According to the General Department of Customs, in Q1/2024, Vietnam’s rubber exports reached 414.3 thousand tons, with a turnover of 607.4 million USD, up 8.5% in volume and 14.3% in value compared to the same period. The average export price of rubber reached 1,466 USD/ton, up 5.3%.

Vietnamese rubber is mainly exported to China. According to the Import and Export Department (Ministry of Industry and Trade), in the first three months of the year, Vietnam exported 287.9 thousand tons of rubber to this market, worth 407.8 million USD, down 1.6% in volume but up 2.7% in value.

On the stock exchange, the number of rubber businesses with revenue growth accounted for the majority after rubber prices and consumption volume improved compared to the same period.

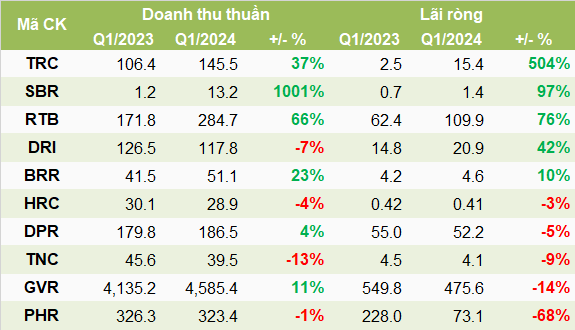

According to data from VietstockFinance, out of 13 rubber and tire companies listed on the 3 exchanges HOSE, HNX, and UPCoM, 6 companies reported higher profits, while 6 saw declines. The industry’s total revenue reached VND8,071 billion, up 5%; however, net profit decreased by nearly VND830 billion, down 13% due to the decline of the two giants GVR and PHR.

Mixed emotions in the rubber business group, with the “big guys” missing out on the joy

|

Results of the rubber business group in Q1/2024

Unit: VND billion

Source: VietstockFinance

|

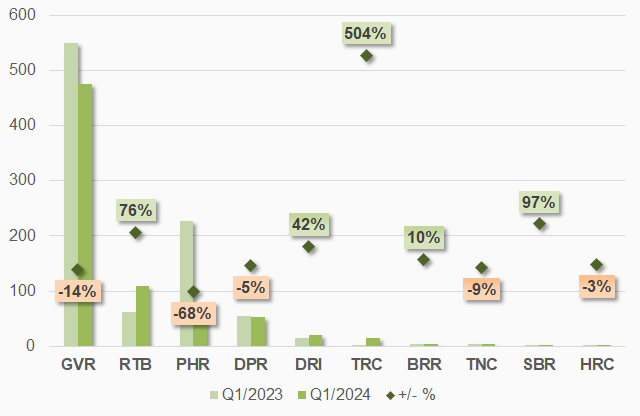

The 5 companies with higher net profits were Tay Ninh Rubber Joint Stock Company (Taniruco, HOSE: TRC), Song Be Rubber Joint Stock Company (Soruco, UPCoM: SBR), Tan Bien Rubber Joint Stock Company (Tabiruco, UPCoM: RTB), Dak Lak Rubber Investment Joint Stock Company (UPCoM: DRI), and Ba Ria Rubber Joint Stock Company (Baruco, UPCoM: BRR). Among these companies, most experienced revenue growth except for DRI.

TRC led the profit growth with a 504% increase to over VND15 billion, the highest in the past 3 years, thanks to the average rubber selling price increasing by VND4.7 million/ton to VND38.1 million/ton. At the same time, its subsidiary, Tay Ninh – Siem Reap Rubber Development Company, made a profit, while it was still making a planned loss in the same period last year.

Ranking second was SBR with a 97% increase in net profit, reaching VND1.4 billion, thanks to higher profits from rubber trading activities due to increased sales volume and SVR3L rubber prices. Other positive factors included higher profits from financial activities and lower business management expenses.

RTB achieved the highest net profit since its listing, VND110 billion, up 76%. RTB stated that rubber consumption volume increased by 2,200 tons, and rubber prices were also higher by VND5 million/ton. In terms of costs, the selling cost of rubber was lower thanks to a reduction of over VND3.2 million/ton.

Regarding BRR, consumption volume reached 1,299 tons, up 14%, and the selling price was slightly higher at VND35.6 million/ton. BRR also earned more than VND1 billion in financial activities, up 72%, thanks to higher interest income and gains from foreign currency sales. Thus, the company’s net profit exceeded VND5 billion, up 10%.

As for DRI, the decline in revenue from the sale of rubber semi-finished products and cashew nuts led to a decrease in total revenue. However, due to the absence of tax expenses on profit remittance to headquarters, as recorded in the same period last year, the company’s profit increased by 50%.

|

Net profit performance of rubber businesses in Q1/2024

Unit: VND billion

Source: VietstockFinance

|

The 5 companies with lower net profits were Phuoc Hoa Rubber Joint Stock Company (Phuruco, HOSE: PHR), Vietnam Rubber Industry Group (HOSE: GVR), Thong Nhat Rubber Joint Stock Company (HOSE: TNC), Dong Phu Rubber Joint Stock Company (HOSE: DPR), and Hoa Binh Rubber Joint Stock Company (HOSE: HRC).

