|

Source: VietstockFinance

|

The VN-Index closed almost flat on May 9th. NVL (+1.1%) and SHB (-1.26%) remained the two most traded stocks on the market, with over 24 million units traded. A host of securities stocks, including VIX (-1.43%), SHS (-1.05%), SSI (-1.26%), and HCM (+0.53%), also saw high trading volumes during this session.

In the afternoon session, MWG (-0.34%) climbed close to DGC (+1.05%) in terms of trading value, reaching 615 billion VND, second only to the phosphorus trading stock at 881 billion VND. HPG (-0.81%) also saw active trading with 592 billion VND.

The latest information reveals that the Dragon Capital group of fund companies has increased its stake in MWG to 7.45%. Based on the previous session’s closing price of 55,700 VND per share, the group is estimated to have invested approximately 445 billion VND in this transaction.

Dragon Capital’s actions reflect the net buying trend of foreign investors in the retail giant’s stock in 2024, a stark contrast to what happened in 2023.

After the afternoon session, foreign investors net bought a significant amount of HVN (+5.58%) worth 216 billion VND, while continuing to net sell VHM (+0.12%) up to 1.2 trillion VND. Since the beginning of the year, this real estate stock has been net sold up to 7.7 trillion VND.

| Foreign Trading from the Beginning of 2024 |

14:30: PVT and FRT hit new highs

On May 9th, several stocks reached their all-time highs, including PVT, FRT, and BVB, which broke its previous peak set a long time ago.

FRT is surging with a 3.08% gain today. This retail stock has risen steadily by 25% in just three weeks, reaching a new peak at 167,000 VND per share. In less than a year, FRT has soared by 215%, a dream return for any investor.

Although the company reported a net loss in 2023, the first quarter of 2024 showed some positive signs. Perhaps the market is anticipating a strong recovery in the retail industry, as well as the prospects of its subsidiary, Duoc Pham Long Chau, continuing to expand its pharmacy network and maintaining its revenue growth.

Similarly, PVT (+2.49%) has also surpassed its previous peak from six months ago. The oil and gas transportation stock is currently trading around 29,000 VND per share.

The stock price of PVT has been supported by the company’s strong first-quarter performance, with a significant increase in profit compared to the same period last year, thus completing 40% of its annual profit plan.

Source: stockchart.vietstock.vn

|

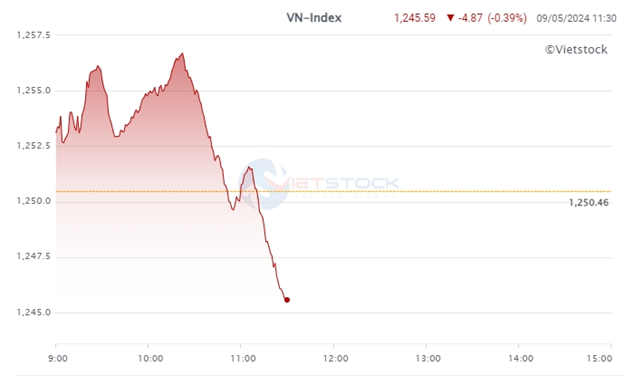

Morning Session: Wind Changes Direction in the Latter Half

It was quite surprising to see the VN-Index turn negative, falling nearly 5 points in the latter half of the morning session, ending at 1,245 points. HPG, VCB, and GAS became the biggest disappointments for investors.

Movement of the VN-Index in the morning session of May 9th. Source: VietstockFinance

|

The market quickly changed direction in the last hour of the morning session. HPG (-1.47%), VCB (-0.54%), and GAS (-1.29%) are the main culprits for this downturn.

This morning, DGC (+3.08%) was the most actively traded stock on the HOSE, with a trading value of 614 billion VND, nearly double that of the second-placed stock, SSI (-1.12%), and MSN (-1.11%).

Foreign investors are net selling by nearly 600 billion VND, almost half of the previous session. They are heavily selling VHM (+0.61%) and VHC (+5.33%) while IDC (+0.65%) and MWG (-0.68%) are also on their radar.

So far in May, foreign investors have net sold VHM worth nearly 1.2 trillion VND and showed a similar interest in buying MWG. These two stocks are also the most net bought and sold by foreign investors since the beginning of 2024.

| Top 10 Stocks with the Strongest Net Buying/Selling in the Morning Session of May 9, 2024 (as of 11:30 am) |

Since the beginning of the year, on the HOSE alone, HVN has seen the highest increase, at 60%. In the last three months, the stock has risen by 57%. The session on May 7th witnessed a sudden surge in trading volume. This jump in business activity comes amid a shortage of aircraft in the aviation market and high domestic airfare demand during the peak Tet holiday season.

Additionally, the resumption of international routes has also contributed to the positive performance of Vietnam Airlines. As a result, the airline reported record profits in the first quarter of 2024, pushing the stock price to new heights.

10:40: NVL and SHB Lead in Trading Volume

NVL and SHB are currently trading at over 12 million and 10 million units, respectively, leading the market and doubling the volumes of the next stocks.

In the middle of the morning session, the market’s largest index continued to fluctuate, showing little change from the update an hour earlier. Turnover stood at approximately 5.7 trillion VND, lower than the previous session’s 7.6 trillion VND.

DGC is a new standout, surging by 4.7%. Duc Giang is a large-scale producer of yellow phosphorus in Asia, a critical material in semiconductor manufacturing. This material is also used in various other industries, including F&B.

MSN (-0.29%) and TCB (0%) are the top two stocks in terms of trading value at this point, reaching 220 billion VND and 186 billion VND, respectively. They are followed by SSI (-0.84%) with a trading value of 168 billion VND.

According to VietstockFinance, most sectors are in positive territory, with seafood processing (+5.01%) leading the way. On the other hand, securities (-0.36%) and agriculture, forestry, and fisheries (-0.29%) are facing selling pressure.

Sector Movement as of 10:40 am. Source: VietstockFinance

|

Market Open: Seafood Stocks Surge at the Open

The seafood processing sector quickly rose by 5.71% in the early session. Notably, VHC hit its intraday limit of 6.89%, while other stocks in the sector, such as ANV, ASM, IDI, and others, also gained more than 4%.

Performance of Seafood Stocks at the Open on May 9th. Source: VietstockFinance

|

At the opening bell on May 9th, the VN-Index quickly climbed more than 5 points, reaching around 1,255.86 points (+0.43%).

VHC, BID (+0.3%), and NVL (+3.31%) are the main contributors to the index’s gain, while HPG (-0.65%) and VIC (-0.66%) are dragging it down.

NVL is currently leading the market in trading volume, with over 7 million units traded. This real estate stock is also rebounding strongly after a series of disappointing sessions.