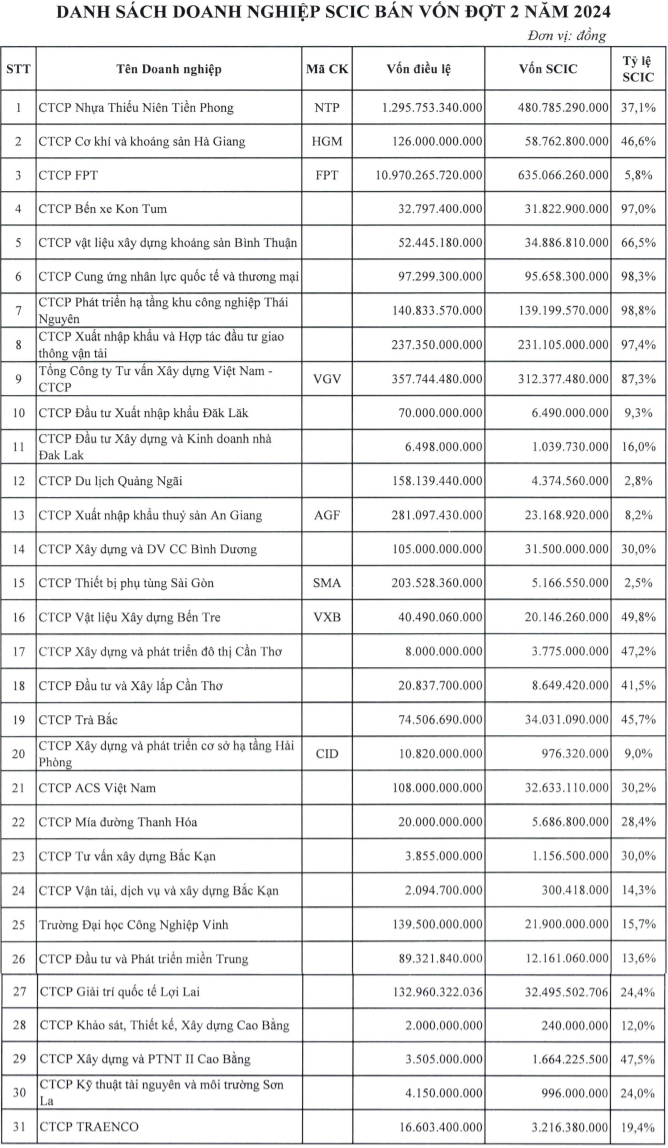

The State Capital Investment Corporation (SCIC) has just announced its second round of divestments for 2024, involving 31 enterprises.

Eight listed companies are included in the list: NTP – Thanh Nien Plastic Joint Stock Company, HGM – Hanoi Machinery and Mineral Joint Stock Company, FPT Joint Stock Company, VGV – Vietnam Construction Consulting Corporation, AGF – An Giang Fisheries Import and Export Joint Stock Company, SMA – Saigon Equipment and Spare Parts Joint Stock Company, VXB – Ben Tre Construction Material Joint Stock Company, and CID – Hai Phong Infrastructure Development and Investment Joint Stock Company.

SCIC’s Divestment List for the 2nd Batch of 2024

The most notable transaction in this batch is SCIC’s planned divestment of its entire 5.8% stake in FPT Joint Stock Company, valued at approximately VND 635 billion. This is the largest expected transaction value in SCIC’s 2024 second-batch divestment list. If successful, SCIC will no longer be a shareholder of FPT.

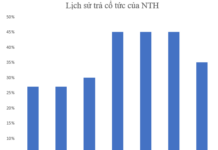

In addition to FPT, other significant divestments by SCIC in this batch include NTP (37.1% stake) valued at VND 480 billion, VGV (87.3%) at VND 312 billion, Transportation Investment and Cooperation Joint Stock Company (97.4%) at VND 231 billion, and Infrastructure Development of Industrial Parks in Thai Nguyen Joint Stock Company (98.8%) at VND 139 billion, among others.

Earlier, in the first batch of divestments for 2024, SCIC announced its plan to divest from 27 enterprises, including listed companies such as DMC – Domesco Medical Import Export Joint Stock Company, VNB – Vietnam Book Joint Stock Company – Savina, SEA – Seaprodex, Vietnam National Seafood Corporation, VNP – Vietnam Plastics Joint Stock Company, and VEC – Vietnam Electronics and Informatics Corporation. SCIC has successfully divested from VNC and Feature Film 1 Joint Stock Company.

According to SCIC’s audited financial statements for 2023, the corporation achieved revenue of VND 7,143 billion, a decrease of 30.1% compared to 2022. Investment revenue decreased by 92% to VND 116 billion, and revenue from dividends and profit sharing decreased by 29.5% to VND 5,383 billion.

In 2023, SCIC reversed VND 816 billion of provisions for investment depreciation, resulting in a reversal of VND 489.2 billion in business capital investment expenses. Thanks to the increase in gross profit and a significant reduction in losses in associated companies to VND 1,728 billion, SCIC’s pre-tax profit reached VND 5,650 billion, doubling that of the previous year.

As of the end of 2023, SCIC’s total assets amounted to VND 52,750 billion, an increase of 6% compared to the beginning of 2022. Short-term financial investments accounted for VND 33,343 billion, an increase of 10.4%. The corporation’s term deposits increased by more than VND 4,000 billion to VND 30,450 billion, while investments in stocks decreased by over VND 1,000 billion to VND 2,945 billion. Long-term financial investments increased by 6.3% to VND 28,023 billion, with investments in subsidiary companies exceeding VND 17,449 billion, a 12% increase from the beginning of the year.