GVR’s production and business activities recorded a revenue of VND4,585 billion, up 11%. However, income from land compensation and local land return decreased significantly, causing other income to drop by nearly 80% to VND70 billion. As a result, net profit decreased by 14% to VND476 billion.

PHR recorded the sharpest profit decline of 68%, to over VND73 billion. During this period, PHR no longer received income from compensation for the implementation of the Vietnam-Singapore Industrial Park III (VSIP III) project in Binh Duong province, while it received VND200 billion in the same period last year. In addition, the decrease in bank interest income and the corresponding profit of PHR’s ownership in Nam Tan Uyen Industrial Zone (UPCoM: NTC) also had a significant impact.

Most tire companies in the group witnessed robust growth

|

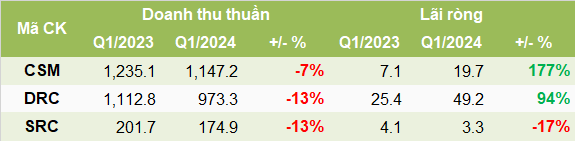

Results of the tire group in Q1/2024

Unit: VND billion

Source: VietstockFinance

|

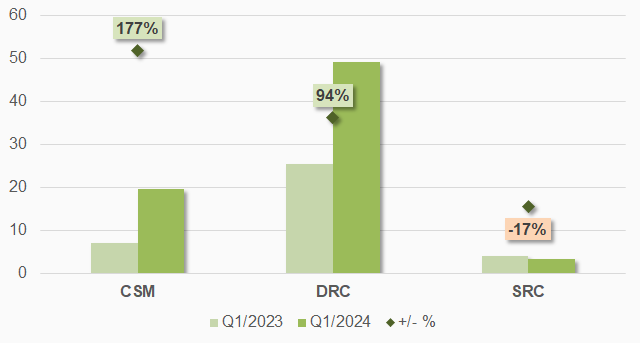

The 3 tire companies in the statistics, including Southern Rubber Industry Joint Stock Company (Casumina, HOSE: CSM), Danang Rubber Joint Stock Company (HOSE: DRC), and Sao Vang Rubber Joint Stock Company (HOSE: SRC), all experienced revenue declines, but CSM and DRC reported higher net profits.

CSM’s revenue in Q1/2024 was VND1,147 billion, down 7%, due to the domestic market’s slow recovery and low consumption. Moreover, the economic recession led to requests for price reductions from export customers. However, net profit increased by 177% to nearly VND20 billion thanks to improved gross profit margin and higher other income, marking the highest Q1 profit since 2018.

DRC also achieved positive results with a profit of VND49 billion, up 94% despite lower revenue. The company explained that the decrease in raw material prices compared to the same period and the appreciation of foreign exchange rates benefited export activities.

SRC’s revenue and net profit declined due to lower sales and higher payment discounts, along with the loss of other income from tax reductions.

|

Net profit performance of tire companies in Q1/2024

Unit: VND billion

Source: VietstockFinance

|

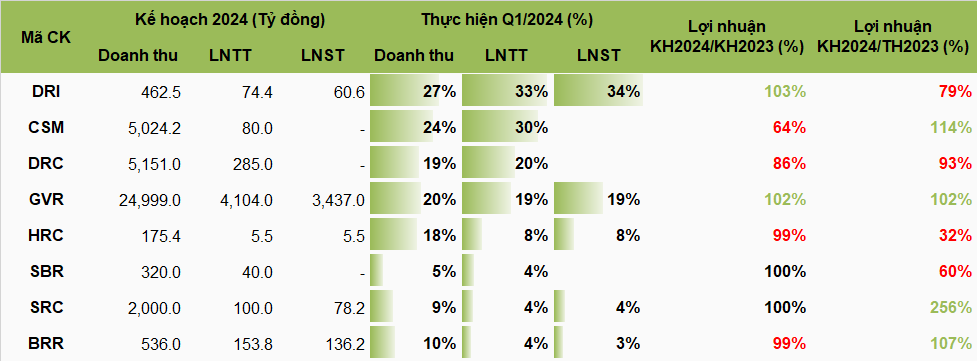

Implementation of the 2024 business plan

Rubber companies approach 2024 with a common cautious mindset, setting targets similar to or lower than the 2023 performance.

Among the 8 rubber companies that have announced their 2024 targets, including those approved by the General Meeting of Shareholders and those to be presented to the General Meeting, 4 companies aim for growth, while 4 set more conservative goals.

After the first three months, DRI led in terms of the implementation of the year’s plan, achieving 27% of revenue, 33% of pre-tax profit, and 34% of after-tax profit.

CSM reached 24% of the revenue target and 30% of the pre-tax profit goal. CSM’s targets for this year are lower than those of 2022.

In contrast, SRC aims for an ambitious 256% increase in after-tax profit compared to the previous year’s performance.

HRC, DBR, and BRR achieved less than 10% of their annual targets after the first quarter, but it is worth noting that these companies tend to see profit peaks in Q4.

|

Implementation of the 2024 business plan

Source: VietstockFinance

|

Rubber Companies Remain Cautious in Setting 2024 Targets

Which Rubber Companies Will Benefit from the Shift to Industrial Park Land?