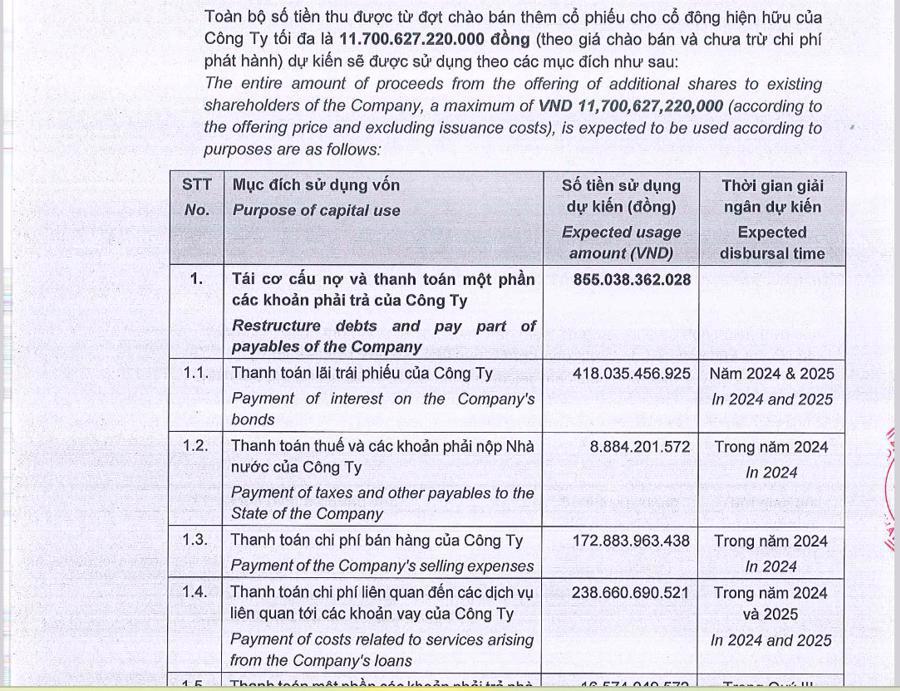

The company also sold over 1.17 billion unrestricted transferable shares to existing shareholders at a ratio of 60%, meaning 10 shares could be “exchanged” for 6 new shares. If the issuance is successful, NVL could raise a minimum of approximately VND 13,700 billion. The proceeds will be used to pay salaries to the company’s employees and also to cover operating expenses, contribute capital to subsidiaries, develop the company’s projects, restructure debt, and partially settle payables.

No Va Real Estate Investment Corporation (NVL) has just reported a record net loss for the first quarter of 2024. During this period, NVL recorded revenue of over VND 697 billion, a 15% increase compared to the same period last year. This growth was driven by increases in revenue from real estate transfers, consulting and management services, and leasing activities. However, NVL’s financial income decreased by 30% to VND 640 billion due to a reduction in profit from cooperative investment contracts, which fell to just over VND 456 billion.

On the other hand, while interest expenses decreased by 52%, financial expenses only decreased by 6% due to an increase in foreign exchange losses. Operating expenses also increased, resulting in a quarterly loss of VND 600 billion for the company, the highest quarterly loss in NVL’s history, compared to a loss of VND 410 billion in the same period last year.

As of the end of the first quarter, Novaland’s total assets decreased to VND 236,480 billion, with inventory increasing to VND 140,881 billion and cash and cash equivalents decreasing. The company’s current liabilities are VND 191,778 billion, four times the equity, including VND 58,000 billion in financial debt.

In early April, Vietnam Construction and Import-Export Joint Stock Corporation (Vinaconex, ticker: VCG) also announced a plan to offer a maximum of 119.7 million shares to existing shareholders, equivalent to 20% of the circulating shares, at a price of VND 10,500 per share. The expected proceeds from this offering are VND 1,197 billion, which will be used to repay Vinaconex’s maturing debts, including bank loans, credit institution debts, and payments to contractors and suppliers due in 2024 and 2025.

As of the end of March 2024, Vinaconex’s total liabilities were VND 11,721 billion, nearly twice its equity, with financial debt accounting for VND 4,800 billion.

Hai Phat Investment Joint Stock Company (Hai Phat Invest, ticker: HPX) aims to raise VND 3,000 billion to restructure its debt obligations and settle maturing payables.

Specifically, Hai Phat Invest plans to offer 159.69 million shares to existing shareholders and 140.3 million shares to strategic investors at a price of VND 10,000 per share. As of December 31, 2023, the company’s total debt amounted to VND 2,465.4 billion, or 68.7% of equity. Short-term debt stood at VND 1,828.4 billion, while long-term debt was VND 637 billion.

Recently, Deo Ca Transport Infrastructure Investment Joint Stock Company (HHV) published its financial report, revealing a challenging financial situation. As of the first quarter of 2024, Deo Ca’s total assets were VND 37,660 billion, an increase of VND 1,122 billion over the previous 12 months. However, its total liabilities were VND 27,834 billion, triple the equity of VND 9,826 billion. Financial debt accounted for 74% of the total liabilities, amounting to over VND 20,000 billion. Notably, employees of Deo Ca also lent the company nearly VND 3 billion.

With this debt burden, in the first quarter alone, Deo Ca had to pay VND 208 billion in interest, averaging VND 1.7 billion per day in interest expenses.

As of March 31, 2024, Deo Ca’s short-term debt exceeded its current assets by VND 1,362 billion. The current ratio, which measures the ability of a company to pay its short-term obligations, is 0.52, indicating a low level of liquidity and potential challenges in meeting short-term financial commitments.