Liquidity on May 15 hit its highest level in the last 15 sessions. HoSE trading value reached nearly VND 22,150 billion. Domestic and foreign capital both recorded positive trading. Foreign investors bought a net VND 293 billion. HPG recorded the most active trading and the highest liquidity on the exchange.

With HPG’s upward momentum, Hoa Phat surpassed Vingroup to become the 5th largest company by market capitalization on the exchange – over VND 181,000 billion. Hoa Phat’s market cap ranks 5th, just behind four state-owned enterprises, including three banks : Vietcombank, BIDV, Viettel Global, and ACV.

The net worth of billionaire Tran Dinh Long, Chairman of HPG, also surged following the stock’s rally. Forbes recorded a $94 million (3.8%) increase in Mr. Long’s wealth, bringing his total net worth to $2.6 billion.

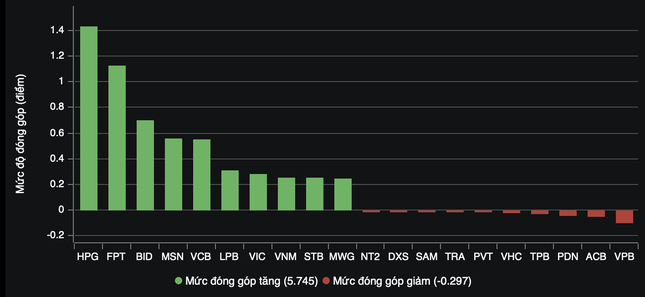

HPG leads the market’s driving force.

HPG alone contributed nearly 1.5 points to the VN-Index , with a trading value of nearly VND 1,400 billion, a significant gap from the second-highest, MWG. MWG’s liquidity was only VND 800 billion. MWG and HPG were the focus of net foreign buying, with respective values of VND 271 billion and VND 176 billion. With support from both domestic and foreign capital, HPG and MWG rose.

In the steel group , green covered HPG, NKG, HSG, TVN, and TLJ. The shipping, fertilizer, textile, and securities industries also saw notable trading. Among the large-cap VN30 group, 26/30 stocks advanced. However, the gains of the leading banks were modest, contributing modestly to the main index.

Some stocks surged with their own stories. Viettel Construction’s CTR hit the ceiling price after the company announced its April business results, with revenue reaching nearly VND 1,000 billion. Ceiling prices were also seen in securities stocks FTS and CTS. Securities stocks unanimously traded positively, with over 20 codes advancing. Large-cap and high-liquidity stocks such as VIX, SHS, SSI, VND, HCM, and VCI rose by around 1%.

At the close, the VN-Index rose 11.11 points (0.89%) to 1,254.39. The HNX-Index increased 1.83 points (0.77%) to 238.78, and the UPCoM-Index climbed 0.48 points (0.52%) to 92.10. Liquidity surged, with the HoSE matching value exceeding VND 19,300 billion.