HPG stock witnessed a trading frenzy on May 15, with a staggering 45 million shares changing hands, resulting in a transaction value of nearly VND 1,400 billion, the highest on the market. This influx of cash propelled the HPG share price to surge by 3.3% to VND 31,200 per share, the highest in two years.

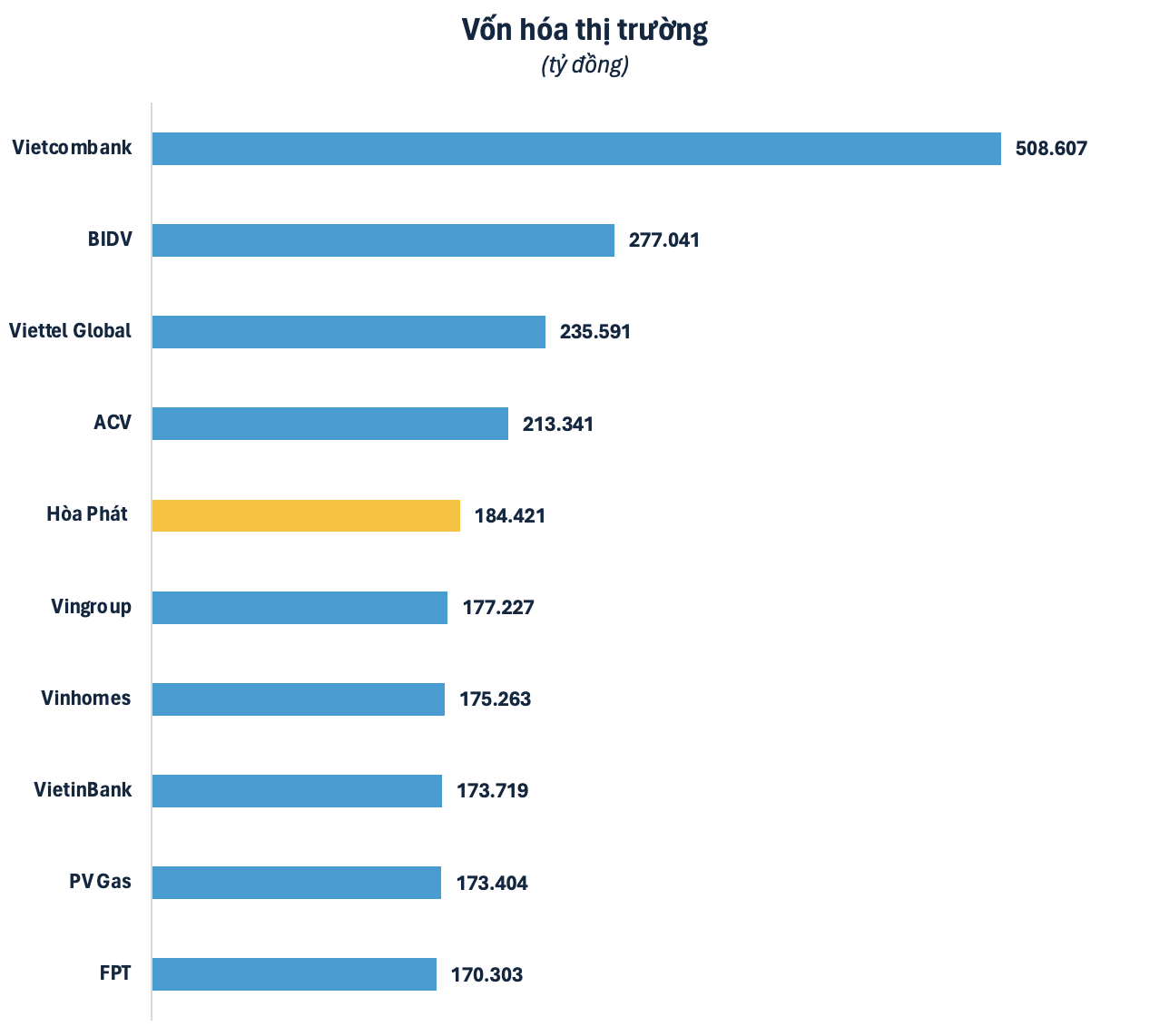

The corresponding market capitalization reached VND 181,400 billion (USD 7.5 billion), an increase of nearly VND 53,000 billion (USD 2.2 billion) compared to the same period last year. With this market capitalization, Hoa Phat, owned by billionaire Tran Dinh Long, has surpassed Vingroup to become the largest private conglomerate on the Vietnamese stock market. Hoa Phat’s value is now only surpassed by four state-owned giants: Vietcombank, BIDV, Viettel Global, and ACV.

