On May 15, 2024, Ho Chi Minh City-Hanoi Securities Joint Stock Company (SHS) held its annual General Meeting of Shareholders (GMOS). In addition to attending in person, SHS shareholders could also attend online. According to the announcement, a total of 1,633 shareholders, representing over 433 million shares, or 54.59% of the total voting shares, attended or were represented at the meeting.

2024 Targets: Regain Top 10 HoSE Brokerage Market Share, Aim to Become a Full-Service Securities Company with Best-in-Class Products and Services

SHS shareholders approved the 2024 business plan, which aims to achieve total revenue and other income of VND 1,844 billion and pre-tax profit of VND 1,035 billion, representing a 26% and 51% increase, respectively, compared to the previous year. The management team at SHS expects the securities market in 2024 to accumulate at higher index levels. In a positive scenario, the VN-Index could peak at 1,350-1,400 points and end the year in the range of 1,250-1,300 points, corresponding to a 10.6%-15.5% increase compared to 2023. Market liquidity is also forecast to increase by 20%.

Speaking at the meeting, Mr. Do Quang Vinh, Chairman of the Board of Directors of SHS, said that the company has been gathering talented and experienced professionals to provide customers with optimal and pioneering investment products and services in the securities market. SHS aims to regain its position in the top 10 brokerage market share on the HoSE in 2024. The company continuously trains and enhances the experience of its employees. In addition to leveraging its internal strengths, SHS is also in the process of finding a suitable strategic consultant to restructure the company and move towards a model of a securities investment advisory firm that meets world-class standards.

With its unique and diverse ecosystem, SHS is optimizing resources from various units in different industries, including banking, fund management, and insurance. From now until 2030, the Board of Directors aims to build the company into a central unit of a leading financial investment group in Vietnam. In the next 1 to 2 years, SHS will present a detailed plan to the General Meeting of Shareholders.

Expectations After the Capital Increase to Over VND 17,000 Billion: 2025 Profit of VND 1,600-1,800 Billion, Paying Cash Dividends

Notably, an important agenda item that was added and approved by the shareholders was the plan to issue shares to increase the charter capital, with a total proposed issuance of 899.5 million shares.

Specifically, SHS plans to issue 40.6 million shares as a 5% dividend payment for 2023 (a ratio of 100:5), issue 40.6 million bonus shares to increase capital from equity sources at a ratio of 5%, offer more than 813 million shares to existing shareholders at a ratio of 1:1 at a price of VND 10,000/share, and sell 5 million ESOP shares at VND 10,000/share.

