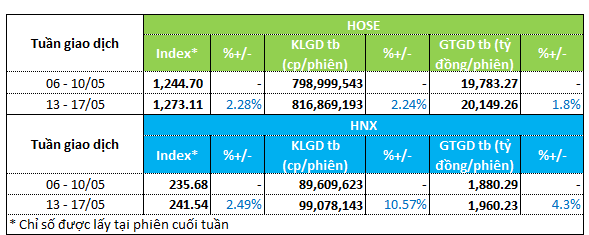

VN-Index surges 2.3% to 1,273 points, while the HNX-Index climbs 2.5% to 241.5 points. Both volume and value of transactions on the two exchanges rose.

Specifically, the volume and value of transactions on the HOSE exchange increased by about 2% to nearly 817 million units and 20.1 trillion VND, respectively. On the HNX exchange, the trading volume rose by 10% to 99 million units, while the trading value increased by 4% to 1.9 trillion VND.

|

Market Liquidity Overview for Week of Mar 13-17

|

The continued inflow of funds into the stock market has created excitement in many sectors.

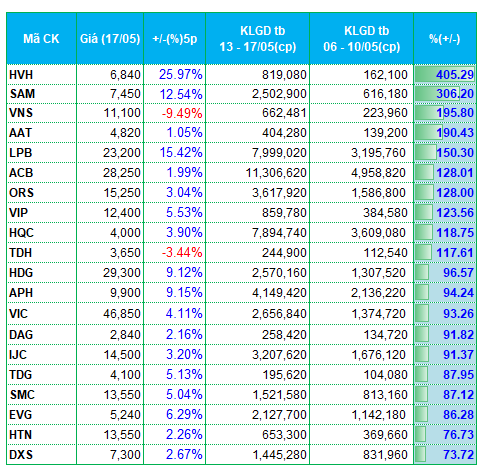

First and foremost, real estate stocks have been attracting strong interest. A slew of real estate stocks, including HQC, TDH, HDG, VIC, IJC, EVG, DXS, IDJ, API, TIG, and DTD, have seen significant money inflows this week.

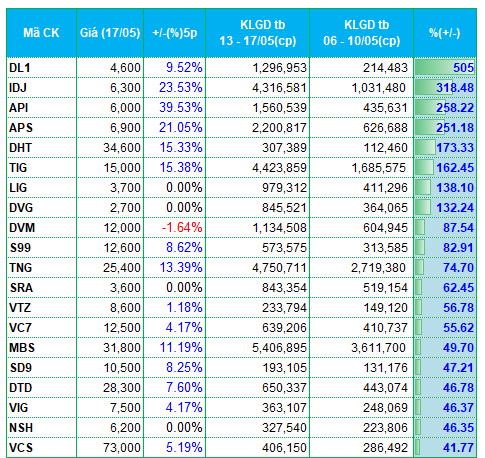

Several stocks in the financial and banking sector, such as ORS, APS, VIG, MBS, LPB, and ACB, also witnessed a substantial increase in liquidity.

The market witnessed a spectacular comeback for the APEC group of stocks, comprising IDJ, API, and APS. These stocks experienced multiple trading sessions with ceiling prices, resulting in a 20-40% surge in market prices. Moreover, the trading volume of these stocks surged by 250-300% compared to the previous week. The remarkable comeback can be attributed to the reappearance of businessman Nguyen Do Lang at the 2024 Annual General Meeting of API.

On the other hand, agriculture and agricultural input stocks experienced a significant outflow of funds. NAF, AFM, TAR, LAS, and BFC were among the stocks that witnessed a sharp decline in liquidity on both exchanges.

Construction stocks listed on the HNX exchange also faced substantial fund outflows. CMS, MST, HUT, and VC2 were among the stocks that witnessed a notable decrease in liquidity during the week.

|

Top 20 Stocks with Highest Increase/Decrease in Liquidity on the HOSE Exchange

|

|

Top 20 Stocks with Highest Increase/Decrease in Liquidity on the HNX Exchange

|

The list of stocks with the highest increase/decrease in liquidity is based on a minimum average trading volume of 100,000 units per session.