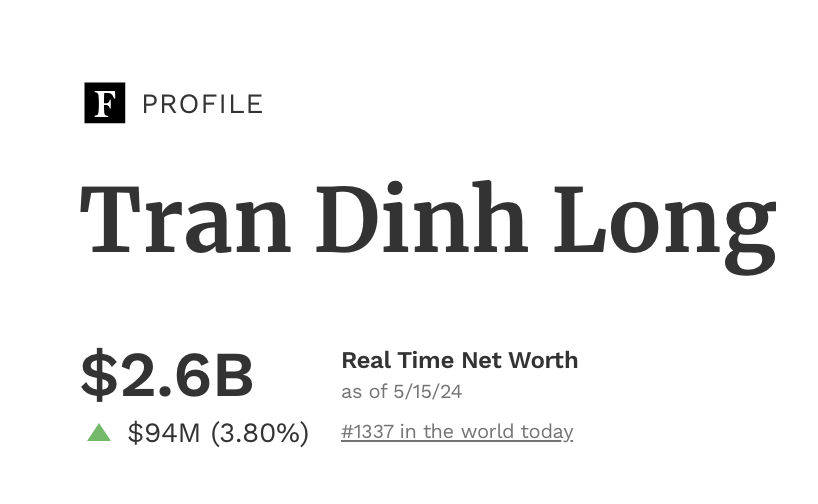

As HPG stock soared, the assets of the family of Chairman of the Board of Directors, Tran Dinh Long, also skyrocketed. With a total holding of over 2 billion shares, accounting for 35% of Hoa Phat’s capital, the family’s stock assets are estimated to be worth nearly VND 63,500 billion (USD 2.6 billion). Of this, the HPG shares directly held by Mr. Long are valued at VND 46,800 billion (USD 1.9 billion), an increase of nearly VND 14,000 billion compared to a year ago.

