Former Truong Thanh Deconin Chairman successfully sells 2 million shares

Mr. Tran Huy Thieu, member of the Board of Directors of Truong Thanh Construction and Development Investment JSC (Truong Thanh Deconin, HOSE: TTA), sold 2 million TTA shares through matching and negotiation from April 25 to May 16, 2024.

As a result, Mr. Thieu’s ownership decreased from over 11.1 million shares (6.52%) to nearly 9.1 million shares (5.34%). Based on the average closing price of TTA during this period, which was VND 7,979 per share, it is estimated that Mr. Thieu earned approximately VND 16 billion.

Mr. Thieu previously served as Chairman of the Board of Directors of TTA from January 15, 2021 to April 26, 2023. Since then, Mrs. Nguyen Thi Ngoc has been serving as Chairman of the Board of Directors up to the present.

Chairman’s younger brother purchased nearly 2 million EVG shares

Mr. Le Dinh Tuan, member of the Board of Directors and Vice President of EverLand Group JSC (HOSE: EVG), bought 1.98 million EVG shares through matching orders from April 19 to 26, 2024, accounting for 99% of the registered purchase volume of 2 million shares.

The reason for not completing the registered volume was that the market price was not suitable for the expected purchase price.

During this period, the average closing price of EVG shares was VND 4,860 per share, meaning Mr. Tuan spent approximately VND 9.6 billion on the purchase. After the transaction, Mr. Tuan’s ownership in EVG increased from 2.1% (4.53 million shares) to 3.03% (6.14 million shares).

It is worth noting that Mr. Tuan is the younger brother of EVG Chairman, Mr. Le Dinh Vinh.

REE Energy divested 2 million PPC shares

REE Energy Company Limited, a major shareholder of Phả Lại Thermal Power Joint Stock Company (HOSE: PPC), announced that it had divested 2 million PPC shares as registered, reducing its ownership to 22.7%.

The transaction was conducted through matching orders from April 12 to May 10, 2024. After the transaction, REE Energy’s ownership decreased from 23.3% (74.7 million shares) to 22.7% (72.7 million shares).

In terms of connections, Mr. Nguyen Quang Quyen, member of the Board of Directors of PPC and Vice President of Refrigeration Electrical Engineering Joint Stock Company (HOSE: REE), is also the Director of REE Energy. Additionally, REE Energy is a subsidiary of REE.

With the average closing price of PPC shares during the above period being approximately VND 14,135 per share, REE Energy is estimated to have earned more than VND 28 billion.

Mr. Bui Thanh Nhon‘s daughter successfully sold over 9 million NVL shares

Ms. Bui Cao Ngoc Quynh, daughter of Mr. Bui Thanh Nhon, Chairman of the Board of Directors of No Va Real Estate Investment Group Joint Stock Company (HOSE: NVL), sold over 9.1 million NVL shares through negotiation from May 9 to 14, 2024.

After the transaction, Ms. Quynh’s ownership decreased from nearly 25 million shares, or 1.266%, to 0.798%, equivalent to nearly 15.6 million shares.

During this period, nearly 9.4 million NVL shares were traded through negotiation, valued at over VND 119 billion, equivalent to approximately VND 12,800 per share. With the sale of over 9.1 million shares, Ms. Quynh is estimated to have earned more than VND 116 billion.

Chairman’s relative of SHB transferred nearly 26 million shares

According to the transaction report, Ms. Do Thi Minh Nguyet successfully sold 25.7 million shares of Saigon-Hanoi Commercial Joint Stock Bank (HOSE: SHB) through negotiation on May 8 and 9, 2024.

These shares accounted for her entire holdings in SHB (0.71%). After the transaction, Ms. Nguyet is no longer a shareholder of the Bank.

On May 8 and 9, SHB shares recorded a negotiated volume of more than 28.2 million shares, valued at approximately VND 340 billion. Of this, Ms. Nguyet transferred more than 25.7 million shares, corresponding to a value of nearly VND 310 billion. The average negotiated transaction price was VND 12,050 per share, 2% higher than the average closing price of the two sessions.

In terms of connections, Ms. Nguyet is the sister of Mr. Do Quang Hien, Chairman of the Board of Directors of SHB. Mr. Hien currently holds 2.75% of the Bank’s capital, equivalent to nearly 100 million shares.

