Huge Potential but Declining Sales Figures

Experts believe that with Vietnam’s per capita GDP surpassing the $4,000 mark, car ownership rates are expected to soar in the coming years.

This means that the Vietnamese market has a lot of room for growth when it comes to the automotive industry. Many multinational companies, such as Toyota, Honda, Ford, and Mercedes-Benz, have already invested in the country, setting up long-term automotive production and assembly facilities in various localities.

Additionally, Vietnam is considered a “magnet” for major car manufacturers due to its favorable geographical location. Being at the heart of Southeast Asia, Vietnam enjoys advantageous connections to large markets such as China, Japan, South Korea, and other ASEAN countries. This strategic position helps reduce transportation costs and optimize the supply chain for automotive businesses.

However, the statistics from the beginning of 2024 tell a different story.

According to data from the International Organization of Motor Vehicle Manufacturers (OICA), Vietnam has a car ownership rate of approximately 50 cars per 1,000 people, which is significantly lower than that of Brunei (721), Thailand (280), Malaysia (542), and Singapore (176). Despite having the highest population among these countries, Vietnam’s total car ownership remains low.

Furthermore, the Vietnam Automobile Manufacturers’ Association (VAMA) reported that in April 2024, the total market sales reached 24,350 vehicles, an 11% decrease from March 2024, but a 9% increase compared to the same period in 2023. The breakdown of sales included 17,258 passenger cars, 6,815 commercial vehicles, and 277 specialized vehicles.

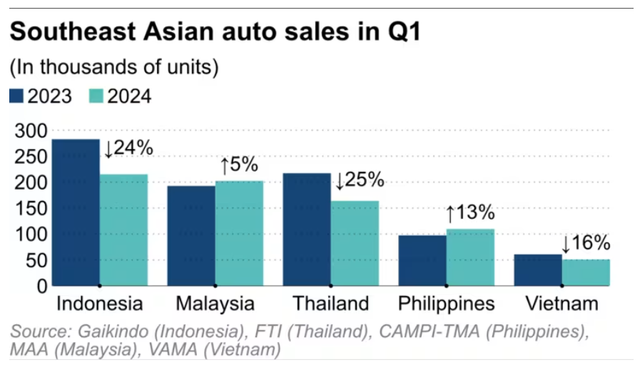

Top 5 Southeast Asian Car Markets in Q1/2024

Both domestically assembled and fully imported cars witnessed a decline in sales, with the former experiencing a sharper drop of 17% compared to the previous month, while the latter saw a more modest decrease of 3%.

Overall, by the end of April 2024, total market sales were down 11% compared to 2023, with passenger car sales decreasing by 14%, commercial vehicle sales by 3%, and specialized vehicle sales by a significant 28%.

The main reason behind these declining figures is consumers tightening their budgets to navigate the challenging macroeconomic environment. Additionally, the surge in demand in December 2023, ahead of the expiration of the reduced registration fee policy for domestically produced cars, resulted in a dip in sales during the first two months of the year compared to the same period in 2023. Consequently, Vietnam ranked last among the top five largest car markets in Southeast Asia in Q1/2024.

Realizing the Goal

Associate Professor Dr. Tran Si Lam from the Foreign Trade University suggested that Vietnam should aim for sustainable and environmentally friendly development in the automotive industry. Promoting green technology and encouraging the use of electric and fuel-efficient vehicles will not only protect the environment but also cater to modern consumption trends, attracting investors interested in sustainable development.

Leading Chinese companies, including automotive manufacturers, have expressed their keen interest in the Vietnamese market. They appreciate the country’s improved investment and business environment, attributing it to Vietnam’s sound and appropriate development strategies, especially in the fields of digital and green economies, and emerging sectors.

With a current population of 100 million and significant growth potential in the coming years, experts predict that Vietnam’s car market could reach 1 million units sold per year in the early 2030s.

Apart from attracting foreign investment, Vietnam should also provide support to domestic enterprises in the automotive industry. Financial assistance, market information, and facilitating collaborations between local businesses and international partners will enhance their competitiveness and promote sustainable development.

By effectively harnessing its development potential, Vietnam will become an attractive destination for many global automotive giants. The presence of these companies will not only boost economic growth but also enhance technological capabilities and create numerous job opportunities for Vietnamese citizens, solidifying the country’s position as a diverse and promising market that attracts the attention and investment of leading automotive corporations worldwide.

Moreover, to stimulate the market, car manufacturers are expected to introduce various price reduction and promotional programs in the near future to boost purchasing power.