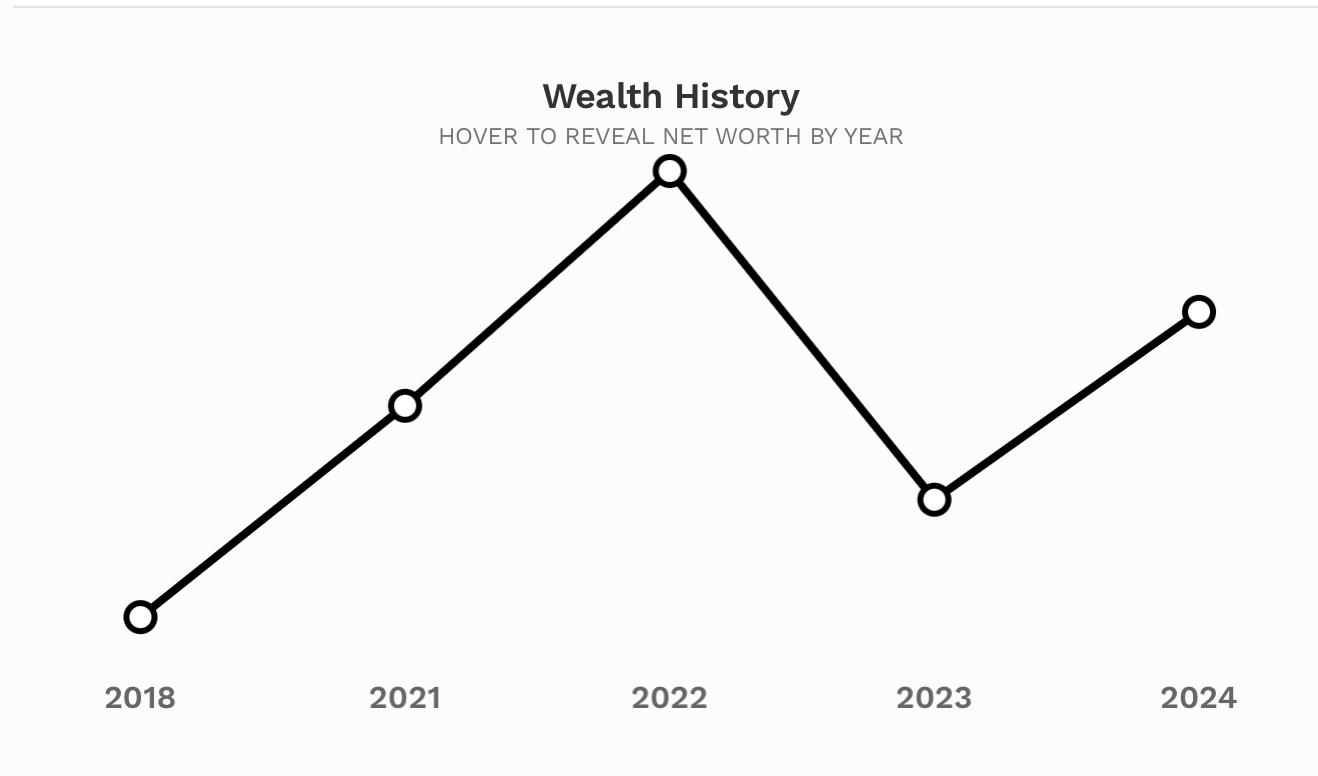

According to Forbes’ latest update, as of May 15, 2024, Mr. Tran Dinh Long’s net worth stood at USD 2.6 billion, ranking him 1,337th on the list of global billionaires. While this figure is significantly higher than last year’s, it is still far below the peak that this billionaire once reached.

On May 25, Hoa Phat will finalize the list of shareholders eligible to receive bonus shares from the company’s equity. Accordingly, the enterprise owned by billionaire Tran Dinh Long will issue over 580 million shares to existing shareholders at a ratio of 10% (for every 10 HPG shares held, shareholders will receive 1 new share). The issuance source will come from the surplus capital fund of over VND 3,200 billion and undistributed post-tax profits of over VND 2,600 billion. After the issuance, Hoa Phat’s charter capital is expected to increase by nearly VND 6,000 billion to nearly VND 64,000 billion, corresponding to nearly 6.4 billion HPG shares in circulation. This will make Hoa Phat the second-largest company in terms of circulating shares on the Vietnamese stock market, only behind VPBank.

According to Chairman Tran Dinh Long, in the past years, Hoa Phat has had to allocate resources for investing in large projects, hence the decision to pay dividends in shares. The conglomerate aims to balance the interests of the company and its shareholders. “If business results are favorable, from 2025, Hoa Phat will resume cash dividend payments,” shared the Chairman.