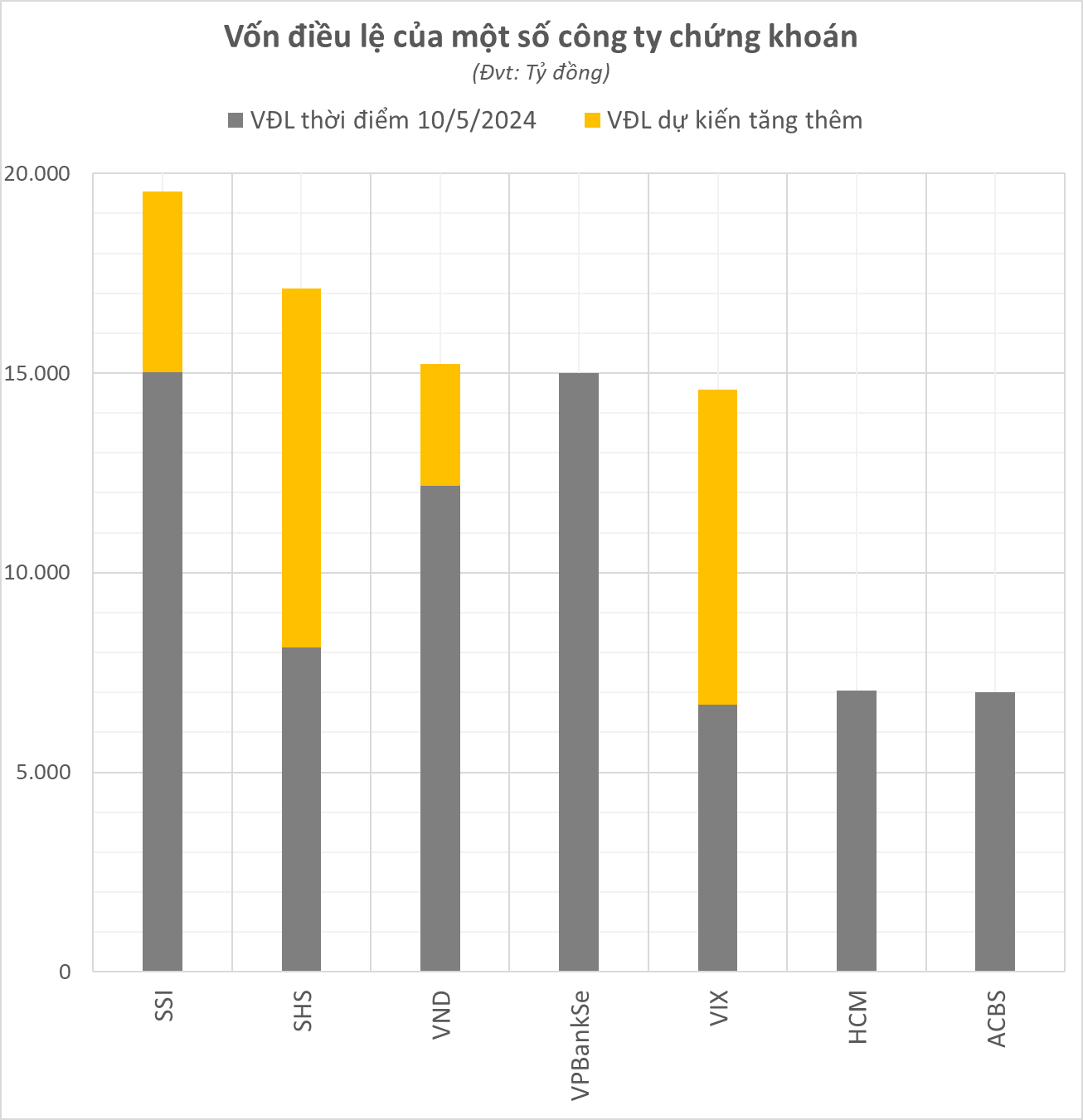

Currently, the charter capital of SHS is VND 8,141.5 billion. If all the above proposals are successfully issued, the charter capital will increase to VND 17,126 billion, making it one of the securities companies with the largest charter capital in the industry.

According to SHS, in the context of the strong development of the financial market, the increase in charter capital is not only a strategic move but also a necessary step to seize opportunities and promote growth. The company needs additional resources to increase its trading capital, expand margin lending, capital investment, and investment activities as the market prospers.

Mr. Do Quang Vinh shared that SHS has close relationships with banks and has access to certain borrowing limits. The company wants to maximize its own capital before utilizing bank loans. The capital increase also aims to build financial strength as a foundation for SHS to develop further in its 3-5-year strategy rather than focusing on the short term.

The Chairman of SHS affirmed the company’s confidence in its plans and stated that they would have a specific strategy to ensure a successful capital increase. Notably, the capital raised from this activity will be utilized in 2025. Against the backdrop of a stable economy and market, the management team is confident that the profit in 2025 could reach VND 1,600-1,800 billion and potentially even higher.

Regarding dividends, shareholders at the meeting expressed their desire for the company to pay cash dividends. Mr. Do Quang Vinh responded, “We all want the company to perform well and distribute high dividends to shareholders. If all goes as planned, there will be cash dividends for shareholders next year, so that shareholders can see the direct and tangible value of investing in SHS.”