The transferee of Ms. Nguyet’s shares is likely to be Mr. Do Quang Vinh, Vice Chairman of the Board of Directors of SHB (son of Mr. Do Quang Hien), as he previously registered to purchase 100.2 million SHB shares, while Ms. Nguyet registered to sell all of her more than 25.7 million SHB shares during the period of April 19 to May 17, 2024.

In addition to Ms. Nguyet, an organization related to the Chairman and Vice Chairman of SHB, the T&T Group, also registered to sell 74.5 million SHB shares from May 13 to June 10, 2024 to restructure its investment portfolio.

The total volume of shares registered for sale by Ms. Nguyet and the T&T Group is equal to the volume of shares registered for purchase by Vice Chairman of the Board of Directors, Mr. Do Quang Vinh. Therefore, it can be speculated that Mr. Vinh likely received the transferred shares from the T&T Group and Ms. Nguyet.

|

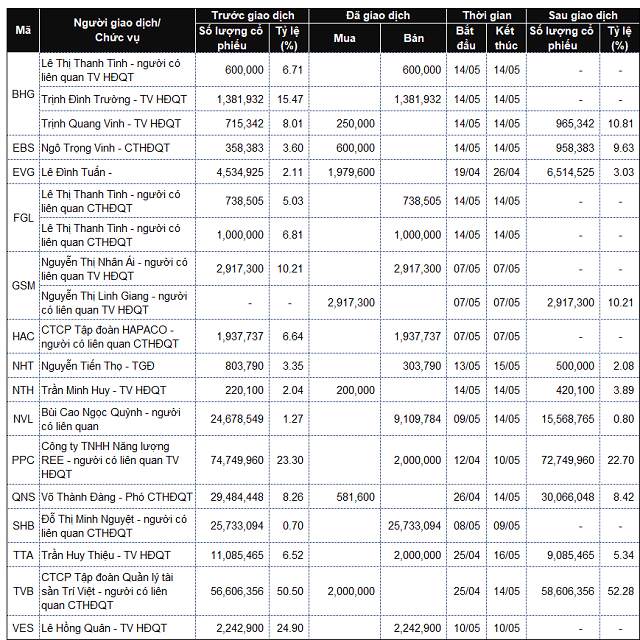

List of company leaders and relatives who traded from May 13 to 17, 2024

Source: VietstockFinance

|

|

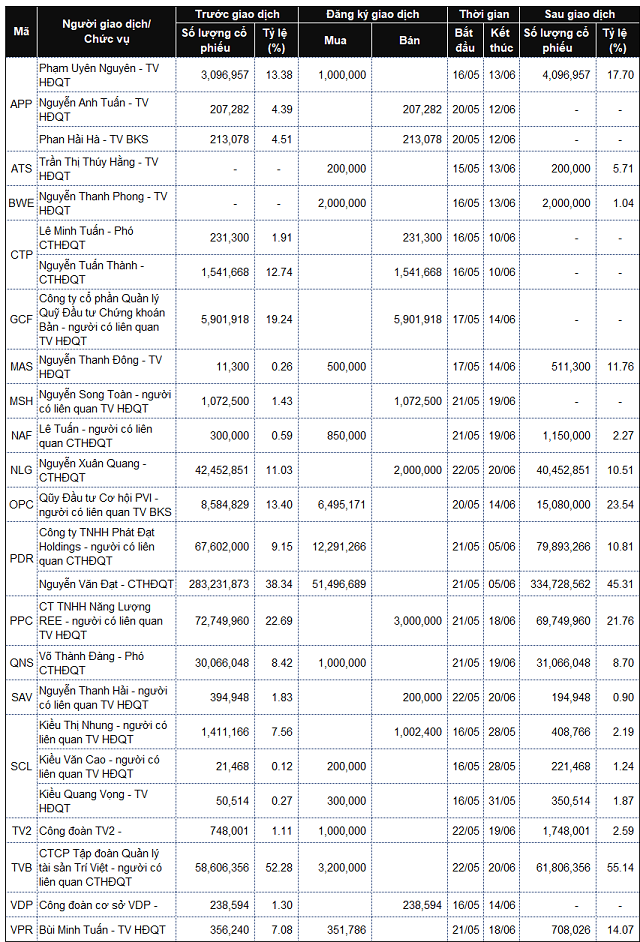

List of company leaders and relatives who registered to trade from May 13 to 17, 2024

Source: VietstockFinance

|