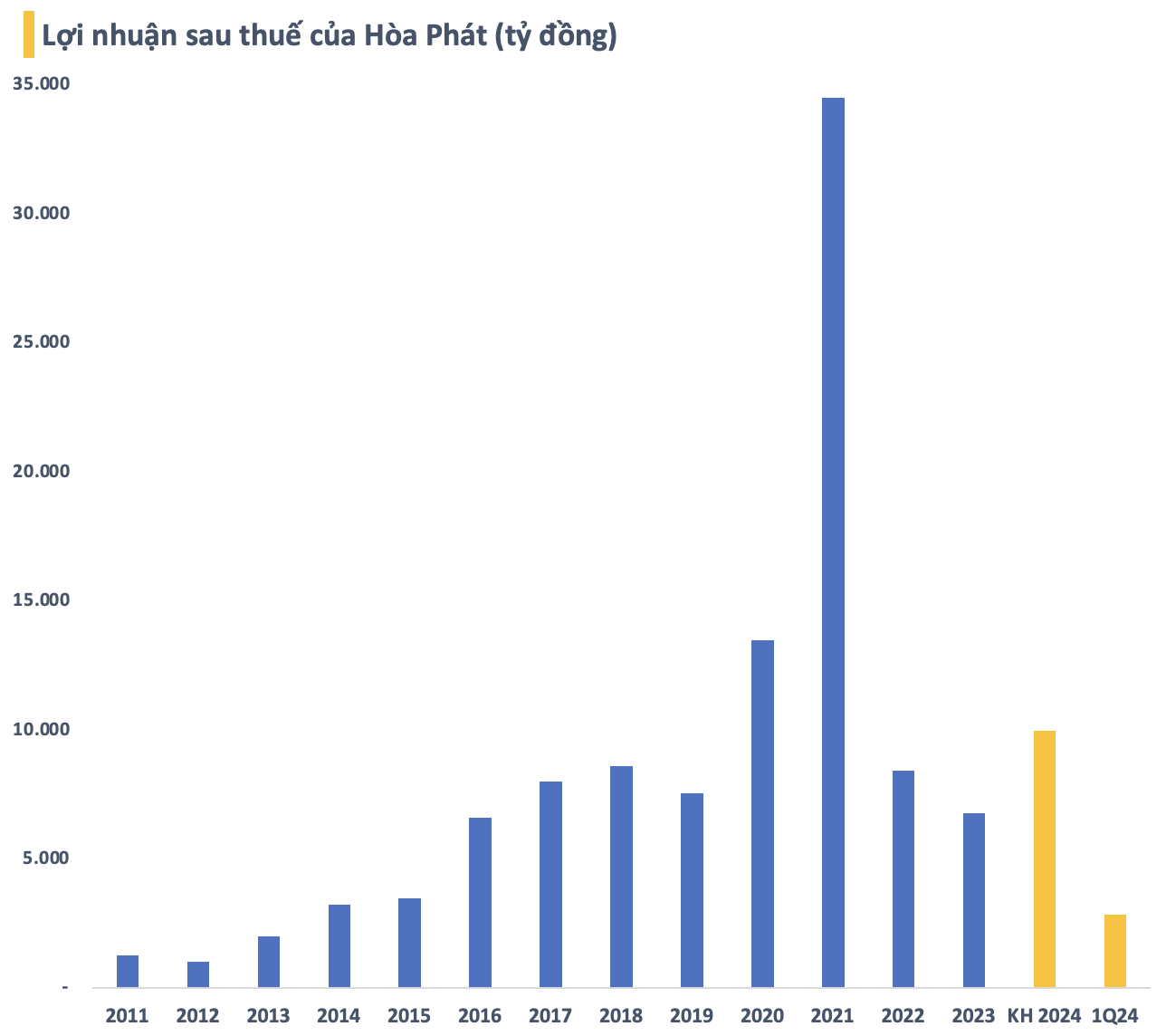

For the 2024 business plan, Hoa Phat sets a target of VND 140,000 billion in revenue and VND 10,000 billion in after-tax profit, an increase of 16% and 47%, respectively, compared to the actual results of 2023. In the first quarter of the year, the leading steel enterprise recorded an after-tax profit of nearly VND 2,900 billion, 7.5 times higher than the same period in 2023. With these results, Hoa Phat has achieved 29% of its full-year profit plan.

Speaking at the shareholders’ meeting earlier in April, billionaire Tran Dinh Long stated that Hoa Phat will focus on steel production in the next 5-10 years. The conglomerate is currently working to complete the Hoa Phat Dung Quat 2 Steel Complex Project in Quang Ngai province. Once operational, this project will boost the company’s crude steel production capacity to over 14 million tons per year.

As of the end of the first quarter of 2024, Hoa Phat had invested VND 26,800 billion in the project, an increase of VND 1,224 billion compared to the beginning of the year. The first phase is expected to be operational in the first quarter of 2025, with the second phase completing in the fourth quarter of the same year. Upon the completion of Dung Quat 2, Hoa Phat (HPG) is projected to enter the top 30 steel companies in the world.

According to a recent analysis report by BIDV Securities Company (BSC Research), Hoa Phat is expected to generate revenue of nearly VND 190,000 billion and after-tax profit of about VND 22,000-23,000 billion in 2025 when the Dung Quat 2 project enters the first phase of operation. The analysts’ forecast is based on three assumptions. First, Dung Quat is expected to operate at 85% capacity. Second, a recovery in the domestic market and a revival in the real estate sector will improve Hoa Phat’s gross profit margin to 19.4%, a 4% increase compared to the previous year. Finally, the company’s long-term debt is projected to reach VND 34,400 billion, with an interest rate of 10% by the end of 2025.