Profit-taking pressure was evident as the Vn-Index had already recovered quite a bit. The index fluctuated with sector-specific stories, unable to rally the entire market, closing with the Vn-Index down 1.82 points. It was a minor loss, but 241 stocks declined, outnumbering the 201 gainers.

Most large-cap sectors turned red, with Oil & Gas down 0.23%, Banks down 0.105%, Securities down 1.01%, Construction Materials down 0.57%, and Food & Beverage down 1.23%. The top negative movers were GAS, VCB, VNM, BID, SAB, HPG, and MSN.

On the flip side, the seafood sector surged 2.10% on news that the US is considering recognizing Vietnam as a market economy, benefiting seafood exporters. VHC hit the upper limit during the session but closed up 2.08%; FMC rose 3.47%, and ANV gained 1.3%.

The total trading value on the three exchanges reached VND 22,500 billion, with foreign investors net selling VND 1,720.5 billion. Their net selling value on the matching board was VND 789.8 billion.

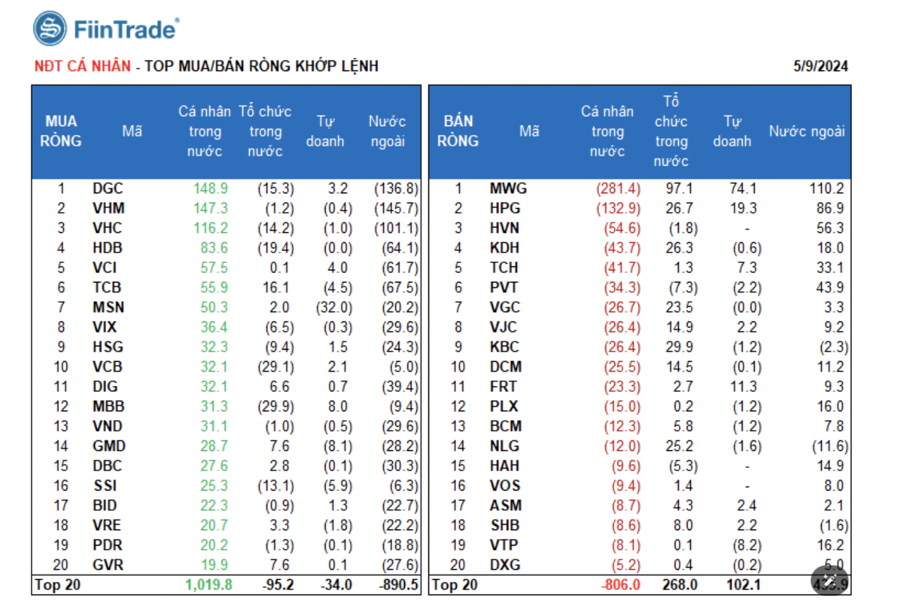

Foreign investors net bought Retail and Basic Resources sectors. Their top net bought stocks were MWG, HPG, HVN, PVT, TCH, KDH, VTP, PLX, HAH, and DCM.

They net sold Banking stocks. Their top net sold stocks were VHM, DGC, VHC, TCB, HDB, DIG, DBC, VND, and VIX.

Individual investors net bought VND 1,555.1 billion, with a net buying value of VND 538.9 billion on the matching board. On the matching board, they net bought 8/18 sectors, mainly Banking. Their top net bought stocks were DGC, VHM, VHC, HDB, VCI, TCB, MSN, VIX, HSG, and VCB.

On the selling side, they net sold 10/18 sectors, mainly Retail and Basic Resources. Their top net sold stocks were MWG, HPG, HVN, KDH, TCH, PVT, VJC, KBC, and DCM.

Proprietary trading accounts net sold VND 94.8 billion and net bought VND 109.6 billion on the matching board.

On the matching board, proprietary trading accounts net bought 11/18 sectors, with Retail and Information Technology being the top sectors. Their top net bought stocks were MWG, FPT, HPG, FRT, VPB, MBB, TCH, STB, VCI, and PAC. They net sold Food & Beverage stocks. Their top net sold stocks were MSN, VTP, GMD, ACB, PNJ, SSI, REE, TCB, VIB, and PVT.

Domestic institutions net bought VND 241.8 billion, with a net buying value of VND 141.3 billion on the matching board.

On the matching board, domestic institutions net sold 10/18 sectors, with Banking being the top sector. Their top net sold stocks were FPT, MBB, VCB, HDB, EIB, BAF, DGC, VHC, SSI, and CTS. They net bought Retail stocks. Their top net bought stocks were MWG, KBC, HPG, KDH, NLG, VGC, FUEVFVND, STB, TCB, and VJC.

Block deals today reached VND 3,726.0 billion, down 14.2% from the previous session, accounting for 16.5% of the total trading value.

VHM stood out with a notable block deal, as 26.9 million shares (worth VND 1,105.2 billion) were transferred from a foreign institution to an individual investor.

There was also a block deal from a domestic proprietary trading account to a foreign institution in HVN shares. Individuals continued to dominate block deals in Banking stocks (LPB, SHB, TCB) and MWG.

Cash flow allocation increased in Securities, Chemicals, Agricultural & Seafood, Food, Retail, Construction, Warehousing & Logistics, and Aviation but decreased in Real Estate, Banking, Steel, Oil & Gas, and Software.

On the matching board, the trading value proportion increased in mid-cap (VNMID) and small-cap (VNSML) stocks while decreasing in large-cap (VN30) stocks.