On May 15, Saigon-Hanoi Securities Joint Stock Company held its 2024 Annual General Meeting. During the Q&A session, a shareholder praised SHS’s strength in proprietary trading compared to its competitors, given the significant contribution of this segment to the company’s revenue structure.

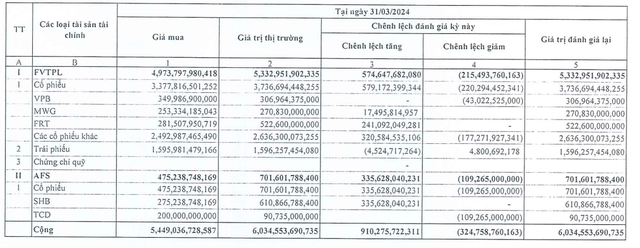

According to this shareholder, last year, SHS held out-performance stocks, such as TCD and BCG, which outperformed the rest of the market. In the first quarter of 2024, SHS’s proprietary trading continued to shine with stocks like MWG, FRT, and VTP.

Hence, the shareholder expressed hope that SHS could offer products like “copy trading” based on the company’s portfolio. Additionally, they noted that SHS’s financial reports currently list only a few stocks that the company invests in, while the rest are grouped under “other stocks” with a value of up to VND 2,600 billion. They wished for SHS to disclose more of its holdings for reference.

SHS’s investment portfolio as of March 31, 2024

The questions and expressions of desire from this investor resonated with the management and many other shareholders in the room. Mr. Do Quang Vinh, Chairman of SHS, addressed the shareholder’s concerns by stating that the company would continue to improve its reporting, analysis, and proprietary trading to help shareholders understand and refer to the company’s portfolio.

“We aim to help shareholders identify potential stocks and improve investment efficiency. This year, SHS has adopted the motto, ‘All for the prosperity of our clients.’ As such, we will provide dedicated consulting to enable shareholders to invest sustainably,” Mr. Vinh added.

Supplementing the response, Mr. Nguyen Chi Thanh, CEO of SHS, said he would seriously consider the idea of creating an investment portfolio recommendation based on the company’s proprietary trading for its clients.

Mr. Nguyen Chi Thanh, CEO of SHS

Mr. Thanh also shared the rigorous process that enables SHS to select potential stocks. He explained that all stocks go through a comprehensive analysis by the research and investment teams, which then produce reports. These reports guide their capital withdrawal or investment plans, executed in phases.

In addition to proprietary trading, SHS’s management has set ambitious goals for developing brokerage and margin lending activities to return the company to the top 10 brokers on HNX. To achieve this, SHS will strive to become a versatile securities company, offering diverse products and developing derivatives to optimize investor benefits.

For 2024, SHS aims to achieve a total revenue and other income of VND 1,844 billion and a pre-tax profit of VND 1,035 billion. In the first quarter, the company reported a nearly 17% year-on-year decrease in operating revenue to VND 565 billion. However, a significant reduction in expenses resulted in a pre-tax profit of nearly VND 444 billion and an after-tax profit of over VND 356 billion, almost eight times higher than the figure for the same period last year.